Barefoot Investor: Bitcoin still just a punt, but we love to gamble

Right from the start I have said I believe blockchain technology will eventually transform entire industries and, at some stage, online payments, however, the truth is right now many cryptocurrencies are junk and Bitcoin is still a punt, writes the Barefoot Investor.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

LET me show you how not to write a Facebook post.

Almost a year ago to the day, I wrote a post warning that cryptocurrency was in a bubble.

See, at the time, there were a lot of hairy claims being spruiked by investment newsletters, like: “$642,245 for every $10,000 invested?”“This could turn $500 into 42k.”

“A potential 629 per cent gain if you buy on tomorrow’s opening.”

EVERYTHING YOU NEED TO KNOW ABOUT CRYPTOCURRENCY

(Note the artful disclaimers in each headline: the question mark, “could”, and “potential”.)

Basically, I suggested that buying cryptocurrencies shouldn’t be confused with investing in income-producing assets (such as shares and property), and the frenzy that was occurring was really “just a punt”.

And the fine people of the internet thought deeply about my reasoned argument, considered it intently, shrugged their shoulders, and went back to stalking their ex on social media.

Actually, no. My Facebook feed went feral.

At the time, there weren’t just cryptocurrency converts, there were crypto-crusaders, who were openly aggressive to anyone who dared question the new paradigm:

“Well this is what clutching straws looks like when you’re slowly becoming irrelevant.”

“You need to either adapt to change and accept crypto as a legitimate investment or be disrupted … the winds of change blow upon you.”

“Maybe stick to telling bogans not to buy $100k LandCruisers, Mr Barefoot.”

And that just was the start!

Little did I know it was about to get a lot worse.

You see, on the day I wrote the Facebook post, the price of one Bitcoin was $US7022.

Over the next 30 days two things happened:

First, the price rocketed to a high of $US19,783.

Second, the crypto-crusaders crucified me every single day … it went from a few snarky replies to 1870!

And fair enough, too: as the price went exponential, my post, frozen in time at a much lower price, made me look pathetic. (Undeterred, I doubled down in December — a week before the high — and warned people again not to buy Bitcoin. That only served to make people completely lose their minds: “YOU HAVE NO CREDIBILITY!”).

Now, 12 months on, as I sit and type this, Bitcoin is trading at … $US4450.

Its price is down 30 per cent this month, 50 per cent in the past six months, and almost 80 per cent since December.

Let me be clear:

Right from the start I have said that I believe blockchain technology will eventually transform entire industries and, at some stage, online payments. However, the truth is that right now many of the cryptocurrencies are junk. And while Bitcoin is more established, its seesawing price is preventing it from being used as a widespread dependable currency.

Bottom line? At this early stage of the game, it’s still very much a punt.

However, I also never said that punting doesn’t sometimes pay off. After all, those people who cashed in after those 30 days last December would have made a killing. The trouble, of course, is knowing when you’ve won.

With the pokies it’s easy — when you hit the jackpot, the lights flash, the music chimes, and you hit “collect”.

But no lights flashed when Bitcoin hit $US19,783. Hopefully some of the crypto-crusaders hit “collect”, yet, judging by the fever on my Facebook post last December, I doubt many did.

Then again, we Aussies are the biggest punters on the planet. British-based global gambling analysts H2 Gambling Capital put Australia’s average loss per adult at $1324 over the past year, the highest in the world.

So, I’ve learnt two things since I wrote that post a year ago:

We love a punt in this country. And no one likes a killjoy.

Tread Your Own Path!

Q&As

CUT THE MIDDLE MAN

TERRY ASKS: I know you’re a fan of Warren Buffett’s Berkshire Hathaway. Well, there’s a relatively small listed investment company (LIC), called Global Masters Fund Limited (ASX: GFL), that invests in Berkshire Hathaway, British shares and cash.

It appears to have performed fairly well over the past five years or so. I am considering investing in it but have some reservations, like their exposure to the British market given the Brexit situation. Is there any advice you can provide when weighing up a fund like this?

BAREFOOT REPLIES: Yes, I’ve heard of them.

I wrote about them when they first listed in 2006, and then sent my column to Warren Buffett himself in the post (he doesn’t do email).

A few weeks later, Buffett sent me a handwritten letter thanking me for alerting him to Global Masters Fund, and for advising people not to invest in them.

As of September 30, the Global Masters Portfolio has 63.8 per cent invested in one stock, Berkshire Hathaway, 9 per cent in ASX listed investment company Flagship Investments, 6 per cent in the Athelney Trust, 6.3 per cent in cash and 14.7 per cent in something they refer to as “other UK”.

(Interestingly, the managing director of Global Masters is also a director of Flagship Investments, and the Athelney Trust).

Global Master estimates its fees at just 0.23 per cent.

Which is fairly low. Cheaper than many exchange traded funds (ETFs).

Except … it’s not. Flicking open their annual report it shows that shareholders also cough up for auditor costs, share registry costs, directors’ fees and admin costs.

Put it all together and the true cost of investing through Global Masters Fund is actually closer to 2.2 per cent — and that’s bloody expensive!

So Terry, considering you don’t even like British investments … why not just Brexit?

With international brokerage fees as low as $10 a trade (and there are some apps that are free, but they tend to screw you on the currency conversion), why not buy shares directly in Berkshire Hathaway (BRK.B)?

After all, Buffett refers to his shareholders as partners, and treats them as such.

A quick look at Berkshire’s annual report shows that he takes a salary of just $US100,000, and even reimburses the company for personal expenses.

A SPLURGE OF SAVINGS

JOANNE ASKS: Loving your new book, but I have a question. If a child does not want to spend their accumulated “Splurge” money, isn’t that effectively another form of savings?

I am trying to identify the more important lesson.

Is it the realisation through experience that splurging can result in the impulse buying of random, insignificant items or should it be rewarding the decision not to splurge at times and having that money to top up their savings?

BAREFOOT REPLIES: Congratulations on doing the jam jars!

You’re well ahead of most parents, who do pocket money for a while, and then let it fizzle out, and then give up.

Having your kids put their pocket money into three jars teaches fundamental life lessons:

The “Smile” jar teaches them the power of saving up for something that makes them smile.

The “Give” jar teaches them the joy of generosity, and breaks the entitled bratty mentality some kids have.

The “Splurge” jar teaches them how to spend their money wisely and enjoy it.

(The biggest financial fear that I have for my kids — having the Barefoot Investor as their dad — is they’ll be so focused on money that they’ll become tight-a---- I don’t want to raise stingy, money hungry kids. There’s a fine line between “8-year-old Johnny’s such a good saver, he won’t spend a cent!” and “28-year-old John is such a tight-a---, no wonder he doesn’t have a girlfriend”).

So Joanne, I’d encourage your kids to splurge some of their money.

Yes, they’ll make some mistakes, as we all do.

Then again, that’s how we learn, right?

LIKE WINNING LOTTO

ZOE WRITES: I am 19 and was given your book last Christmas.

I am not the greatest saver — I like to splurge a little too often.

Yet a year after reading the book I have over $16,000 in savings, $4000 of which is in shares. Recently I did my tax return, and the accountant was asking how a 19-year-old girl seems to have it so together.

I explained that she could buy your book for $29.95 (or less at Big W), and while she was doing my tax return I drew your “serviette strategy” on the back of an invoice sheet. She looked at me in amazement the entire time, even though I was basically regurgitating everything you had explained. It was an awesome feeling.

So I wanted to say thank you — you have given me a $29.95 lottery ticket that has earned me thousands!

BAREFOOT REPLIES:

I’m punching the air as I’m reading this.

Most people leave school believing they have no idea about money, and then they prove it to themselves.

Not you!

I guarantee your accountant was thinking, “why wasn’t I this sorted out when I was 19?” (As is everyone reading this).

Well done, you got this!

If you’ve got a burning money question, visit barefootinvestor.com

and #ASKBAREFOOT

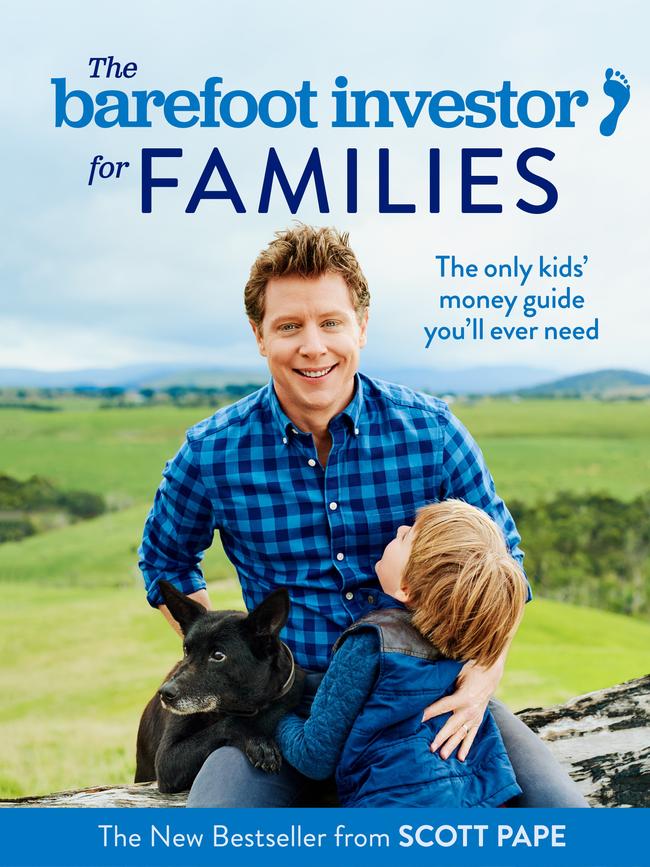

The Barefoot Investor for Families: The Only Kids’ Money Guide You’ll Ever Need (HarperCollins)

RRP $29.99. Available now in all good bookstores and online

The Barefoot Investor holds an Australian Financial Services Licence (302081). This is general advice only. It should not replace individual, independent, personal financial advice.

Originally published as Barefoot Investor: Bitcoin still just a punt, but we love to gamble