Best super funds: Hostplus again tops table with full-year return of 12.5 per cent

AUSTRALIA’S top 10 super funds for the past financial year have been named … and bank-owned funds are nowhere to be seen. Here’s the top 10, and how they all performed.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

AUSTRALIA’S top 10 superannuation funds for the past financial year have been revealed, and bank-owned funds are nowhere to be seen.

Industry super funds have snared all top 10 spots on the league table for best returns among balanced funds over the year to June.

READ MORE: GET READY FOR SUPER-SIZED AUSSIE FUNDS

BAREFOOT INVESTOR: IT PAYS TO BE SUPER VIGILANT

The ladder has been compiled by research house SuperRatings.

Top of the table for the 2017-18 financial year is Hostplus, the industry super fund pitched at employees in the hospitality, tourism and sports sectors.

Hostplus’s balance fund delivered a return of 12.5 per cent, according to interim results.

That figure is down slightly from 13.2 per cent the previous year, when Melbourne-based Hostplus was also top of the ladder.

But it is significantly higher than the median return the past financial year of 9.3 per cent across Australia’s low-fee MySuper funds — the default funds offered to employees.

Runner up was AustSafe Super, which is based in Queensland and focused on farmers, with a return of 11.4 per cent.

Australia’s biggest fund, AustralianSuper, came in third, with an 11.1 per cent return (see the full list of the top 10 funds below).

The Hostplus MySuper fund has also been the best performing balanced fund over three, five, seven and 15-year time frames.

But it slips slightly down the table measured over the past 10 years, to fifth spot.

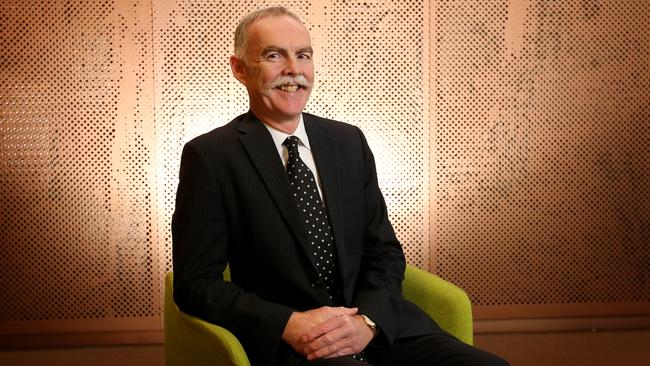

Hostplus chief David Elia said the fund’s success over the past financial year validated its decision to “avoid the noise in the market”, whereby many other funds moved into cash in preparation for a downturn.

Hostplus, which has $34 billion under management, was planning to stick to its more active equity management model, he said.

“We have a very low allocation to index-hugging managers.”

Mr Elia said Hostplus would also maintain its focus on unlisted assets, which make up 47 per cent of its portfolio.

Discussing the economic outlook, Mr Elia praised Australia’s banking regulators for their efforts to cool the housing market.

House prices no longer loom as a risk to the economy following efforts to strip heat from the market, he said.

But he said he was still wary about the “potential de-globalising” effect of the trade stoush between the US and China, Australia’s biggest trading partner.

Mr Elia, who visited Washington DC last month to look at potential US infrastructure investments, also says Hostplus is “getting closer to making inroads” in that market.

He said he saw two economic risks that, in the short to medium term, could affect the performance of super funds broadly.

“The first is central banks largely acting in advance of inflation and stifling economic growth (by) increasing interest rates,” he said.

Mr Elia said RBA governor Phillip Lowe had sensibly noted there was no case to raise the cash rate here, but rates were still broadly rising globally.

The housing market did not loom as a risk thanks to the good work of the RBA and regulators, he said.

“The housing market seems — through proper regulation and tightening lending practices — to have cooled off,” Mr Elia said.

“Everything I now read seems to talk about the property market coming off.”

The other economic threat was that of “trade wars and potential de-globalisation”, he said, in a nod to the trade conflict between China and the US.

Hostplus is one of 30 super funds that was asked to make a submission for the next round of hearings, starting on August 6, in the financial services royal commission.

THE TOP TEN BALANCED FUNDS

Returns for the 2017-18 financial year

1. Hostplus, Balanced — 12.5% (interim result)

2. AustSafe Super, MySuper Balanced — 11.4%

3. AustralianSuper, Balanced — 11.1%

4. Cbus, Growth (Cbus MySuper) — 10.9% (interim result)

5. Club Plus Super, MySuper — 10.8%

6. Equip MyFuture, Balanced Growth — 10.7%

7. Sunsuper For Life, Balanced — 10.7%

8. Hesta, Core Pool — 10.6%

9. NGS Super, Diversified (MySuper) — 10.5%

10. UniSuper Accumulation 1 Balanced — 10.5%

Source: SuperRatings

Originally published as Best super funds: Hostplus again tops table with full-year return of 12.5 per cent