Barefoot Investor: Give them the gift that lasts forever

Years ago, I cracked the Christmas shopping code and now I give everyone the ultimate present, the gift of books. Here is some inspiration for your Christmas list, writes the Barefoot Investor.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

Christmas shopping sucks, right?

Not for me.

Years ago, I cracked the Christmas shopping code: I buy people books.

They’re the ultimate present: they cost under $30, they don’t need a separate card (I simply scribble a Merry Christmas message on the inside cover), and my local bookstore will even gift wrap them for me.

Job done!

So here are the books I’ve got in my Santa sack this year:

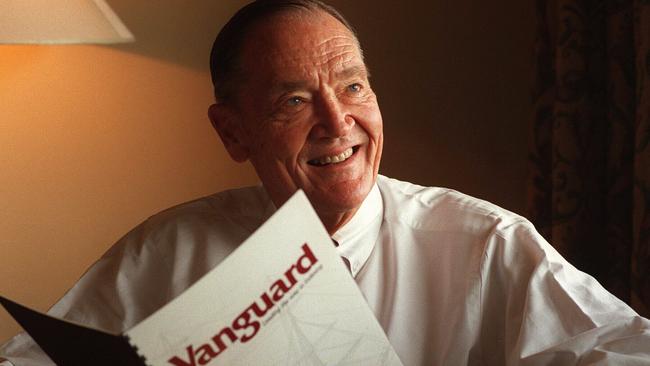

Enough: True Measures of Money, Business and Life, by John C. Bogle

We lost a giant this year.

Jack Bogle was the founder of the Vanguard group, and the creator of the first index fund.

Here’s the crazy thing: Bogle could have become one of the richest men on the planet, yet early on in his career he chose to pass those billions on to everyday mum and dad investors in the form of lower fees.

He writes this book as an old man, reflecting on the rampant greed of the finance industry, his philosophy on commonsense investment principles, and what really matters at the end of your life.

In the end, Bogle died with a relatively modest sum of money … yet with a legacy creating billions of dollars in value for everyday investors.

Warren Buffett said that Jack Bogle was his hero. I agree.

Banking Bad: Whistleblowers. Corporate Cover-ups. One Journalist’s Fight for the Truth, by Adele Ferguson

A few weeks ago a bombshell dropped: Westpac had breached anti-money-laundering laws 23 million times, and had facilitated paedophiles in the Philippines.

“We don’t need to overcook this,” said CEO Brian Hartzer.

The bank boss assured his troops that “mainstream Australia is not overly concerned”, and that it would soon be back to business as usual.

The Westpac board agreed (well, until they realised we did care, deeply).

If you want a glimpse of the reality distortion that multi-millionaire bankers live in, you need to read Banking Bad.

Adele Ferguson’s work was a key factor in getting the banking royal commission established. This is not only her story but a history of how banking went bad.

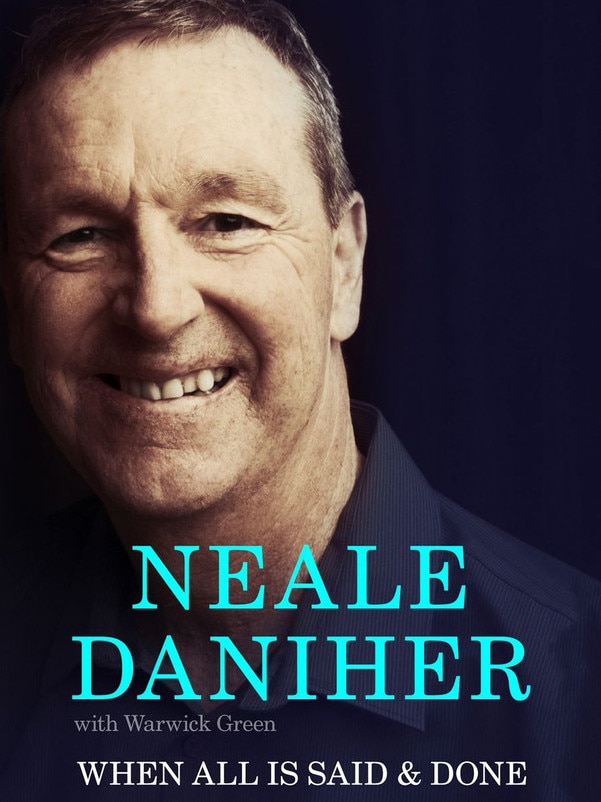

When All Is Said & Done, by Neale Daniher (with Warwick Green).

Okay, so this isn’t a book about finance … and it isn’t really a book about footy, either. Rather, it’s the wisdom of a man who’s staring down the barrel of death, talking about what really matters in life.

In 2013, AFL legend Neale Daniher was diagnosed with motor neurone disease, and he began writing this book (in part) for the grandkids he’d never meet. And in the process he’s probably written the most honest, hard-hitting and down-to-earth self-help book on the market.

The final chapter, “When You’re Dying, Everyone Thinks You’re a Great Bloke”, is a ripper.

This is a great book for your dad. I bought it for my old man’s birthday last month and he read it cover to cover in a day. He called me up that night and proclaimed that it was the best book he’d ever read.

“Well, you mean apart from my books, right, Dad?” I said. “Oh, yeah, I guess so,” he replied unconvincingly.

High praise indeed!

P.S. You guessed it, I’ll also be giving my books, The Barefoot Investor and The Barefoot Investor for Families.

Tread Your Own Path!

Q&As

NOTHING LEFT FOR PRESENTS

JANELLE WRITES: I am currently reading your book and loving it, but I am wondering where Christmas presents fit into the budget. I don’t want to use my Smile account as that is for holiday savings. I don’t want to use my Fire Extinguisher account as that is for bigger things. We usually spoil our kids too much so I admit we need to reduce that, but we want to give them something! What to do?

BAREFOOT REPLIES: Generally, I’d say it would come out of the Smile account, but if there’s not enough money there then you’ll have to get creative … perhaps buy some smaller stocking-fillers and explain that the family holiday is the big Christmas present this year.

Look, I have three kids — six, four and (almost) two — so I get the pressure of presents (marketers call it “pester power”).

However, even though Liz and I are doing well financially, we’re intentionally pulling back on what’s under the tree.

It’s not about being Grinches, but more about not wanting to spoil our kids — after all, the word “spoiled” means “rotten”.

And who wants that?

That’s why this year I’ve got my boys packing hampers for a charity, so they can learn the real reason for the season.

Finally, you need to drop the parenting guilt: you’re giving your kids the ultimate gift of financially confident and secure parents, and that’s a present that delivers 365 days a year.

CLAIM YOUR REFUND FOR CHRISTMAS

GERARD WRITES: I am the CEO of the Consumer Action Law Centre and I just wanted to tell you that your promotion of our campaign to get dodgy insurance refunded — DemandARefund.com — has really helped.

The claims we have helped get paid out jumped from $5 million to $13 million in a very short space of time!

The great thing is that consumers are getting real money back — just this week we had an email from a person who received a refund of $15,000. Thanks for all your help.

BAREFOOT REPLIES: Thanks for your kind words. For readers who don’t know what we’re on about, for years the banks flogged “junk insurance” to unsuspecting customers.

Basically this was insurance or a warranty that was added on, or flogged to you, when you were getting a car loan, credit card or personal loan.

Now it’s the banks’ turn to get a flogging: they’re on the hook to repay more than $1 billion to consumers. So bugger the class action lawyers (which can take years and cost a fortune).

Simply head over to the not-for-profit, community-led DemandARefund.com website and claim your share … just in time for Christmas.

Ho! Ho! Ho!

YOUR BOOK BROUGHT ME FREEDOM

NIKKI WRITES: For most of my life I have felt clueless and powerless with money. I was working hard with nothing to show for it. Then last December I read The Barefoot Investor and it changed my life. Since then I have achieved so much: paid off my credit card, saved $20,000 towards a house deposit, travelled to Italy, and been able to pay for surgery for endometriosis, which had been causing me debilitating chronic pain.

But, most importantly, I was able to drop everything to be with my nan in her final days. Thank you!

BAREFOOT REPLIES: You’ve hit the nail on the head: the real power of having your money sorted is that you have the freedom to drop everything and help the people you love.

Now, given you read my book in December, I’m guessing someone gave it you for Christmas. Now this is totally self-serving, but I’d love it if you could pay it forward and buy the book for your friends and family.

You Got This!

Merry Christmas! I’m off for the holiday break (we’re heading off on a family cruise — aka a floating petri dish — so wish me luck!). Thanks to all the Barefooters who asked questions and shared their stories this year, and a special thankyou to you for reading. Have a safe Christmas, and I’ll see you in 2020.

If you have a burning money question, go to barefootinvestor.com and #askbarefoot

The Barefoot Investor for Families: The Only Kids’ Money Guide You’ll Ever Need (HarperCollins)RRP $29.99

The Barefoot Investor holds an Australian Financial Services Licence (302081). This is general advice only. It should not replace individual, independent, personal financial advice.

Originally published as Barefoot Investor: Give them the gift that lasts forever