Scott Pape asks: would you like a lab-grown diamond 90% cheaper?

Barefoot Investor Scott Pape says diamond rings are decades-long marketing con job, as much cheaper lab-grown stones emerge.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

The diamond ring is one of the biggest marketing con jobs in history.

It was created by mining company De Beers, who in the 19th century found a massive deposit of diamonds in South Africa and stitched up a cartel controlling 90 per cent of world supply.

Then they created one of the most successful advertising campaigns in history, tying their product to life’s big moment – the marriage proposal. And oh boy did it work! In 1940, only 10 per cent of brides-to-be received a diamond ring … today it’s more than 85 per cent.

Yet there’s only one problem.

Diamonds are way more common than dog’s balls.

Seriously.

There are said to be 39 billion stones in existence – more than five for every person on Earth — according to diamond analyst Martin Rapaport.

Yet De Beers’ gig looks like it’s going the way of the Marlboro Man (cough, cough!). Their sales dropped 36 per cent last year, and the business took a billion-dollar writedown.

Here’s one reason why:

Gen Z (people born between 1996 and 2010) are now officially the largest generation on earth. They make up 32 per cent of the global population, surpassing Millennials and Boomers. The oldest Zoomer is 28, which means they’re getting down to their last few rounds of dating musical chairs.

(Yep, I’ll take you.)

And Gen Z are the most ethical shoppers ever. A full three-quarters of them prefer to buy sustainably rather than go for brand names, according to a study by Wharton University, as reported by the World Economic Forum.

And that means:

Bye-bye blood diamonds …

Hello, lab-grown diamonds!

No, I’m not talking about cubic zirconias. Lab-grown diamonds are chemically identical to mined diamonds (often with fewer impurities), because they’re created under similar conditions. Which explains why they look identical to the naked eye – even jewellers can’t tell the difference.

Now De Beers may have paid Marilyn Monroe to sing that diamonds were her best friend, but Gen Z’s influencers – like Meghan Markle, Billie Eilish, and Bindi Irwin – all reportedly wear ‘ethical, sustainable and conflict-free’ lab-grown diamonds. Heck, even old Leo DiCaprio, who starred in the film Blood Diamond, apparently gives his girlfriends ethical rings.

And here’s the badda-bing-badda-bling:

These lab-grown diamonds are 90 per cent cheaper than mined diamonds.

Who says a man needs to spend ‘three months of his salary’ on an engagement ring?

(Actually De Beers said that in their advertising … of course.)

Today many young people (mostly men) are spending way less, plus they get to claim the moral high ground that they’re doing it not to be a tight-arse but to save the planet!

(There are even more bragging rights if your bride-to-be can say her lab-grown diamond was made in a factory run on solar power.)

And so I’ve been fascinated with this question all week:

“Knowing all this, which ring would you choose?”

I asked my accountant (a mum of three). She didn’t blink: “The lab, of course. Better value for money.”

(Typical.)

Whereas my assistant said she prefers the real deal: “I want someone to have suffered for my ring.”

(I’m still not sure if she was talking about the miner or her husband.)

And what about my lovely wife, who wears a shiny – and a painfully expensive – rock?

“I love the one you gave me … and I’m not planning on getting another”, she said diplomatically.

Nice.

What about you?

Tread Your Own Path!

House Cleaner Gets Her PhD in Finance

Hi Scott,

In 2017 I found myself a newly single mother of three little kids. I got a job as a house cleaner for three wealthy wives, and they all paid me in cash. So I spent all my money in cash (rent, groceries, the lot), and I am convinced it not only saved me hundreds of dollars in surcharge fees that you wrote about last week but also helped me keep to a budget during an extremely stressful time of my life. To this day (seven years on), I still withdraw my spending money each week in $50 and $20 notes. Life is simple with cash!

Rita

Hi Rita

You worked out for yourself what a bunch of PhDs from the University of Melbourne and University of Adelaide concluded after analysing data from 11,000 participants:

“It doesn’t matter whether you use a credit card, a debit card or a buy-now-pay-later service – you are likely to spend more money using cashless methods than when you pay with cash.”

(Then again, the casinos worked this out over 150 years ago, which explains why they take your money and give you those little chips.)

That being said, cash is going the way of Kevin Rudd. (It pops up every so often just to let us know that it’s still relevant, only to fade back into oblivion.)

Cash is now only used for 16 per cent of transactions, and you can bet your shiny ’lil fitty that the Commissioner of Taxation is the main one cheering on its demise.

After all, the ATO’s supercomputer has so much data on you it would make Mark Zuckerberg drool (and it’s only getting more powerful with artificial intelligence). Yet, for all its computing power, it’s still no match for a single mum with a dustbuster.

Grumpy Boomers

G’day Scott

My wife and I are enjoying retirement with a healthy level of super and considerable assets, giving us an asset base of about $7.5 million and total annual income of about $350,000. I am 68 and my wife is 69. Chances are we will probably die not having spent all we own. But here’s my problem. We have seven kids between us and would not trust any of them to look after us in an unselfish and humane way when we can’t look after ourselves anymore. Too many times we have seen kids treat elderly parents badly in order to protect their inheritance. Any suggestions while we still have control?

Donna and Steve

Hi Guys,

What are the chances … you have seven kids and they are all horrible?!

Each state and territory allows us to appoint someone to manage our finances (enduring power of attorney) and our health and medical decisions (guardianship and medical treatment decision-maker).

I discussed the options with my estate planning lawyer, Dr. Brett Davies, who emphasised the importance of choosing someone trustworthy. It could be a professional like an accountant, financial planner, or lawyer, but these professionals charge fees and often hand off tasks to junior staff.

Therefore, your safest option may still be your children.

Yet that means that when you lose your mental capacity you’ll likely be under the control of your children. And that’s the rub. You may have seven bricks in the bank, but you aren’t wealthy if you can’t trust them to look out for you as you get older. If I were in your situation, I’d spend as much time and money with my kids and grandkids as I could, trying to rebuild the trust and relationships you have with them. That’s where true wealth lies.

Good luck.

The Bakers Delight!

Hi Scott,

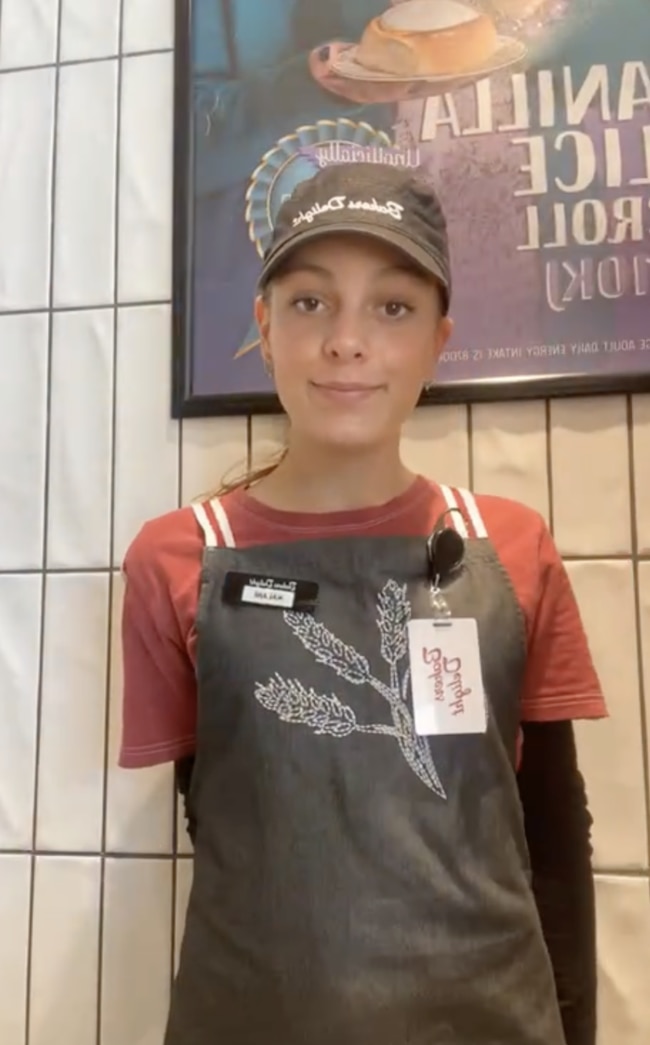

My name is Kalani and I am 14 years old. I contacted you this time last year about a message you sent to my mum for Mother’s Day. To this day we still talk about it and how lucky we are that you responded! Since then I have got a job at my local Bakers Delight (using the resumé template from your Barefoot Kids book) and have started saving. And I now have $9000 in the bank! Thanks to you and my mum, $50 of my savings a month goes to shares in Vanguard. My goal by the end of this year is to save $10,000. I would like to say thank you for teaching my mum and me about finance, because it has changed our lives!

Kalani

P.S. I know you get 4,000 emails a week, which is why I sent this five times, just for a better chance!

Hey Kalani,

You are taking one hell of an elective subject, called Real Life 101.

(To this day I still buy one Bakers Delight roll each day and then head to Woolies and get a slice of ham. Mmmmmmm, processed meat and white flour!)

Seriously, you’re a legend.

Next up, think about starting up your own Barefoot Business!

And please say g’day to your mum for me – she must be very proud.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

More Coverage

Originally published as Scott Pape asks: would you like a lab-grown diamond 90% cheaper?