‘A moment in time’: Hardie pays up for the American dream

James Hardie is betting it all to hitch itself to a new growth business. The test is whether the combination can prove to be more valuable than going it alone.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

James Hardie will finally shed what remains of its Aussie accent as it becomes a fully-fledged US building player after a friendly move on a fast-growing rival. Although at $US8.75bn ($13.9bn), and a hefty premium, buying this growth has not come cheap for the cladding specialist.

The Azek deal has stirred a moribund local M&A market back to life, and represents an all-in bet by Hardie on the housing market there, even as Donald Trump’s tariffs have threatened to put the economy into the rough.

The present is not the concern for Hardie’s Chicago-based chief executive Aaron Erter. He is eyeing the multi-decade opportunity in the so-called R&R market (repair and renovation) as tens of millions of America’s suburban houses hit their middle-age blues.

In fact, a downturn is the precise moment to move, particularly as the renovation of ageing homes is expected to hit the sweet spot over the next 10 to 15 years.

“This is a moment in time,” Erter tells The Australian. “We’re very confident in the medium- to long-term prospects of the US housing market. That’s just by nature of there being 40 million homes that are four decades and older”.

Erter has been watching Azek for at least two years, but talks began in earnest from late last year.

The deal stands to fundamentally change the $20bn James Hardie. The building materials player has increasingly been narrowing its focus on flagship fibre cladding for the bewilderedly-lightly-finished US homes.

Even today, some housing facades are being finished with vinyl and low-grade wood.

Fibre cladding is the space that the smaller Azek plays in, but the bulk of its growth in recent years is from its branded wood-substitutes for outdoor living renovation – that is homeowners putting in decking, balconies and pergolas and the like. This represents three-quarters of Azek’s sales.

To underscore Erter’s conviction over the resilience of the business, last year was a tough year for the US housing, as interest rates hit their cyclic peak.

Even Hardie felt the squeeze of a flat R&R market. Yet, Azek still generated sales growth of more than 17 per cent on established houses. This, and Azek’s wide margins, is the stuff he is prepared to pay top dollar for.

James Hardie has averaged sales growth of 11 per cent for the past seven years as its booming North American business has been slowed by its more mature Australian and European operations. By comparison, Azek has delivered 15 per cent annualised growth is it focuses purely on North America.

On the current runway there’s a near $23bn addressable market of siding, exteriors and outdoor landscaping, Erter believes.

“The home is the most important asset people have, and they have to repair it, they are going to do it right. I know people have some concerns, but we’re really confident toward US housing.”

Erter will need that confidence given the hefty price he is paying to get a slice of Azek’s growth. This is what has investors worried.

The headline cash and scrip transaction – which has been backed by Azek’s board – is pitched at a nearly 40 per cent premium to its last trading price. But what is more challenging it represents about 22 times earnings.

And much of the price tag will be paid for with Hardie shares, which have been tracking sideways for the past year and are trading at just over 11 times. If you put fold a higher growth businesses into a much larger, but slower growing one, chances gravity will eventually catch up and you have two lower growth businesses. Shares in Hardie have dropped as much as 14 per cent since the deal was unveiled.

There are concerns too the transaction that moves Hardie’s into new fields of decking and railings could distracting Erter from his boring but beautiful fibre cement cladding business he has spent considerable energy building up.

Synergy squeeze?

As part of the deal, James Hardie plans to move its primary listing from ASX to New York, although investors will be able to retain share exposure here under a local CDI listing.

Hardie’s moved its legal headquarters to the low-tax Netherlands at the height of its asbestos controversy some two decades ago, it later shifted this to Ireland.

However, for years, the company’s operational headquarters has been Chicago, with North America representing the overwhelming bulk of sales. Australia, where it was founded more than a century ago, now represents a little over 12 per cent of sales. This will fall below 10 per cent on the Azek deal.

Significantly, the upheaval marks the latest of the Australia’s crop of post-world war-industrials to either downgrade their listing here or leave the ASX all together.

Boral and CSR have both been acquired in separate deals. Last year, Amcor moved its primary listing and headquarters to the US following the blockbuster $13bn Berry acquisition.

The Azek buyout will see Hardie’s even more leveraged to the US economy, with US sales rising to just over 81 per cent from 74 per cent currently. Combined, the two companies will generate nearly $US5.5bn in annual sales.

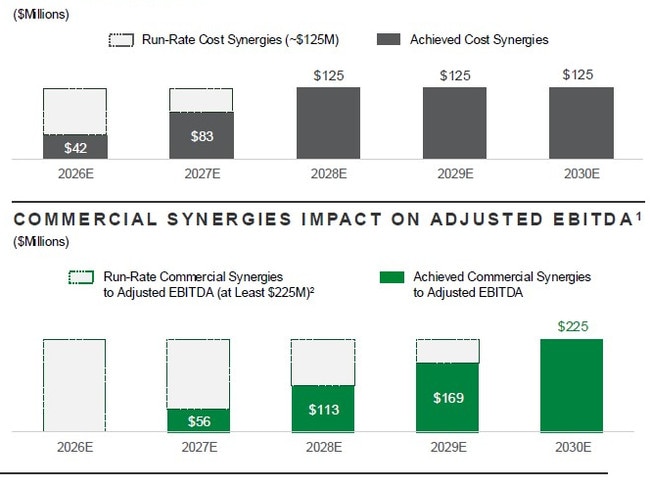

The key to this deal is whether Hardies can secure the $US625m or more in mooted synergies over time. If these are booked and it translates into an earnings lift, it effectively brings down the price tag. That’s the strategy Erter is working around.

Of these there’s $US150m in so-called cost synergies and another $US500m in revenue synergies, given the combination of two highly overlapping businesses. This represents savings across administration, R&D and manufacturing.

The blue sky opportunity is really the $US500m of so-called commercial synergies, that is, selling a broader suite of products at a higher margin through the same distribution channels – including tradies, builders and architects. This is a big test for Hardie and will be the focus point for investors in coming years.

Erter is ever confident of hitting these targets. Commercial synergies have been conservatively pitched. He says the opportunity is around 50 per cent of builders and tradies are using either James Hardie or Azek products for projects. He suggests there could be further upside to the sales numbers over time.

“We believe that we’re going to be able to convince a great majority of them to use Azek and vice-versa. The vision is to be able to give the homeowner a complete solution. If we can give homeowners contemplating siding and decking together, if we can give them a vision of design, that’s pretty powerful”.

Hardie’s is clearly paying a premium for Azek’s growth. The challenge will be whether it can become the boost Hardie’s is looking for.

eric.johnston@news.com.au

Originally published as ‘A moment in time’: Hardie pays up for the American dream