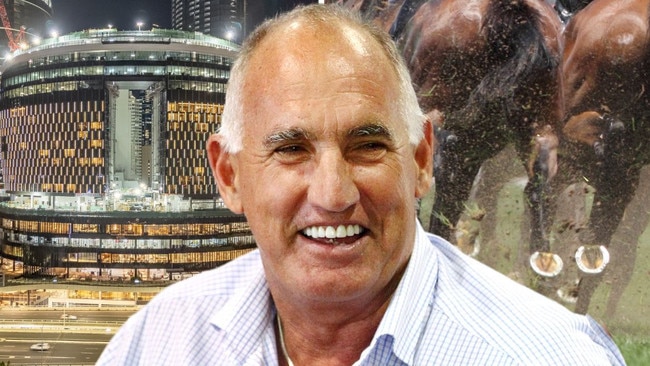

Hoss Heinrich: Horse racing royalty and construction company boss ordered over $11m tax debt

The construction boss whose company Heinrich Formwork worked on Queen’s Wharf and Cross River Rail projects has been given a Supreme Court order over $11m in unpaid taxes.

Police & Courts

Don't miss out on the headlines from Police & Courts. Followed categories will be added to My News.

A horseracing identity and former chairman of the Gold Coast Turf Club whose construction company worked on the Queen’s Wharf project has been ordered to pay $11m in unpaid taxes to the Australian Taxation Office, the Supreme Court has ruled.

On April 3, Justice Glenn Martin ordered Gerhard Horst “Hoss” Heinrich, the director of an eponymous formwork company based in Yatala, south of Brisbane, to pay $10,870,135 in a summary judgment because there was no need for a trial.

Justice Martin ruled the tax office was entitled to judgment, with interest, because Mr Heinrich, from Bundall, had “no real prospect” of success in arguing that he and Heinrich Formwork Pty had “an agreement with” the ATO where payment was not necessary.

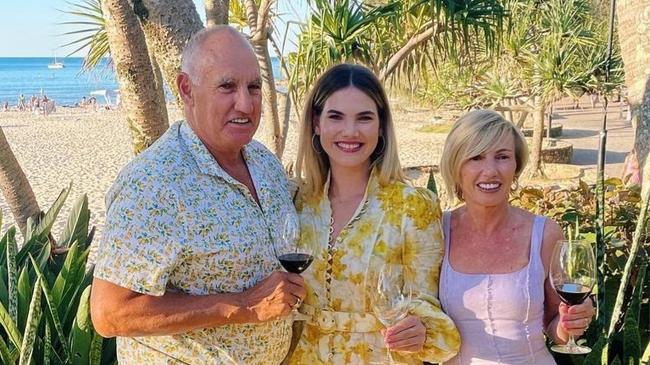

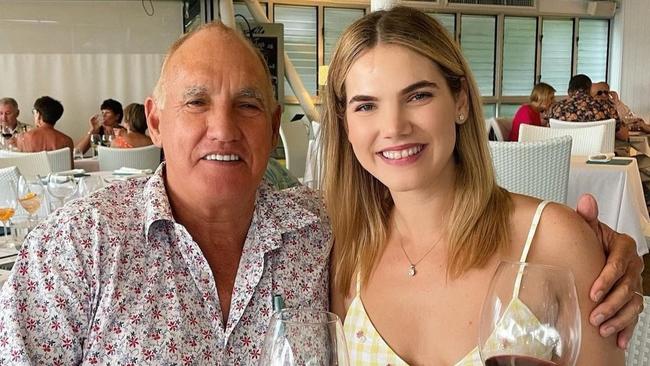

Mr Heinrich’s companies worked on the $1.4b Jewel development, the Cross River Rail and Queen’s Wharf in Brisbane and Mr Heinrich also owns more than 60 racehorses.

Mr Heinrich’s wife Gillian, who is not party to the court case, is one of the most successful horse trainers in the state.

Liquidator Derrick Vickers of PwC was appointed to Heinrich Formwork in 2022 after the ATO applied to wind up the company in the Federal Court.

The ATO told the Supreme Court that Heinrich Formwork had failed to remit Pay As You Go Withholding (PAYGW) payments to it.

The amount owed by the Heinrich Formwork was not contested but rather Mr Heinrich submitted that the ATO’s claim “was compromised” when it entered into an agreement in mid-2021 related to tax owed by the Heinrich Group – of which the Heinrich Formwork was a part.

A letter from the Deputy Commissioner of Taxation (DCT) to Mr Heinrich dated September 24, 2021

discloses that the DCT was willing to allow Heinrich Constructions Pty Ltd and Heinrich Formwork Pty Ltd respectively to pay $30,000 and $50,000 each week pending the sale of the family’s four Darlington Stud properties at Greenmount.

Darlington Stud later sold for $2.58m.

“Mr Hoss Heinrich undertakes to ensure that the net proceeds, after selling costs and payment to parties with a secured interest in the properties, of the sale of the Darlington Stud properties will be remitted to the Commissioner in satisfaction of the taxation liabilities of Heinrich Formwork Gold Coast Pty Ltd, Heinrich Plant Hire Pty Ltd and Heinrich Constructions Pty Ltd,” the DCT letter states, as quoted in the decision.

But Justice Martin found that Mr Heinrich breached an undertaking to the DCT not to further encumber the Darlington Stud properties, or deal with them in a manner that would diminish their value.

Mr Heinrich, 65, admitted that $2 million was borrowed against the strength of “the contract and properties, despite the undertaking” to the DCT, the decision states.

Mr Heinrich also argued that Heinrich Formwork lost more than $10 million during the Covid-19 pandemic even though it continued to employ staff to work at the Queens Wharf project as a subcontractor to Multiplex Constructions.