Australia’s failure to ‘crack down on harm’

Every day Australians will be up against cashed up corporations when trying to tackle this huge problem.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

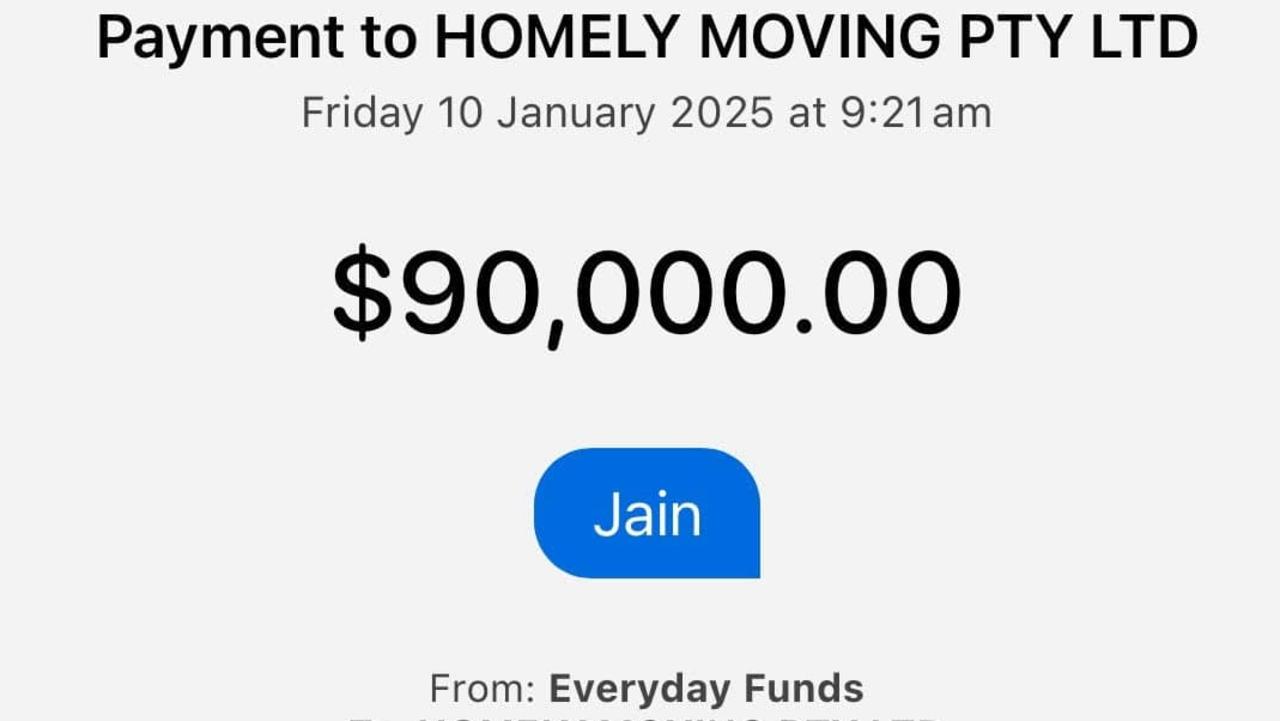

Scam victims are being set up to fail under proposed new rules and will be locked in a bitter battle against cashed up corporations, according to politicians and consumer groups.

They have hit out at a Senate report that has recommended pushing through legislation aimed at tackling scams but has no requirement to mandatorily compensate Australian victims.

The government’s proposed legislation will pit a victim against “well-resourced multinational corporations such as Meta and Google, or a major bank or telco’ in a David and Goliath battle”, Greens Senator Nick McKim said.

The report noted that Australia is known as “the world’s honey pot for scammers” with $2.74 billion stolen in one year alone - yet one victim told the inquiry the total amount lost to scams is likely significantly under-reported, due to the shame experienced.

News.com.au has launched People Before Profit, calling on the federal government to make it mandatory for banks to compensate scam victims – just like in the UK.

In October last year, the UK introduced world-leading legislation making compensation mandatory for scam victims within five business days except in cases of gross negligence.

IT’S TIME BANKS PUT PEOPLE BEFORE PROFITS. SIGN THE PETITION HERE

Mr McKim said the Scam Prevention Framework places the onus on a person who has been scammed to take on their bank, telco and/or social media platform to prove the billion dollar profit machines did not prevent the scam.

As unveiled by consumer groups, this would be a complex, legalistic and a time and resource draining task for victims, he said.

“Labor’s Scams Prevention Framework Bill could have been a much needed opportunity to crack down on the harm caused by scams,” Mr Mckim said.

“Disappointingly, Labor has chosen to prioritise the interests of their political donors – the major banks with their multibillion-dollar profits – over the interests of everyday people.”

The Greens backed a modified version of the UK model that would include a presumption of bank reimbursement. However, it would allow the banks to share liability for the scam loss between social media companies and telcos – after the consumer has been reimbursed.

“The Greens support this model because it is evidence based and places the interests of people, not corporations, at the centre,” Mr McKim said.

“It ensures people who are scammed are quickly reimbursed at the point where they lost their money, and banks, telcos and digital platforms are incentivised to innovate to prevent scams from occurring in the first place.”

Australia needs to adopt the UK’s successful scam reimbursement model, which ensures banks refund victims first, rather than forcing them into a bureaucratic nightmare, he told news.com.au.

“The big banks raked in nearly $32 billion in profits last year. They can afford to refund scam victims and then recover costs from other companies like telcos and social media platforms - just like they do in the UK,” he added.

“No one should have to fight for months, or even years, just to get their own money back.

“The Greens will push to amend this bill to introduce a clear presumption of reimbursement, so victims aren’t left to battle the banks on their own.”

The Greens will fight to fix this bill and make sure banks take responsibility for protecting their customers, he said.

ACT independent senator David Pocock said the Senate committee inquiry has highlighted very clearly that this bill needs more work.

“We urgently need better, legislated protections for consumers but we also need a workable framework with clear obligations and opportunities for redress, including compensation for Australians who get scammed,” Mr Pocock told news.com.au.

“I hosted a briefing for crossbench colleagues with consumer representatives in parliament this morning and will continue conversations with colleagues across the parliament about opportunities to improve the bill.”

Consumer groups told the Senate inquiry that the proposed framework relies heavily on banks, social media giants and telcos handling the majority of scam complaints in “good faith and always putting their customer’s rights and needs ahead of their other commercial evidence’.

But they were sceptical that this would be the case without explicit compensation measures under the framework.

They pointed to cases in which scam victims are “treated appallingly”, arguing that “this is not the conduct of outlier bad actors, but industry-wide practice”, the Senate report revealed.

Chillingly, it was also pointed out the corporations may be able to appeal any decision made to repay scam victims to the Federal Court if they disagreed with the external dispute resolution outcome.

The report noted that evidence was given that it “will be a rare victim who has the funds to defend their case in the Federal Court”.

“This is unprecedented and undermines a cornerstone of external dispute resolution, giving deep-pocketed multinationals immense power in dispute resolution: they can just challenge a decision in a jurisdiction where victims can’t afford to defend,” the Consumer Action Law Centre said.

It considered that the threat of appeals to the Federal Court “fundamentally shifts the power dynamic in that dispute”.

A consumer is far more likely to settle rather than getting a fair hearing, they added.

Legal Aid Queensland also argued that “consumers should not be required to approach all the organisations that may have been involved in a scam individually”.

Instead, a complaint to either a bank, social media company or telco should “be treated as a “one stop shop” for the consumer”, the report said.

The Law Council of Australia also called out the dispute resolution model proposed in the bill, suggesting it may result in “protracted examinations” of banks, social media companies and telcos roles in a scammer’s attack to determine liability “leading to lengthy disputes”.

Concerns about the uncertainty around liability and apportionment surrounding a scam could create a chain of countersuing between entities to apportion liability for consumer compensation was another issue raised in the report.

Assistant Treasurer Stephen Jones said it is clear that there is strong support for the legislation to pass.

“We will work through some of the details, but the overwhelming message from this inquiry is that strong prevention measures are needed,” he said.

In the report, Choice also argued that there is little that digital platforms “don’t know about their users, but the rate that scams have proliferated on Google and Meta platforms makes it abundantly clear these tech giants are choosing not to adequately invest in scam prevention”. The consumer group also criticised the issue that digital platforms take an “approve first and ask questions later, if ever” approach to publishing ads.

This means they are “paid directly by scammers to promote scam advertisements, [so] there is an inherent conflict between the financial interests of digital platforms and the safety of their users”, Choice added.

The Australian Banking Association is opposed to banks refunding scam victims in the first instance, like legislation introduced in the UK in October last year, and then working with social media giants and telcos to apportion liability for the scam.

“Social media giants are some of the biggest companies on earth. Why would we as Australians let them off the hook? If banks are the only ones liable for scams there will be a million more of these sorts of ads luring people in tricking them and taking their life savings,” CEO Anna Bligh said.

Originally published as Australia’s failure to ‘crack down on harm’