Australia’s rental crisis laid bare in damning report

New data has revealed a drop in rental affordability across Australia this year, with a surprising capital city topping the list.

NewsWire

Don't miss out on the headlines from NewsWire. Followed categories will be added to My News.

Every capital city in Australia has experienced a fall in rental affordability this year, according to the latest Rental Affordability Index.

Data from the 92-page report shows Australians are being whacked with unsustainable increases, with rents climbing faster than incomes.

Low vacancy rates, interstate migration and global supply chain problems are also contributing to higher rents.

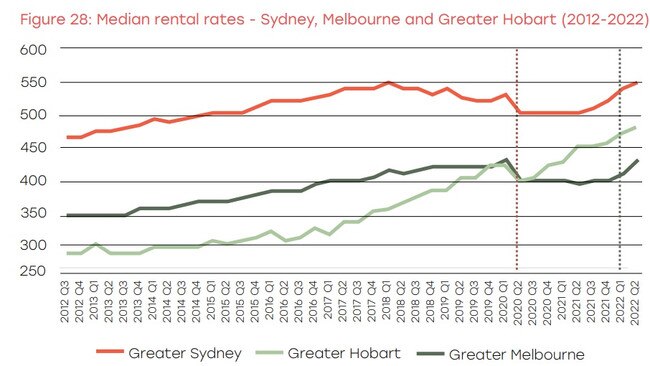

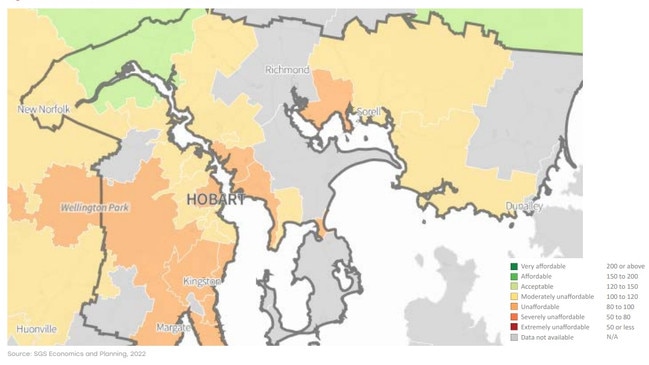

Greater Hobart remains the least affordable capital city, while Greater Brisbane has hit a historic low for affordability.

Brisbane is now considered moderately unaffordable for the first time, with an 11 per cent drop in its score over the past year – the largest fall of any capital city.

Meanwhile, Greater Perth is at its lowest rental affordability since 2016, declining a massive 15 per cent over the past two years despite high incomes for some parts of the community.

Greater Sydney, Greater Melbourne, Greater Adelaide and the ACT all fell in affordability this year, following slight improvements during the Covid-19 pandemic.

Low-income households were particularly at risk, the report found.

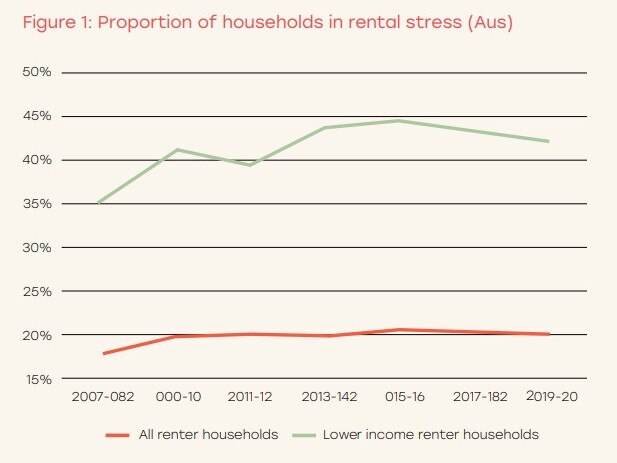

In 2019-20, 42 per cent of all low-income households were in rental stress – meaning they were spending more than 30 per cent of their income on housing costs – compared to 35 per cent in 2008.

That figure rose to 58 per cent when considering only the private rental market, the report noted.

SGS Economics and Planning partner and lead author Ellen Witte said the static or slightly falling rents of the early pandemic were short-lived, with rents now equal or higher than before 2020.

“The pandemic also saw the existing rental crisis spread to the regions, when many households left capital cities,” she said.

“More and more regional households are struggling to pay their rent and key workers are unable to access housing, especially in the regional areas of Queensland, Tasmania, NSW and Western Australia.

“This year’s severe floods also significantly impacted affordability in the Northern Rivers of NSW.

“Lismore is one of the worst affected towns, where affordability declined by 10 per cent between 2021 and 2022.

“Bellingen was similarly affected, with affordability declining by 14 per cent.”

The report noted rental stress was pushing single people on JobSeeker to the outer fringes of cities, removing them from employment opportunities.

“The regional areas offer scarce alternatives for the single person on benefits, where rents for this household remain extremely to severely unaffordable,” the report read.

For single pensioners, their annual income has increased by $2460 since the last index was released, but it has not stopped a drop in affordability, as rental rates outpaced this rising income in all capital cities except Brisbane and Adelaide.

“Across the nation, the single pensioner household faces unaffordable to extremely unaffordable rents,” the report read.

“For the most part, living in metropolitan areas, which is where one-bedroom dwellings are most numerous, would require 50 per cent or more of the pensioner’s income to be spent on rent.

“Housing pressures on this household type are likely to be compounded by healthcare costs associated with ageing.”

Greater Sydney and ACT remain the least affordable for single pensioners.

Pensioner couples have seen their annual income increase by $3832, but they still face severely unaffordable rents in metropolitan areas.

Regional South Australia is the only location with acceptable rents, actually improving in affordability over the past year.

Most areas within a 10km radius of the Sydney CBD and some inner areas of Melbourne are severely unaffordable to pensioner couples, who must pay 39 to 48 per cent of their total income if renting at the median rate.

For a single, part-time worker parent on benefits, their income has increased by $876.

“Affordability for this household type has deteriorated considerably across Australia and is now worse than in 2019 (pre-Covid) in all metropolitan areas except Greater Melbourne and Greater Sydney,” the report read.

“This group often experiences additional cost pressures. Childcare and healthcare costs may compound the financial stress on this rental household.”

Single, full-time working parents are mostly in the acceptable range, including all capital cities except Sydney and Canberra.

Regional areas are generally more affordable, especially in South Australia.

For single income couples with children, they face moderately unaffordable to acceptable rents.

However, inner parts of cities are unaffordable to severely unaffordable, with areas of Sydney deemed extremely unaffordable.

Dual income couples with children can generally access affordable to very affordable rents, with their income up almost $4500.

Finally, the income of student sharehouses is up slightly, but rental affordability fell in all regions, with some at historic lows.

CAPITAL CITIES AT A GLANCE:

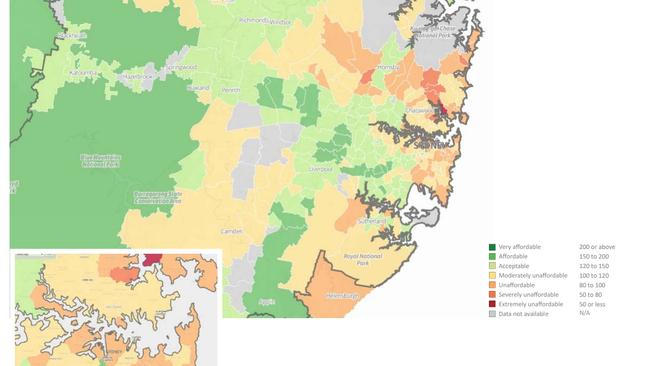

Sydney

The average rental household in Greater Sydney has a gross annual income of $114,231.

Rental affordability has steadily declined in the past year and is now between moderately unaffordable and acceptable.

Sydney remains critically unaffordable to many people.

Melbourne

The average rental household in Greater Melbourne has a gross annual income of $105,000.

Despite returning to pre-pandemic levels of affordability, Greater Melbourne is the most affordable capital city in Australia.

The average rental household spends about 21 per cent of its total income on rent, which is considered acceptable.

Brisbane

The average rental household in Greater Brisbane has a gross annual income of $99,428.

Following four years of improvement between 2015 and 2019, rental affordability in Greater Brisbane has fallen over the past two years.

Brisbane is considered moderately unaffordable for the first time, with people spending 27 per cent of their total income on rent.

Adelaide

The average rental household in Greater Adelaide has a gross annual income of $84,047.

Greater Adelaide is slightly below the threshold of having acceptable rents, with the average household paying 25 per cent of its total income.

Perth

The average rental household in Greater Perth has a gross annual income of $98,470.

Rental affordability in Greater Perth has dropped significantly over the past two years, becoming the lowest since 2016.

But Perth remains the second most affordable capital city, with the average rental household paying 24 per cent of its income.

Hobart

The average rental household in Greater Hobart has a gross annual income of $84,613.

High rents, relative to household incomes, mean Greater Hobart is the least affordable capital in Australia and has been since 2019.

Canberra

The average rental household in the ACT has a gross annual income of $123,566 – the highest in the nation.

The ACT has rents which are acceptable to the average rental household.