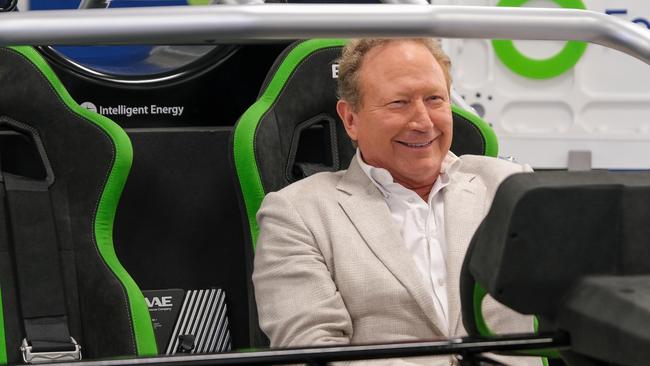

Andrew Forrest’s credibility gone along with Fortescue’s green hydrogen collapse

The Fortescue founder made his vast fortune by snubbing the doubters and repeatedly made bigger and bolder promises on his green revolution. So the cost of failure is more than financial.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Andrew Forrest made his vast fortune by snubbing the doubters. The approach worked on his iron ore bet two decades ago. This time with green hydrogen, the story couldn’t be any more different.

After refusing to acknowledge any internal warning signs and critics from the energy industry, Forrest was determined to keep crashing through. Now reality has hit and his green energy ambitions have crashed spectacularly. There is more than a financial cost – much of which is yet to be quantified.

Firstly, there’s the emotional toll on the 700 employees from across Fortescue – including those that bought into the green energy dream – who are now set to be sacked.

The second is Andrew Forrest’s credibility has taken a major hit.

For more than two years, Fortescue has been full throttle trying to turn Forrest’s promise of converting green hydrogen into a commercial reality within years.

He talked a big game and travelled the world meeting governments while handing out green MoU’s like calling cards.

Instead, as the economics around surging electricity costs needed to produce green hydrogen sunk in, deadlines were pushed back and back. The mission changed, then there was a revolving door of executives.

With all the optics of a rare defeat, Forrest has finally moved away from his centrepiece promise of developing a commercial green hydrogen export business by the end of the decade.

Instead Fortescue is again looking more like it’s bigger rivals BHP and Rio Tinto with plans to switch to conventional renewables like wind, solar and storage and in-house development to help it meet its net zero targets by 2030, while building up business lines.

The running of two Fortescues in parallel – one division that covered mining and another in energy – will be unwound to save on hundreds of millions in costs.

Even with the much-welcomed streamlining, investors are still in the dark about financials and whether key executives in the energy adventure are staying or going.

Forrest on Thursday was firmly standing by green hydrogen as a technology and promised that Fortescue will bring it to market as the economics become more favourable. So too his commitment to decarbonisation where he had already spent more than $1bn.

“I am not giving up on hydrogen at all,” Forrest tells The Australian.

“The green electricity price just kept keeps heading north, and It’s been dragged up by the fossil fuel price. We’re not pivoting away. We’re going upstream to get the green electrons at the right price”.

He says the benefits of the spend are spread through Fortescue, which now has product division for battery-powered trucks, and trains and ships in development powered with green energy. So too he is developing inputs for green fertiliser as well as trailing a green iron plant in the Pilbara to make the ore more pure.

“These are each multipliers of market cap. They’re not adders to market cap. They’re big movers, and that’s all come about because the company’s pushing to hydrogen, and all of those are ripe”.

Still, the sheer chaos of the adventure was more like watching a start-up burn bright and then implode and Fortescue’s board needs to remind itself it is a top 10 company with thousands of workers and whether it likes it or not has an army of stakeholders from governments, investors to customers.

Out of corporate failure there are usually some valuable lessons. But the Forrest show has likely put the global quest for green hydrogen back years. If Forrest with all his substantial resources and connections couldn’t pull it off as planned, it will most certainly make others think twice about investing in the technology.

‘No customers, no energy’

For Forrest though, the problems were multi-faced.

He was trying to develop an over-the-horizon technology for a product that didn’t have any customers ready to go. And as he discovered, it didn’t have the green energy sources at scale needed to make the raw material.

The rule of thumb is that more energy goes into producing hydrogen than what hydrogen offers. That’s why Forrest needed to pin down an energy source, and lots of it. Surging power prices made that even harder.

Even if Forrest had a breakthrough on the technology of producing hydrogen from water, it simply wouldn’t be economical enough at today’s prices to make it work.

Essentially Forrest was solving the answer to a riddle that belonged to a different question.

At the peak of Forrest’s hydrogen push, energy players were casting doubts while Australia’s biggest steelmaker, BlueScope, loudly cautioned the technology was still a long way from reality.

BlueScope boss Mark Vassella had sweated the numbers as he was embarking on his own green steel road map ahead of the reline of his $1.1bn upgrade of its Port Kembla blast furnace.

BlueScope was a potential customer and here Vassella couldn’t find a commercial case for hydrogen to be used in the blast furnace.

Vassella’s number one problem was the extremely high energy intensity needed to run the furnace which he conservatively estimated would run to 15 times BlueScope’s existing energy needs.

BlueScope is now joining with BHP and Rio Tinto to develop an electric smelting furnace. A process that also relies on vast volumes of electricity, although cuts out the need for the conversion of hydrogen altogether.

Big promise

Hydrogen is classic Forrest play – big ambition and promising something that changes the world.

But we should ask whether the business of hydrogen fits the business of Forrest.

It is methodical manufacturing and requires buckets of patience. The Japanese government and electricity conglomerates have been quietly, but seriously working away for decades at solving the hydrogen puzzle. All without fanfare.

Forrest promised he could do it and be a global exporter by the end of decade. A surprising number even believed him.

No-one knows the true financial cost of the green adventure, given transparency was sorely lacking, although next month’s accounts release should shed some light.

Forrest still has dozens of green plans in train, with pilot plants underway and the push to build a green energy expressway from Morocco into Europe. He is also ready to hit “real net zero” emissions (without the buy in of carbon credits) for the end of the decade. The promises are still big, but who is going to buy in?

–

AI hype?

Influential stock picker David Paradice might have some leftover change – some $500,000 – aboard the runaway Nvidia train, but his own team are going to need more convincing around the benefits of artificial intelligence.

While AI has been the power story on Wall Street, driving names like Microsoft, Amazon and even Nvidia to fresh record highs, Paradice’s own managers have called out the hype behind the tech.

“It is not clear to us that at this juncture the monetisation or productivity improvements from AI justifies the hype and very extensive re-rating of AI-exposed stocks,” Paradice’s large cap manager Troy Angus has told the $14.5bn fund manager’s clients.

Angus too remains cautious on Australian stocks, tipping a possible interest rate hike here next month, based around the string of strong data around consumption and inflation.

He believes the Reserve Bank could be underestimating the impact of strong migration, fiscal stimulus but importantly, the “lagged effect” of EBA agreements is likely to sustain higher wage inflation and therefore spending for some time.

Paradice’s Australian Equity Fund posted returns of 12.77 per cent for the year, coming in just below the benchmark S&P/ASX 200 (total return). The fund continues to outperform on 3-year and 5-year horizon.

In recent weeks Paradice has sold off BHP on a weaker China outlook. But Paradice was not a supporter of the mining giant’s mega bid $65bn for Anglo American, which it ultimately abandoned in May after its advances were rejected.

The fund also kept the pressure on Qantas, recently meeting newly appointed Qantas director Nora Scheinkestel, who is also in charge of the airline’s board remuneration committee. Here the issue of around nearly $15m in long-term bonus payments made to former Qantas boss Alan Joyce was pressed – as well as the prospect of recovery.

johnstone@theaustralian.com.au

More Coverage

Originally published as Andrew Forrest’s credibility gone along with Fortescue’s green hydrogen collapse