No wonder people are dumping health insurance. It’s out of control

Health insurance premiums are out of control, but tinkering isn’t going to fix it. A complete overhaul is needed, writes Margaret Wenham.

Rendezview

Don't miss out on the headlines from Rendezview. Followed categories will be added to My News.

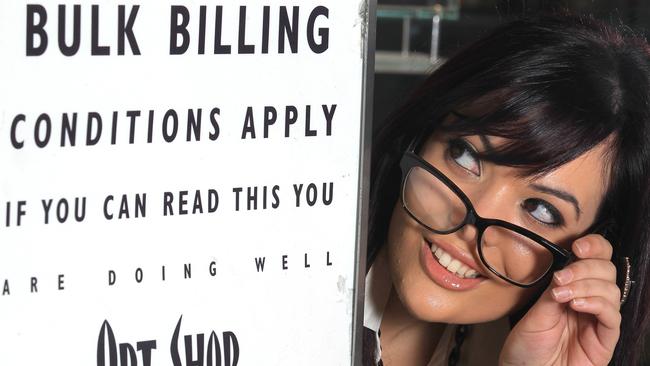

HANDS up everyone whose private health insurance has gone up by more than 4.8 per cent, the average increase Health Minister Greg Hunt spruiked in February.

Mine’s up 6.3 per cent. Last year it was up 8.1 per cent. So that’s more than 14 per cent in two years and not one cent claimed.

But perhaps I shouldn’t complain. Trusty reader Bill says his has gone up 8.5 per cent this year, a snip compared to last year’s hike of 10.9 per cent.

Bill’s pretty good at keeping track of these things. He says in 2008 his top level private health insurance cost $2865. Now it’s $5342 which means he and his wife’s health insurance has increased by 86.5 per cent in just eight years. Bill’s pretty cheesed off. And I’ll just chuck in here that the headline inflation rate is currently 1.5 per cent.

It seems clear private health insurance premiums are out of control. Not surprising then that the most recent APRA report for the December quarter showed another small drop in those with hospital cover, down to 46.6 per cent of the population.

Of course, the premiums — impacted by things like private hospitals’ bed and theatre costs and the insane, government-regulated arrangement that sees private hospitals allowed to charge insurers inflated costs for prostheses — are just one aspect of rising health care unaffordability to which no one in Canberra seems to want to face up.

But another big factor is the gaps lots of Medicare levy-paying Aussies have to stump up for specialists’ fees and treatments.

I know three people with top level insurance who recently had cancer treatment and are out of pocket a total of around $60,000. I know another who’s pregnant and has top private cover but who is going public for her antenatal care and the birth to avoid paying a whopping gap. If she opted for private care, her insurer told her, it may be as much as $9500.

And why wouldn’t any rational person make that choice, at the same time wondering why the hell they’ve got private insurance?

Now I’m fairly sympathetic to doctors not bulk billing and charging over the set Medicare Benefits Schedule fee for services and procedures as it is hopelessly out of whack with realistic and fair costs thanks, in part, to politicians blithely using the Schedule as a means of cost cutting to make their Budgets look better. Indeed, the MBS is currently subject to an indexation freeze to 2020. But a study published in the Medical Journal of Australia the other week pointed to some specialists really taking the urine sample.

The study looked at every Medicare claim in 2015 in 11 medical speciality areas for Item 110, an initial appointment with a specialist, the cost of which the MBS set at $150.90, with the benefit payable $128.30 (85 per cent of the MBS fee).

First, the study showed bulk billing among these specialists (where the charge is the same as the benefit payable, so there are no out-of-pocket costs at all for the patient) occurred at below 50 per cent nationally and in every state, except the Northern Territory. Queensland was the second lowest at about 30 per cent. It also showed 56.1 per cent of specialists charged more than the MBS fee. No surprises — as I said, the Schedule fee doesn’t reflect reality. But from there the study throws up data indicating there are practitioners out there prepared to toss the notion of affordable care to the four winds or, more like it, in the direction of expensive European cars and holidays.

For example, the average charge of immunologists was $257 (70 per cent higher than the MBS) with the top 10 per cent charging more than $305. This means a Medicare levy-paying Aussie, even with top level private insurance which doesn’t chip in anything, is slugged a minimum of $176.70. The average for neurology was $252 with the top 10 per cent charging more than $340 (out-of-pocket a minimum of $211.70). Rheumatologists and endocrinologists weren’t far behind, with a number of practitioners charging more than $300 and leaving patients at least $171.70 the poorer.

Reports this week the Turnbull Government might look at lifting the MBS rebate freeze is a little bit of good news for doctors, especially for those dedicated to bulk billing but, the truth is, where doctors charge well over the MBS fee, you and I will be lucky to have our gap payments reduced by a couple of bucks.

It’s just more tinkering about the edges of the growing problem of health unaffordability when the whole system needs root and branch review and reform. From the recalibration of MBS fees, which would require the first increase of the Medicare levy since July 1995, to a forensic examination of what is driving up insurance premiums, including private medical companies’ charges for hospital beds, prostheses etc (and some of the questionable extras offered), and on to an investigation into the unreasonably high fees charged by some specialists.

But don’t hold your breath.

Working against us are neoliberal ideology, the petitioning power of the big medical companies and for-profit insurers and, potentially, the considerable clout of the medical lobby.

It’s enough to make you sick.

Margaret Wenham is opinion editor of the Courier-Mail.