Share market loses ground as consumer stocks offset healthcare, materials rally

Shares slipped for a second straight session on Tuesday as consumer stocks weighed on the benchmark index.

Business Breaking News

Don't miss out on the headlines from Business Breaking News. Followed categories will be added to My News.

Australian shares struggled to gain momentum on Tuesday as a rally in the healthcare and materials sectors was offset by declines in consumer stocks.

At the closing bell, the benchmark index, the ASX200 had retreated 0.15 per cent, or 11.6 points, to 7724.2, while the All Ordinaries slipped by 0.1 per cent to 7988.3.

The Australian dollar dipped to buy US65.01c.

Capital.com senior market analyst Kyle Rodda said after reaching a record high last week, the share market was tracking sideways as investors awaited a fresh batch of economic data from the United States.

“We’re continuing to look for obvious signs of potential disinflation and the prospect of rate cuts out of the US,” Mr Rodda said.

“Any kind of surprise that suggests there’s re-acceleration in inflation – that’s going to really upset investors. But for now, things actually look pretty solid.”

Four of 13 industry sectors finished in the green, led by healthcare stocks which increased 1 per cent.

Gold stocks continued to advance as the precious metal struck a three-month high of $US2127. St Barbara vaulted 12.5 per cent to 18c, Regis Resources climbed 5.5 per cent to $2.03 and Evolution Mining added 3.6 per cent to $3.20.

Elsewhere in commodities, iron ore miners rebounded. BHP rose 0.9 per cent to $44.63, Rio Tinto added 1.1 per cent to $124.77 and Fortescue firmed 1.9 per cent to $25.84.

However, gains in the sector were partly offset after US-listed lithium miner Albemarle announced it was seeking to raise $US2.1bn ($AU3.2bn) in a share issue to investors as it sought to stem losses due to dwindling commodity prices.

ASX-listed lithium producers retreated on the news with Pilbara Minerals off 7 per cent to $4.10, IGO down 5.3 per cent to $7.73, and Liontown 4.1 per cent lower to $1.28.

Meanwhile, consumer stocks were the biggest laggards as sector heavyweights Coles, Endeavour Group and Lovisa traded ex-dividend.

Ahead of key GDP figures to be released on Wednesday, fresh data from the Bureau of Statistics on Tuesday eased fears that the Australian economy may have contracted during the December quarter, after it showed improved terms of trade, bolstered by higher export prices for coal and iron ore.

“The larger than expected net exports addition and an increase in public sector inventories provide an offset to the weak private inventories data reported yesterday,” ANZ economist Blair Chapman said.

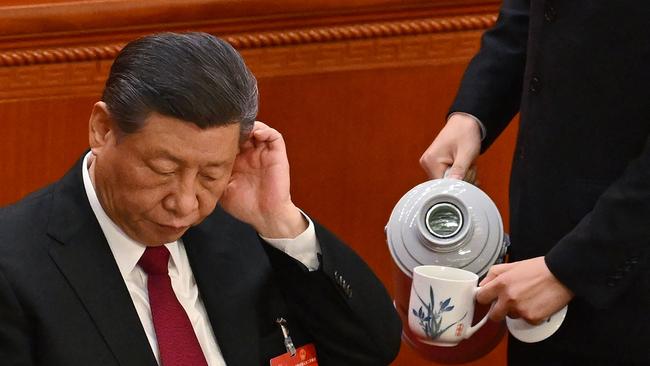

Meanwhile, at a meeting of its National People’s Congress on Tuesday, China announced an economic growth target of “around 5 per cent”, a goal analysts labelled as ambitious granted the dual challenges of weak investor confidence and the country’s debt-laden property sector.

“In the absence of last year’s tailwind from the pandemic rebound, that will be hard to achieve,” NAB senior economist Taylor Nugent said.

Bitcoin, the most traded cryptocurrency, continued to advance, resetting its two-year high at US$68,828.

In corporate news, Telix Pharmaceuticals added 1.2 per cent to $12 after the drug maker announced its acquisition of Canadian tech firm ARTMS in a deal worth $126 million.

Medibank Private shares rose 1.6 per cent to $3.75, after the health insurer announced it was raising its premiums by 3.3 per cent, above the industry average premium increase of 3 per cent, after approval from Health Minister Mark Butler.

Rival health insurer NIB also added 3.4 per cent to $7.85. Its customers will incur a premium hike of 4.1 per cent.

Embattled pathology provider Healius jumped 14.7 per cent to $1.29, its biggest intraday gain since June 2020. The firm has commenced a strategic review of its assets and structure, while CFO Paul Anderson will succeed Maxine Jaquet as chief executive and managing director.

Originally published as Share market loses ground as consumer stocks offset healthcare, materials rally