200 Aussies caught up worldwide scam

Australian victims are speaking out about being “abused badly” and the “ridiculous” lies they have been fed, including one about $65 million.

Costs

Don't miss out on the headlines from Costs. Followed categories will be added to My News.

Up to 200 Australians have been caught up in a worldwide scam with estimates that millions of dollars have been lost as leaked messages reveal the chilling strategy used by the scammers to convince people they weren’t being deceived.

The scammers, who were using a company name called Validus, were promoting investments to Australians that promised a 300 per cent return.

The money making scheme was alleged to be generated by professional traders who traded in crypto, foreign currency exchange and other financial products using pooled funds.

Despite a warning from the Australian Securities and Investment Commission (ASIC) in November 2022, telling people not to deal with or transfer money to Validus, Aussies have still fallen victim to the scam.

ASIC also warned that the operators of Validus do not have an Australian financial services (AFS) licence.

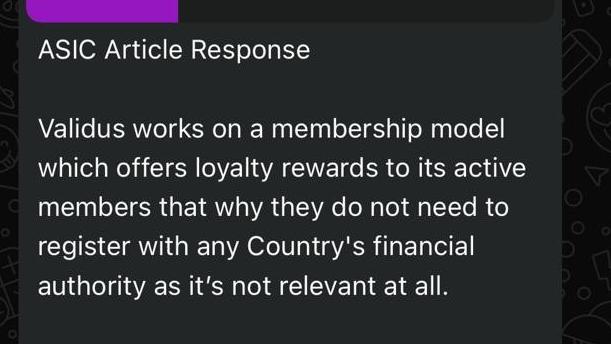

Chillingly, a leaked message from the Validus WhatsApp group revealed the scammers’ tactics of responding to ASIC’s warning with some extraordinary claims.

The message from Validus claimed they were not an investment company or offering a return on investment.

“Validus works on a membership model, which offers loyalty rewards to its active members that (sic) why they do not need to register with any country’s financial authority as it’s not relevant at all,” the company said in the WhatsApp message.

“Validus gives loyalty rewards to active members very similar to Qantas Frequent Flyer, Flybuys and Woolworths everyday rewards etc.”

Karishma* was one Australian victim who invested in the scam in January last year despite the ASIC warning.

She has lost $7500 and said the scammers used a model where a “reputable person from the community” brought in people by convincing them it was a “good investment opportunity”.

She said a gift card supplied by Validus where she spent $600 at David Jones convinced her that the scheme “must be real”.

In messages to victims, Validus told them they could do three things with their “points” purchased through their investment – buy more memberships, gift points to other members or redeem for digital assets such as bitcoin.

But when people could no longer withdraw money last year and they started “panicking”, Karishma said they were fed excuses by the scammers such as the portal being upgraded as to why they could not access their money.

“Then there was a WhatsApp group of people who had joined the scam … someone has put $500,000 in and another put in all their super money,” she told news.com.au.

But she said many people had also handed over cash so don’t have proof that they even paid the money.

“So many people have lost super or lost their life long savings but they are scared to talk to anyone,” she added. “The worst part is … we don’t know where the money is … and it might be millions or billions.

“They have used vulnerabilities in the community and when I get to know people who are victims of the scam they are from every walk in life, even accountants and people working in banks.”

Have you been a victim of a scam? Contact sarah.sharples@news.com.au

‘Abused badly’

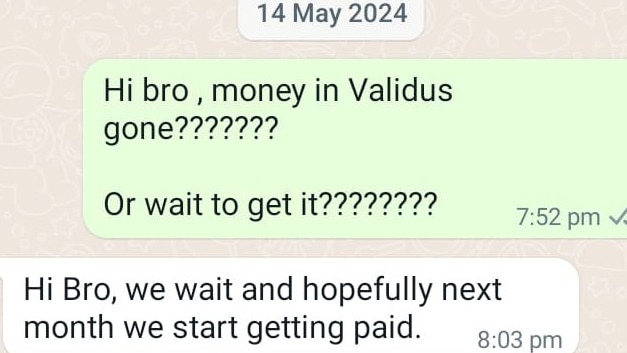

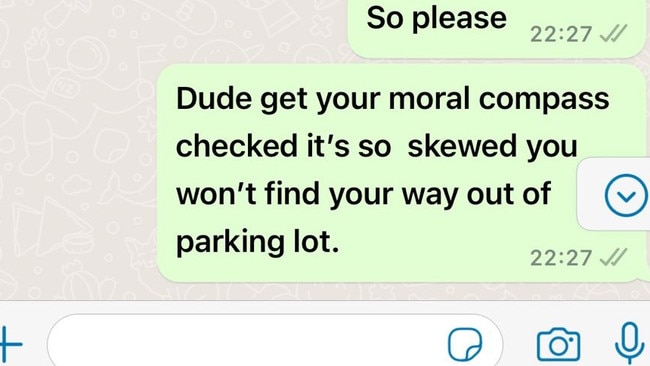

WhatsApp messages reveal the level of frustration and despair among victims when they could no longer access their money.

“There are so many people who have benefited from this. People who have recruited people will never want to do anything … Everyone who recruited someone (sic) is benefited in this,” wrote one person.

“Our senior leader already block us ...... and abused badly. when they need money they called every day when we ask questions they block,” another said.

“We will never see our money,” one person wrote, while another added they were criminals “who had spread like fungi in India too” by scamming people.

Other spoke about how “poor people have been scammed across the world”.

Many were disappointed they trusted Validus despite the ASIC alert.

“Remember how every single top person said to us that the ASIC website mentioning Validus (was) a fraud, was not right and we all fell for this nonsense, because we trusted them and put our money into it, now realising we can’t withdraw at this stage,” they said.

News.com.au has also seen screenshots of Australians transferring amounts of around $15,000 to Validus.

Even this year, Validus are still claiming they will get the money back to the victims.

Karishma said the Indian community in Australia had been particularly targeted as part of the Validus scam.

“The top leaders … had groomed people and hand-picked someone from each community and lured them into their community to take out the money with big promises. It looks like a very big scam and we don’t know where the money is getting used,” she said.

“There is this boss who has flown to Dubai and he is having all his big cars, a bungalow in Dubai, flashing all these things on Instagram and social.

“The scam is not limited to Australia itself. They are still grooming people in New Zealand, South Africa and PNG for example.”

Belgium, New Zealand and Dubai’s authorities have all previously issued warnings about Validus.

Wild claims

In May this year, Validus was claiming it had not gone under and people would still be able to access their accounts.

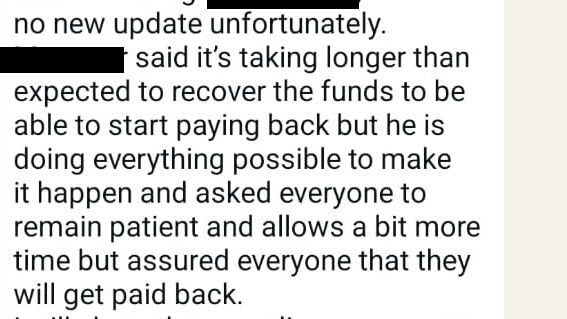

Validus even held online meetings in June promising to update victims, but many lashed out afterwards as they had heard the “same thing for the last eight months”.

“I had a enough of it, it is (sic) become ridiculous. It’s the same story hearing today of not having money and not able to recover from their investors,” an angry victim wrote.

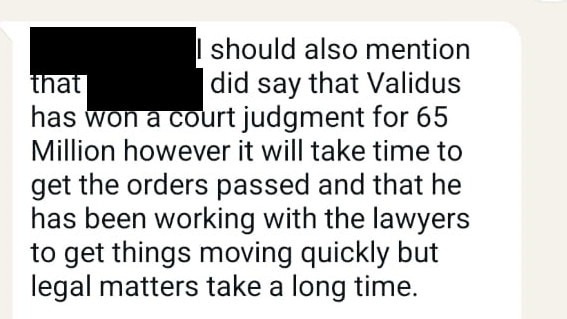

One community member who had allegedly introduced victims to the scam made astonishing claims over WhatsApp.

“Valdius has won a court judgement for 65 million however it will take time to get the orders passed and that he has been working with the lawyers to get things moving quickly but legal matters take a long time,” he said.

“He also said he has shown proof of these court proceedings to those who have visited him personally in Dubai and he continues to meet with anyone who wants to see him. However due to the matter being in court he can’t share any more information at the present time as it could harm the proceedings.

“But he is confident to recover the funds and pay members back and that is his top most priority and he is not going to do anything else till this happens.”

New scam launched

Even after the downfall of Validus, news.com.au has been leaked a video from September showing the company announcing they had a “second chance” and are selling a new product, which would “allow people to make good money”.

There were a “a lot of opportunities” for people from the network, the company claimed, but they were still working on the court cases and recovery of the money.

“At the moment, we are still in grave challenges, people owe us money, as of right now we are owed on paper over $140 million from different parties for Validus and that is something we are will not give up on,” the company said in a video.

Validus claimed once they have the money that accounts will be “settled” for people and added people shouldn’t buy into the “fabrications” spreading around as the company had been “transparent”.

The company added it deeply regretted any hurt or damage anyone’s personal life that had been caused.

People were outraged by the video.

“This is all bulls**t. Please let them know we need our hard earned money back at any cost,” one person wrote.

“They are trying again to fool the people.”

“It is interesting they are planning to promote another scam scheme,” someone else added.

An ASIC spokesperson said the corporate regulator warned investors about Validus in November 2022 over concerns that it was a scam.

“ASIC also shared information regarding potential fraud offences about Validus with NSW Police and Victoria Police in 2022,” they said.

The ASIC spokesperson added Validus does not hold an Australian financial services (AFS) licence.

“When we issued our warning, it used several websites to promote investments to Australians that promised returns of over 300 per cent – a clear warning sign. Existing investors were also encouraged to recruit new investors into the scheme, a classic sign of a pyramid scheme,” they said.

“The information promoted by Validus and the ‘investments’ they purport to make do not appear to involve financial products under the law, meaning ASIC has limited grounds to take action.”

Since ASIC published its warning in 2022, the corporate regulator said it had received a limited number of complaints – fewer than 10 from Australians.

“After considering the most recent complaint made to us in late 2023, we did not identify any current offerings or promotions in Australia,” they added.

However, ASIC encourages anyone who has invested in Validus to share information with them, the spokesperson said.

“ASIC will consider any new information we receive,” they added.

“ASIC encourages investors to visit the Investor Alert list on ASIC’s Moneysmart website before making investments, to find out if an investment may be unlicensed or fraudulent. Investors can also check ASIC’s professional registers to confirm whether an entity offering an investment holds an Australian financial services license or is an authorised representative of an AFS licensee.

“Investors should not invest their money with unlicensed or unauthorised entities, as they will miss out on important consumer protections including access to free dispute resolution services.”

sarah.sharples@news.com.au

*Name withheld over privacy concerns

Originally published as 200 Aussies caught up worldwide scam