Marketplace, SMS, impersonators: The biggest scams and how to spot them

Scams saw Australians lose more than $3 billion last year, learn how to spot the most popular and complex social media con tricks and how to report them.

Police & Courts

Don't miss out on the headlines from Police & Courts. Followed categories will be added to My News.

In 2022, Australians lost $3.1 billion to scams, an 80 per cent increase on total losses recorded in 2021.

And these were just the reported losses, with previous research by the Australian Competition and Consumer Commission (ACCC) showing that more than 30 per cent of people do not report scams at all.

These shocking findings from the ACCC’s Targeting Scams 2022 report revealed that investment scams were the worst in terms of financial loss, accounting for 66 per cent of all monetary losses, totalling $1.5 billion.

Text messages were the top most reported contact method of 2022, but scam calls and social media were the highest contact method in terms of reported losses respectively, totalling an increased loss of more than $220 million since 2022.

With scams increasingly becoming more complex and hard to identify, the ACCC advises people to follow these three simple steps to protect themselves from scams:

- STOP: Don’t give money or personal information to anyone if unsure, many scammers will pretend to be trustworthy figures such as banks, police or government organisations.

- THINK: Ask yourself could the message or call be fake, and never click on a link in a message.

- PROTECT: Act quickly if something feels wrong and seek help from Australia’s national identity and cyber support service at IDCARE on 1800 595 160 or find more information at Scamwatch.

Take a look at some of the most popular scams in regional Queensland and how you can spot them.

Investment scams

Investment scams, or scams that “promise big returns with an aim of stealing money from you” are the worst scam in terms of financial loss, accounting for 60 per cent of the reported $328m in scams in 2023 so far.

Investment scams come in many different forms, with scammers targeting victims by posing as anything from super funds and banks to celebrities, or even posing as potential love interests on dating apps to gain your trust before sharing a false ‘investment opportunity’ with their victims.

In September this year, a Queensland woman reportedly lost $200k in an online trading scam, after investing her money in a cryptocurrency site called Trytrade.com which had been returning small amounts of her money back to her until communications stopped.

Another Queensland woman in her 70s, fell victim to multiple scammers, a Queensland Civil and Administrative Tribunal in June, 2023 hearing she allegedly lost a total of $1,004,580 after scammers allegedly told her they were investing funds for her over multiple years.

Scamwatch advises potential victims to look out for warnings signs of investment scams, including ‘over-the-top promises’ of high returns, high pressure tactics to make you act quickly and people or organisations that do not have an Australian Financial Services (AFS) licence.

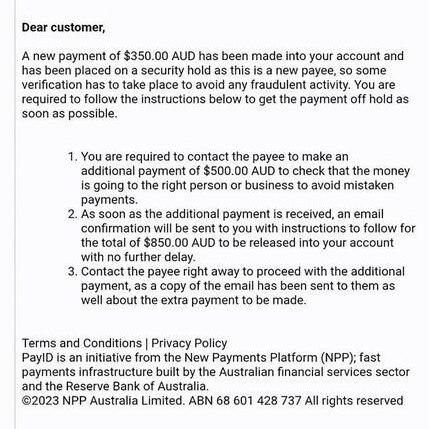

PayID scams

Popular on online marketplace communities, this sophisticated scam sees potential buyers and sellers of products tricking victims to pay them directly while posing as a customer support rep from PayID.

Offenders will usually start by inquiring about an item on Facebook Marketplace and offering to pay via PayID, an instant payment method that uses a person’s mobile number, email or ABN to transfer money.

After receiving your email address, the scammer then contacts you directly via your email from a fake PayID email stating that you must transfer money which will be immediately refunded as a verification process, but is never returned.

People on the Facebook community group ‘Sunshine Coast buy sell swap page’ have shared their interactions with these scammers, showing the realistic emails the fraudsters use to pose as PayID, using the realistic email address ‘payid@customerinquirysupport.com’.

When selling or buying on Facebook Marketplace, make sure to keep an eye out for strange payment methods or people asking you to set up PayID to make or receive payments – many payment methods are instantaneous, making it harder to get your money back when it gets in the wrong hands.

Marketplace product scams

Some scammers target their victims via marketplace platforms such as Facebook and Gumtree by selling products and not delivering on the goods that were sold, or falsely advertising said products.

One Toowoomba man, Brendan James Blatchly was sentenced at Maroochydore Magistrates Court in June, 2023 after pleading guilty to defrauding four people, pretending to sell a pedigree sphinx cat, an iPhone and a Harley Davidson motorcycle without delivering on the goods.

Pleading guilty to four charges of fraud and two separate charges of wilful damage, Blatchly was sentenced to six months behind bars with immediate parole with convictions recorded and had to pay $3445 in restitution for the total sum he defrauded from his victims.

Another man on the Sunshine Coast was charged with three counts of fraud, one count of attempted fraud and two counts of possess tainted property in July, 2023 when he was found allegedly selling people fake gold bullions on social media which was actually gold-plated copper.

The ACCC advises that you should always inspect the product before making a payment, use secure payment methods and be careful with products on offer that sound too good to be true.

Australia Post scams

A common texting scam, scammers will impersonate Australia Post, DHL, and other delivery companies, claiming that your parcel could not be delivered and a new delivery date or pick-up option must be arranged.

Sent from a random number that looks real, the aim of the message is to get you to click on the link in the text and make a payment or enter your details via a fraudulent website.

There are multiple ways to identify these scams, with the text itself often featuring typos, strange wording or generic phrases that are not specific to your delivery.

Rental scams

Targeting prospective tenants, online rental scams involve scammers impersonating landlords and real estate agents and asking for bonds to secure a rental property on social media marketplaces, such as Facebook.

Particularly prevalent during the cost of living and housing crisis, the scam targets those in the highly competitive rental market, with one Sunshine Coast mother sharing her story in March, 2023 where she nearly fell victim to the scam when a three bedroom Maroochydore home was advertised on Facebook.

Scamwatch advises people to never pay money for a rental property you are not able to inspect and to always make sure you are dealing with a licensed estate agent in your state.

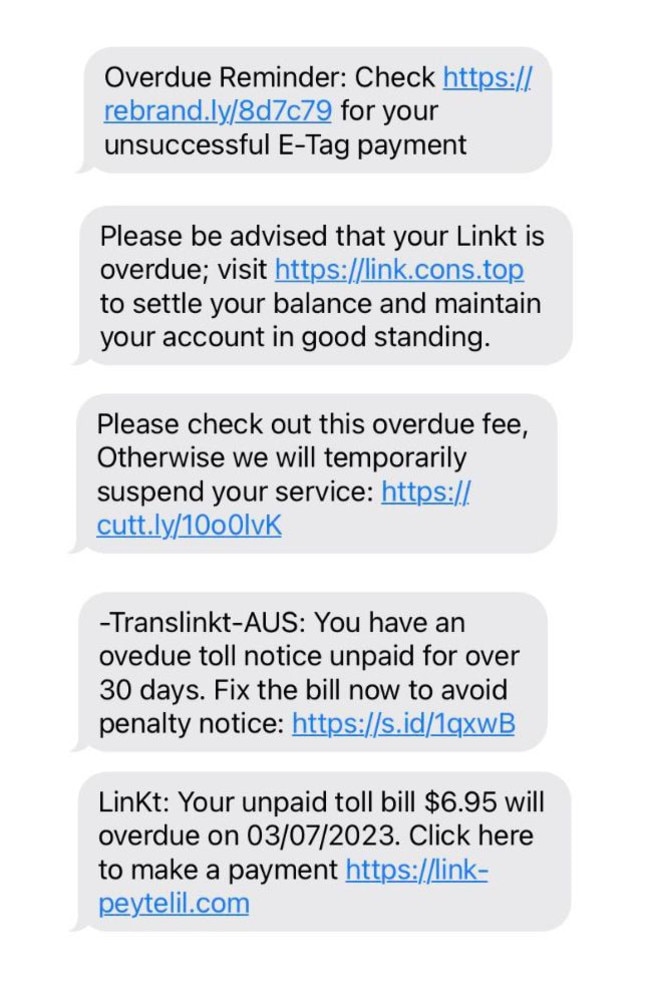

Linkt tolls scams

Contacting people directly via SMS, some scammers impersonate toll company Linkt to coax victims into paying overdue tolls and fees that do not exist.

One Gold Coast couple, Renee and Sean Dormer experienced this scam first hand, losing $15,000 in four days after receiving a text saying they would receive a $500 fine if they did not pay an overdue toll of $5.83.

The easiest way to avoid these scams is to never click on the link in messages, and instead, log directly into your Linkt account to check your balance.