Asian developer Atlantic Gulf & Pacific Company seeks gas import partners

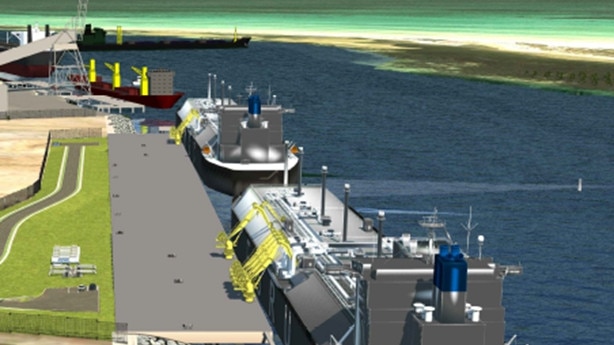

AP&G wants to accelerate work on one proposed solution to the looming gas shortfall, seeking Australia’s gas retailers to partner it in building a LNG import terminal.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Asian developer Atlantic Gulf & Pacific Company has approached Australia’s largest energy companies for a joint venture or supply pact as it runs the ruler over a deal to buy gas import proponent Venice Energy.

A potential deal would accelerate development of the South Australian LNG import terminal, which is now seen as a pivotal short-term solution to a east coast gas shortfall expected in 2025.

Venice Energy expects to be one of the first to import LNG into Australia. The South Australian LNG import terminal project has struggled because Origin Energy has been unable to get large buyers to commit to it, which would have allowed the country’s largest gas retailer to underwrite the infrastructure development.

However, it is believed that the alternative proposal pitched by AG&P is unlikely to appeal to Origin.

Venice Energy is in talks with potential suitors.

Sources familiar with the situation say AG&P – now majority-owned by US-based Nebula Energy, with a minority interest from Osaka Gas – has concrete interest.

AG&P has significant growth ambitions. The company earlier this year said it had aspirations to develop six new LNG import terminals in South and Southeast Asia, notably The Philippines, Vietnam, Indonesia and India.

AG&P has in recent weeks asked Australia’s largest retailers to consider joining a bidding consortium, lowering their risk as they struggle to persuade traditional buyers of gas to commit to 10-year supply deals.

A joint venture deal would then see AG&P sell gas to other retailers, which are increasingly concerned about shortfalls.

It is not clear whether AG&P will proceed with their interest in Venice Energy should they be unable to find a partner, though the country’s energy industry is increasingly alarmed about the supply crunch that would unsettle the industry.

Supplies from the Bass Strait gas fields – which traditionally met up to half of Australia’s east coast gas demand – are rapidly declining, are new developments are struggling to overcome community opposition.

The federal government last week acknowledged the importance of gas to Australia’s economy until 2050, but major projects continue to be held up by regulatory and environmental approvals.

Several new developments, such as Santos’s Narrabri gas project and the expansion plans of Senex Energy, backed by Gina Rinehart and South Korean steel giant POSCO, remain, awaiting regulatory approvals that have dragged on for months.

Critics accuse the government of delaying approvals, but the government insists it is acting with haste but will not cut corners.

But Australia can ill-afford delays in sourcing new gas.

Many manufacturers rely on gas and cannot easily substitute renewables.

Gas is regarded as a “peaker”: generators can burn the fuel for short periods to meet spikes in demand or make up for shortfalls in renewable energy generation. Without adequate supplies, gas power generators will be unable to fire up, electricity prices will rise and the threat of blackouts will increase.

The Australian Energy Market Operator has warned that gas electricity generators could have to turn to burning diesel as soon as next winter to meet supply shortfalls.

Gas generators were last forced to use diesel to prop up the electricity grid in 2022, when Russia’s invasion of Ukraine triggered a domestic crisis.

But opponents such the Greens insist Australia should instead accelerate the rollout of batteries or curtail exports of LNG. Australia is one of the world’s largest LNG exporters, but limiting shipments would hurt the economies of regional allies.

There are also significant challenges in piping gas down from Queensland.

As a result, LNG import terminals have emerged as the most likely solution. LNG cargoes could be shipped to the east coast and piped to Victoria and NSW to meet peak demand during winter.

Critics, however, insist Australia will be outsourcing energy security to LNG exporters such as Qatar, and insist prices are likely to be higher than if new domestic gas fields are opened.

LNG import terminal proponents deny there will be substantial price increases when the cost of gas and piping fees is considered.

Andrew Forrest’s Squadron Energy, which hopes to open Australia’s first LNG import terminal at Port Kembla, last week hit back at claims that gas prices will soar if users on Australia’s eastern seaboard are required to rely on imported gas supplies.

Disputing the findings of a new report released by Frontier Economics, Squadron said import terminals would put downward pressure on prices as it would provide access to a growing supply of global LNG.

Frontier’s research, funded by listed pipeline operator APA Group, found that importing gas would cost both industrial and residential customers significantly more than sourcing it domestically due to the costs of shipping and regasification, and the exposure to international gas prices, which soared after Russia began its war with Ukraine.

However Squadron Energy chief executive Rob Wheals – a former chief executive of APA Group, who joined Squadron in March this year – said the Port Kembla terminal provided the fastest solution to bridging looming gas shortages on Australia’s east coast.

More Coverage

Originally published as Asian developer Atlantic Gulf & Pacific Company seeks gas import partners