Barefoot Investor: The Bitcoin scam that cost Aussies thousands

It’s a dodgy scheme that’s seen Aussies lose thousands of dollars. But this week the Barefoot Investor decided to have a bit of fun with the scammers.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

“Mr Pape, are you ready to make a lot of money?” a stuffy British accent asked me over the phone.

“Maybe, but I’m not feeling it,” I replied.

“Mr Pape, are you aware that Bitcoin is currently surging? My other clients made 63% … just last week.”

“I want you to get me … motivated”, I whispered to him. “I want you to yell … at the top of your lungs … ‘I will make you reeech’.”

Silence.

“I will make you rich”, he nervously repeated.

“Louder.”

“I WILL MAKE YOU RICH!” he yelled, so loud that he forgot to sound British, and revealed his Nigerian accent.

Now I was motivated!

Yet I’m getting ahead of myself, so let me take you back to the beginning.

A few weeks ago my mate Tom Gleeson won the Gold Logie. Yet that wasn’t the only (dubious) award he won.

Tom unwittingly became the latest celebrity to be used to front a fake crypto scam called ‘Bitcoin Profits’.

The scammers not only stole pictures of him (and Waleed Aly), but they also nicked the ABC’s logo (and the logos of other media outlets) to fool people into thinking they were on the ABC News website.

Truth be told, this scam has been around for years.

They’ve used me in their ads before. And Kochie. And Richard Branson. And James Packer … but now a comedian?

So I decided I’d have a bit of fun with them.

I registered my mobile number with the scammer site, and dutifully received a phone call within 15 minutes from a man calling himself ‘David Clark’ (how Anglo a name is that?) — the man who would eventually (with some encouragement from me) scream “I will make you rich!”

From the start, David was trying everything he could to get me to place a $US250 trade with his automated crypto trading program. David assured me (in his best British accent) that I was “absolutely guaranteed to make money”.

Of course, I didn’t take the bait.

Yet a reader, who I’ll call Bill, did.

Bill runs a small family business in country New South Wales and works gruelling 90-hour weeks.

Late one evening he read the Bitcoin Profits article, and the tales of instant easy riches, and thought to himself, why not give it a go?

Like me, a few minutes later he was on the phone to a fast-talking “British” account manager.

Unlike me, Bill gave over his credit card details and made his first $US250 trade.

Guess what happened?

The automatic crypto trading program worked: he doubled his money!

Bill was told to immediately top up his account with his credit card, so he could make even more money.

This process of winning, and topping up his account, kept going for the next two days.

All up, Bill transferred $28,000 into his trading account … while his winnings climbed to $50,000.

So, Bill had made a quick $22,000, right?

NO! WHAT THE HELL IS WRONG WITH YOU? CAN’T YOU SEE WHERE THIS IS GOING?

Bill had been scammed.

When he twigged, he felt physically ill.

Then he frantically called his bank, Westpac, who traced the funds to a company in (of course) Nigeria. He then reported them to the NSW Police, who basically told him there was nothing they could, or would, do.

“I just wish they would at least warn people about this scam … there’s another lady I know who lost $60,000 the same night as me!” lamented Bill.

I promised Bill I’d do everything I could to help.

OK, while that stops short of going to Nigeria, I can ask you, my readers, a favour.

Let’s collectively give these scammers a Hard Chat: tell everyone you know to avoid Bitcoin Profits.

Tread Your Own Path!

Q&As

Fighting in the credit jungle

FIONA ASKS: My mother and her partner owe money left, right and centre — in fact the sheriff is chasing them for more than $100,000.

But they live in a caravan and are “on the run” (not so much Bonnie and Clyde, more like postcard bandits).

So both my brother and I are having the sheriff roll up at our houses looking for them. And we regularly receive letters from banks looking for them.

What can we do to fix this situation?

BAREFOOT REPLIES: I see your postcard bandit analogy, and I’ll raise you.

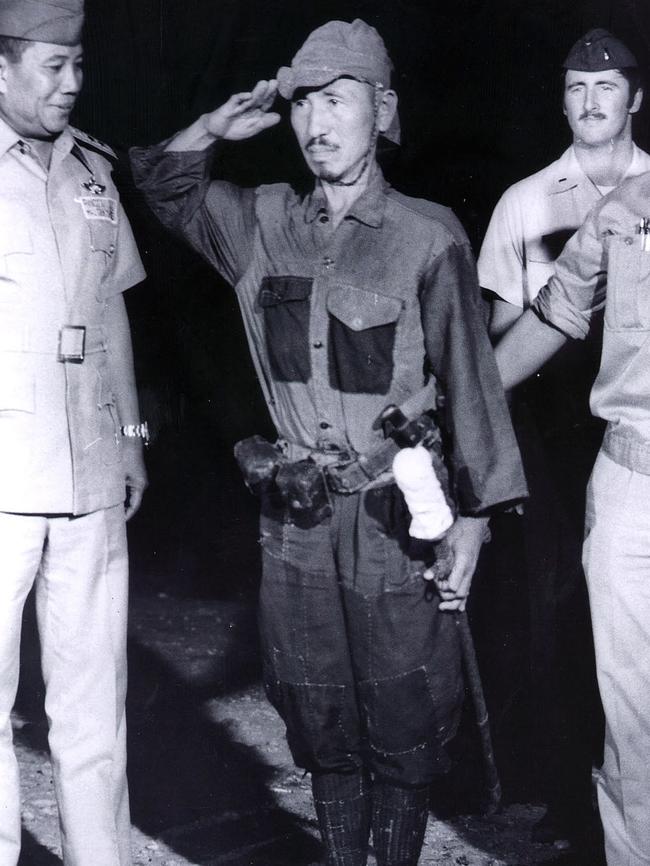

They remind me of Hiroo Onoda.

Hiroo who?

He was a Japanese soldier in World War II, stationed in a jungle in the Philippines.

Unfortunately, no one told him the war was over, so he spent 29 years in the jungle believing it was still going.

In the same way, your mum and her partner still believe they’re fighting a financial war against their creditors.

The reality is that if they’ve got a sheriff chasing them they’ve already had a court judgment against them.

In other words: the war is over, and they are the casualties.

The creditor has 15 years to chase them for the debt (well, in Victoria, other states differ). And during that time the creditor can enforce the debt by seizing their goods, garnishing their wages, or forcing them into bankruptcy.

So what can they do?

Well, they can pay the debt off in full (though that’s unlikely), negotiate to pay the debt off in instalments, or raise the white (financial) flag.

Regardless, the sooner they can call in the cavalry — in the form of their local community-based financial counsellor (1800 007 007) — the better.

He was addicted to PlayStation

TESS WRITES: Last year my son, aged 14, bought a PlayStation with his own money from doing part-time jobs. Fair enough, I thought at first, but then he became rather addicted.

To encourage him to get other interests, my husband and I gave him your book, and he devoured it.

Before we knew it, he had set up all his ING accounts, changed his super fund, and started making extra contributions to his super. Then he set up all our accounts, rang our bank, and used your scripts to have our interest rate lowered.

It has changed the way we function financially as a family!

He now has a fantastic foundation in financial literacy that will make his life so much more manageable.

He is in Year 10 this year, still has a part-time job, plays sport (and a bit of PlayStation), and continues with the “Barefoot ways”. Thank you for the massive effect you are having.

BAREFOOT REPLIES:

You should feel proud, and you should definitely brag about his achievements to your friends (while he’s within earshot).

What you’ve done is build up his financial confidence. Most teenagers have no financial confidence, and then when they turn 18 the financial world conspires to ensure they never get it.

The motto for the Barefoot Money Movement is “teach the kids, help the parents, change the nation”.

This country needs a financial revolution, and it needs to start with our kids — and your son is a shining example of what I’m trying to achieve.

Best of all, there’s no chance he’ll still be living in your spare room when he’s 35, that’s for sure.

Some things are more important than money

LISA WRITES: I’m so sorry for the loss of your beloved sheep dog Betty. Thank you for all that you do — your writing always makes me smile. My husband and I have been “doing Barefoot” for over 18 months now.

We have paid off over $18,000 of debt in less than a year — cleaned the slate. We appreciate your voice, and your generosity. Thanks a million, or at the very least $18,000, and enjoy your family time off.

BAREFOOT REPLIES: Thank you for the kind words — and congratulations on cleaning the slate!

Then again, I had a bloke write in and ask me what losing my faithful old sheep dog had to do with finance.

“Everything”, I wrote back to him.

WHY I’M NOT CHEERING THE RATE CUT

Some things are more important than money … and sometimes it’s nice to be reminded of that.

Yet he was in the minority: I was amazed at the number of Barefooters who reached out and expressed their condolences. For those who did, thank you.

Originally published as Barefoot Investor: The Bitcoin scam that cost Aussies thousands