ASIC sues Macquarie Bank over monitoring failures

Macquarie is facing significant fines as the corporate regulator sues it for alleged failures to monitor third-party withdrawals from customer accounts.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Macquarie is facing significant fines as the corporate regulator sues it for alleged failures to monitor third-party withdrawals from customer accounts.

The Australian Securities & Investments Commission on Tuesday said it had commenced legal proceedings in the Federal Court against Macquarie over its “limited monitoring” of transactions made through its so-called bulk transaction system by financial advisers.

It followed a criminal case that concluded in 2021, with one “deeply stupid” financial adviser locked up for embezzling millions of dollars from wealthy clients through Macquarie’s systems.

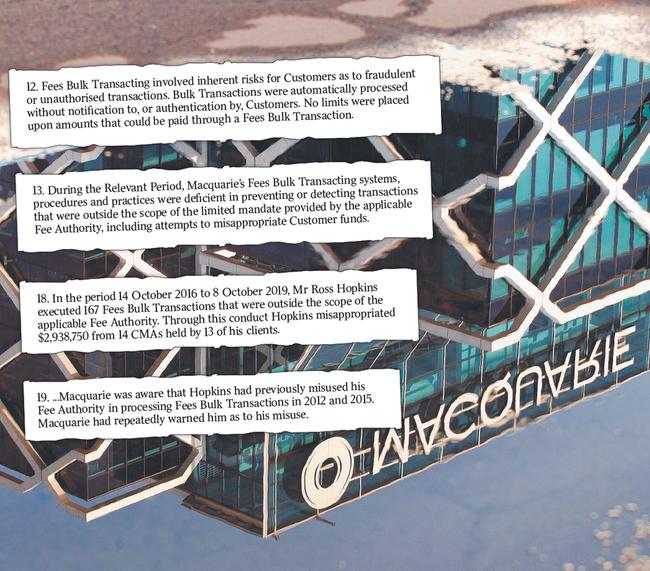

The alleged “limited monitoring” enabled disgraced former financial adviser Ross Andrew Hopkins to embezzle $2.9m from clients over a number of years. Hopkins, who was the sole director of QWL Pty Ltd in Sydney, siphoned the funds from 13 of his clients’ accounts between 2016 and 2019 using the bank’s bulk transaction system.

He was sentenced to six years in jail last May, with Acting District Court Judge Gregory Woods QC at the time labelling his behaviour as “deeply stupid”, while noting that “being stupid is no defence or mitigation”.

According to ASIC, transactions by third parties using a ‘‘fee authority’’ did not pass through a fraud monitoring system at Macquarie or undergo manual checks to confirm they were for fees only.

The case against the bank stemmed from the criminal proceedings against Hopkins, and concerned the inadequate systems in place, ASIC deputy chair Sarah Court told The Australian.

“We allege that Macquarie didn’t have the adequate systems and compliance checks in place to protect its customers from this kind of fraud that Mr Hopkins perpetrated,” Ms Court said.

“Those customers lost nearly $3m in unauthorised withdrawals. Our concern in this case is not so much about Mr Hopkins’ conduct itself, which has been dealt with now by the court, but to … focus in on Macquarie and its systems and compliance processes.”

Macquarie allegedly failed to detect and prevent the unauthorised fee transactions, many of which involved more than $10,000, Ms Court added.

According to the court documents, ASIC alleges that from May 2016 to January 2020, Macquarie failed to take measures to prevent or detect transactions made using its bulk transacting system that were outside the scope of a fee authority given by a customer, including misappropriating, and attempts to misappropriate, customer funds.

ASIC claims that through these failures Macquarie breached its obligations as a financial services provider to ensure its financial services were provided efficiently, honestly and fairly.

Macquarie made false or misleading representations in the promotion and offering of limited third-party access over cash management accounts, according to ASIC. In particular, the regulator claims that where a client gave authority to a third party, Macquarie represented that it would check the transaction made was actually for fees, when it did not.

“We say that Macquarie was really making representations to its customers that if they signed this authority, the only thing that would be deducted out of their accounts would be financial adviser fees,” Ms Court said. “And so we say that was misleading in circumstances where Macquarie’s systems did not restrict the deductions from accounts or those fees and in fact enabled much broader sums to be withdrawn.”

Acknowledging the proceedings, Macquarie said it had co-operated with ASIC on the matter.

“ASIC’s court filing notes that this issue arose in relation to 13 clients of an independent financial adviser between 2016 and 2019, who has since pleaded guilty to fraud,” the bank said. “Following the independent adviser’s failure to compensate his clients for their losses, Macquarie fully reimbursed the 13 clients.”

ASIC is seeking declarations, pecuniary penalties and other relief from the court, including a compliance order for an independent review of Macquarie’s fee authorities and fee transactions.

The penalties could be “significant”, Ms Court said. “Certainly in millions (of dollars) … it needs to be significant.”

ASIC’s investigation into Hopkins and QWL commenced in 2019 in response to allegations that QWL had failed to assist the Australian Financial Complaints Authority in resolving client complaints.

The disgraced former adviser was engaged to manage clients’ self-managed superannuation accounts and had almost complete control of their retirement funds, allowing him to transact on their accounts.

Over the three-year period he executed 167 transfers that were outside the scope of the applicable fee authority. Even prior to this, Macquarie was aware that Hopkins had previously misused his fee authority in processing bulk transactions in 2012 and 2015 and had repeatedly warned him over the misuse, ASIC said in court documents.

The millions of dollars he stole was spent on holidays, rent, paying his own credit card debts and repaying personal loans.

Morningstar banking analyst Nathan Zaia said the major unknown was how big the fine would be, if ASIC succeeded in court. “What it would come down to is whether there will be a severe penalty for the alleged breaches,” Mr Zaia told The Australian.

Originally published as ASIC sues Macquarie Bank over monitoring failures