Council votes down plan to hike rates for vacant investor properties

Brisbane City Council has voted against a motion to slug investors whose properties are vacant. A radical councillor says investors who treat housing like any other commodity are a “cancer on society’’. The real estate peak body says the idea is impractical, while BCC calls it a “tax hike’’. HERE’S THE PLAN

Southeast

Don't miss out on the headlines from Southeast. Followed categories will be added to My News.

Hot on the heels of an “illogical’’ new State Government land tax regimen which will hit investors with properties outside Queensland, a Brisbane councillor is pushing for higher rates on vacant homes.

The move comes after a recent report calculated there were 87,000 vacant residential properties in the state, enough to make a significant dent in booming demand for rentals.

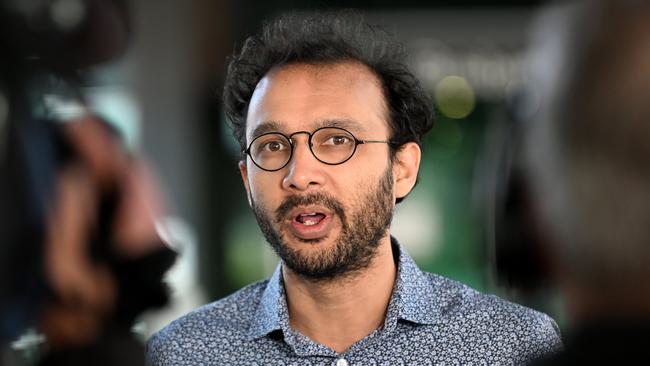

Greens Councillor Jonathan Sriranganathan moved a motion tonight (September 6) calling on Council to impose higher rates on investor-owned residential properties left vacant for more than six months.

Owner-occupier homes would be exempt.

Labor and the sole Independent in Council, Nicole Johnston, supported the motion but the LNP used its numbers to vote it down.

“People are sleeping in cars and public parks while thousands of homes sit empty – it’s a disgrace,’’ Cr Sriranganathan (formerly Sri) said.

“Most investors are renting their properties out, but those few who would rather leave homes empty than rent them out cheaply should pay through the nose for the harm they’re causing to society.

“The council has a differential ratings system, which already charges different rates for owner-occupier properties, investment properties and transitory accommodation properties that are rented out via sites like Airbnb, so this is a pretty straightforward change.

“The Census data shows there were 36,500 unoccupied dwellings in Brisbane on census night, when rolling lockdowns and travel restrictions were still in effect.’’

He said the measure would not apply to owner-occupier homes left empty while people were away for work, leisure, or healthcare.

There would also be exemptions for investment properties undergoing renovations or damaged in a disaster.

“If this move scares speculative investors away from property, that’s a good thing,’’ he said. “The treatment of housing as a for-profit commodity is a cancer on our society.’’

A Council spokesman dismissed the idea as a “tax hike’’.

“In recent weeks we’ve seen the Greens Councillor encourage break and enter as a legitimate housing policy and openly justify shoplifting, yet now he wants law-abiding residents and homeowners slugged with a massive tax hike,’’ the spokesman said.

“It’s clear that the Greens believe some people should be exempt from the rules, while others deserve to be loaded up with more rules and higher taxes.’’

Cr Sriranganathan recently came under fire for posting tips for squatters on how to find vacant properties. He also backed a University of Queensland student union magazine article which advocated shoplifting as a response to the rising cost of living.

REIQ boss Antonia Mercorella acknowledged the rental crisis was being caused by a lack of rental supply.

“One way to increase supply is for more investors to bring rental properties to the long-term rental market,’’ she said.

“However, this motion is another example of politicians seeking to adopt a ‘stick’ rather than a ‘carrot’ approach.

“The more investors are punished financially and restricted around what they can and can’t do with an investment property, the more likely they are to walk away from housing as an investment.

“Arguably that’s what’s happening at the moment, with the rental reforms and new land tax regimen for example, and we’re hearing that’s why investors are exiting the long-term rental market.

“Some investors are taking advantage of the lucrative sales market and selling up.

“In some cases, they are turning to the short-term letting market because the holiday letting market can be incredibly lucrative.’’

Ms Mercorella said it was difficult to see how Cr Sriranganathan’s proposal could be practically administered.

She also blasted the State Government’s “illogical’’ new land tax regimen, due to come into force in January 2023.

“There’s no other state or territory that charges state land tax based on the value of properties held across Australia and outside the jurisdiction where the tax is collected,’’ she said.