Panic now! Barefoot Investor’s advice to heavily mortgaged

Scott Pape tells a ‘postcode povvo’ who forks out 65 per cent of his pay on mortgage repayments that now is the time to panic because interest rates might not come down any time soon.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

My 10-year-old son is thinking about launching his own podcast.

“Is there any money in podcasting, Dad?” he asked.

“Well, if you did one with me … I’d say yes”, I said, smiling smugly.

“Umm, this would be a kids’ podcast – no adults allowed!” he shot back, shutting me down.

Okay, so when my 10-year-old is thinking about doing a podcast, it tells me two things:

First, the barrier to entry is extremely low (which explains why there are 17,000 new podcasts being created each month).

Second, podcasting has now gone mainstream. (Aussies downloaded one billion podcasts last year, and we are proportionately the biggest podcast listeners on the planet.)

So, to answer my son’s question, I decided to talk to a guy I know called Mike Fitzpatrick, who has been at the top of the broadcasting tree in Australia for near on 20 years.

“The biggest podcasters in Australia are earning over $1 million a year from advertisers”, said Fitzy.

“However … your favourite local podcast with, say, 50,000 listeners and 100,000 downloads a week, could be making around $500 a month from advertising … and of course the vast majority of podcasts don’t earn anything”, he added.

Interesting.

I explained to my son that podcasting is a lot like writing a book. Most authors spend hundreds of hours toiling away … and barely cover their costs. However, as with most rewarding things in life, money isn’t their main driver. They do it because they have a passion for the subject at hand, and they want to connect with and help people.

“So”, I told number one son, “creating your own podcast is an awesome idea, mate.”

“But you’ve sold a lot of books, Dad … so maybe you could be my co-host?” he said, rethinking the idea.

Gotcha!

Speaking of which, here are my (latest) favourite podcast episodes:

1. Your Undivided Attention, with Jonathan Haidt

Every parent, school principal and politician should listen to this episode by psychiatrist Jonathan Haidt, author of The Anxious Generation. It made me deeply anxious about the horrible impact social media and AI algorithms are having on our kids. However, Haidt also gives us clear, concrete steps we can take to protect them – if we’re willing to stand up and act. (The episode is called ‘Jonathan Haidt on how to solve the teen mental health crisis’).

2. The Political Fallout of Housing, with David McWilliams

You could be forgiven for thinking that the housing crisis is unique to Australia – yet the truth is that it’s a global phenomenon. This episode looks at the policy failures of older, out-of-touch politicians (who are generally landlords themselves!). If history is a guide, young, angry renters will soon ‘evict’ them from public office. Be forewarned: a political hurricane is heading our way.

3. The Stupidest Thing You Can Do With Your Money, with Freakonomics (Stephen J. Dubner)

This episode is labelled “Wall Street’s worst nightmare”, and it tells the story of the index fund revolution. Once you listen to it you’ll never go near a ‘wealth platform’ again. It will also leave you questioning why most not-for-profit industry super funds don’t invest this way. Maybe they’re too busy building their own empires with their members’ money?

Tread Your Own Path!

My Best Friend Thinks I’m Scum

Hi Scott,

I am so privileged. Thanks to following Barefoot from age 17, I bought my own home in Brisbane on a modest salary when I was 24, which I am now renting out while I live interstate. At 27, I am with the man I plan to marry and we are looking to the future. Yet I feel guilty about having multiple investment properties during a cost-of-living crisis. My best friend says “all landlords and shareholders are scum”. I want to build wealth for my family and future children, but I feel bad about getting ahead when others are being left behind. Can I please get some advice?

Lina

Hi Lina,

Congrats on your success, I’m so proud of you!

Now, what I tell my five-year-old daughter is that whenever someone tries to hurt you with their words it says much more about them than it does about you. They’re the ones who are in pain.

Your friend sounds like she’s frustrated that she hasn’t been able to achieve financial security.

I get it. You get it. Fact is, we may all live in the wealthiest country on earth, but there’s a growing divide between the haves (homeowners) and the have-nots (renters) that is driving deep-seated resentment.

However, calling people names is a five-year-old’s way of looking at the world, and it’s going to lead her to becoming a bitter and twisted Greens voter.

If this was a playground tiff, I’d tell you to not take it personally and to try and be kind to your friend as she goes through a rough patch. However, if she continues to use you like a cat uses a scratching post, I’d argue it’s time to branch out and find some new kittens to play with.

Onward and upward, Lina.

Will the Budget Push Interest Rates Up?

Hi Scott,

I know you boycotted the Budget, but, being a ‘postcode povvo’ who is barely hanging on (after the rate rises, roughly 65 per cent of our income goes to our mortgage!), I have to ask: do you think all the Budget spending will increase interest rates? We’re banking on them coming down!

Sim

Hi Sim,

I had low expectations for the Budget, and Jimbo did the limbo and went lower still! (Though I’m sure James Packer is very happy he’s getting $300 off his power bill, struggling as he is.)

So to your question – will this Budget push up interest rates?

No, it won’t.

Well, that’s according to the Federal Treasury, which employs hundreds of the smartest economic boffins in the land.

The Treasury has 123 years of experience (since 1901) working with the Government analysing the impact of their policies – and they are officially forecasting that inflation will continue to fall.

The problem is that their track record of economic predictions is worse than my boys’ aim at the toilet.

“YOU NEED TO STAND CLOSER TO THE TOILET, BOYS. THIS IS DISGUSTING!”

Look, to be fair, my boys do try – they just don’t have their aim in yet.

However, the boffins at Treasury are fully grown adults who’ve been spraying their predictions around the bathroom for over a century. There is no hope for them. Their economic forecasts are consistently and laughably wrong.

So what does that mean for you?

Absolutely nothing. With over two-thirds of your income going to your mortgage, you are weeing into the wind, Sim.

My advice to you?

Panic.

The key is to panic early: ask yourself what would happen if you lost your job, or you got sick, or interest rates went up. In other words, you need to do something that Jimbo hasn’t been able to do: make some hard decisions, right now.

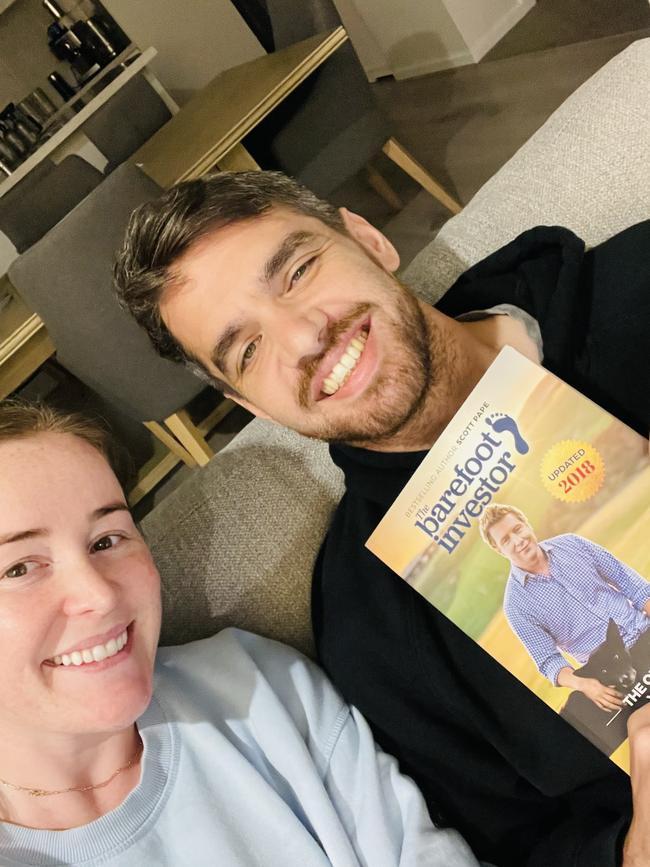

The Anti-Budget Date Night

Hi Scott,

The first time my partner and I sat down to do a budget, we both felt so overwhelmed. Tonight we are reflecting on how much easier these conversations have become since I bought your book back in 2018. Thank you again!

Louise

Hey Louise,

Well done for looking at my ugly mug rather than Jimbo’s (to be fair I actually think we’re a tie).

Politicians spout a lot of bulldust about what they can do for you (especially as we get closer to an election). However, the things you do over a nice meal and glass of wine will have a real, positive and lasting impact on your life – and that’s an outcome that no politician can guarantee.

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

Originally published as Panic now! Barefoot Investor’s advice to heavily mortgaged