NAB Cleveland to close as Capalaba emerges as Redland banking hub | FULL CLOSURE LIST

The exodus of the big four banking giants continues from the bayside, with National Australia Bank the latest to announce it will shut a branch later this year. BRANCH CLOSURE FULL LIST

Redlands Coast

Don't miss out on the headlines from Redlands Coast. Followed categories will be added to My News.

The exodus of the big four banking giants continues from the bayside, with National Australia Bank the latest to announce it will shut its branch in Cleveland.

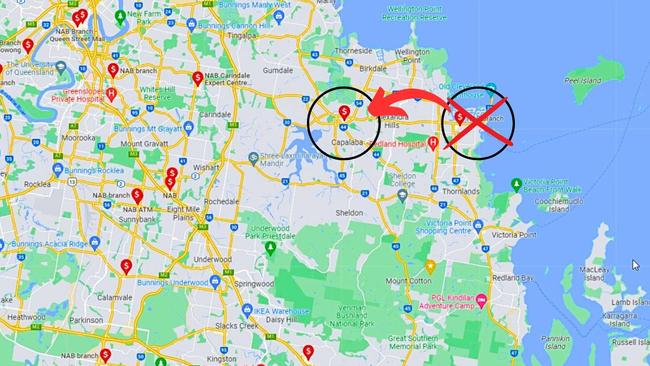

The closure, in September, will leave Redland city with only one NAB branch, at Capalaba.

CBA still has a branch in Middle St, Cleveland, and a second on Moreton Bay Rd, Capalaba with an ATM at Birkdale.

ANZ continues to have a branch at Stockland Shopping Centre at Cleveland and another branch at Capalaba Central.

Westpac also has a branch still open in Middle St, Cleveland, along with one on Old Cleveland Rd, Capalaba.

Capalaba will become home to the remaining banks, with bayside customers having to travel to the shopping hub for one-on-one contact with a bank teller after September.

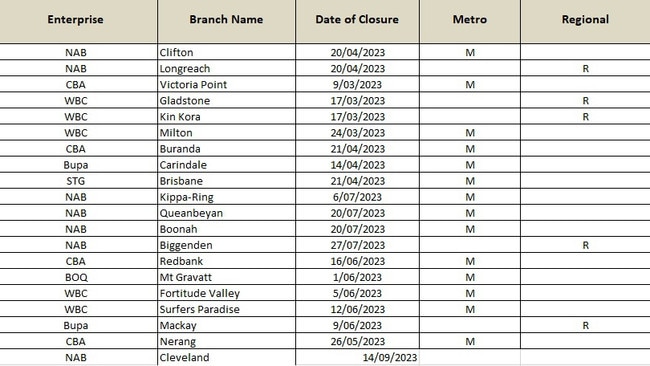

Already this year, NAB closed branches at Longreach and Clifton Hill, near Moorooka, in April in a bid to force customers online, saving shop rental and labour costs for NAB.

Other NAB branches to close this year include at Boonah and Biggenden, with CBA to shut its Redbank branch this week and Westpac to shut branches at Fortitude Valley and Surfers Paradise this month.

Finance Sector Union president Wendy Streets said the NAB closure was a disgrace, but no surprise as there were 12 branches from the big four earmarked to close across the state this year.

Westpac announced five closures last week with its branch in Gray St, South Bank the next one set to roll down the shutters in Queensland.

“NAB is the worst because it refused to commit to halting closures while the Senate Inquiry into banking was under way,” she said.

“Westpac made some concessions but has just announced 12 branch closures including the one at South Bank.

“Capalaba may be the only banking hub left in Redland, but how long will it be before those outlets close? The only branches left will be at Carindale.

“Last month, the big four published their half-year annual profits and all posted increases of around 24 per cent, so they can afford to keep branches open for their customers, from which they derived those extreme profits.”

Ms Streets said the big four regularly made an average of $30 billion in profits each financial year, with data showing that about 40 per cent of customers still used branches regularly.

The announcement was grim news for elderly couple Bob and partner Lisa, who rent on the bay islands and travel by ferry and car each month to the NAB branch at Cleveland.

“We used to be able to do our banking at Victoria Point but that branch shut and now we have to travel into Cleveland,” Bob said.

“But I don’t think we will be able to travel all the way to Capalaba.

“We don’t have access to a computer on the island and I prefer to make sure that the money gets to where it is supposed to go.”

In its announcement, posted on the front door and online, the bank said the decision was because “more and more, our customers are choosing to do their banking online, over the phone, or by video conference”.

“Approximately 60 per cent of our customers in Cleveland have only visited the branch once in the last year,” NAB said.

“More than 67 per cent of Cleveland customers are also using other locations including Capalaba and, as they continue to bank differently, it’s important we continue to adapt with them.

“Because of these changes, we’ve made the difficult decision.”

The bank said its research in Cleveland also found 1318 personal bank customers had made three or more visits to the branch in the past year, with 225 clocking up more than 12 visits.

There were 266 NAB business clients who visited the branch regularly and 140 who visited more than once a month.

Cash withdrawals dropped from 12,042 in 2020 to 9011 in 2022, with cash deposits at the branch also dropping from 9890 to 6612.

Cheque deposits also fell, from 1397 in 2020 to 989 in 2022.

The branch research also found 15 per cent of NAB Cleveland customers were using the nearby post office, with 89 per cent of those registered for online banking regularly using that form of transaction.

After the closure, customers will still be able to get over-the-counter services at NAB Capalaba, which is 9.2km from the Cleveland branch.

The Capalaba branch will be temporarily closed for renovations from July 7, reopening on August 31.

The bank also told customers with NAB cards and passbooks to go to Australia Post offices for cash withdrawals, deposits of cash and cheques, and checking account balances using PIN-enabled cards and passbooks linked to NAB accounts.

■ CAPALABA BRANCH: Capalaba Central Shopping Centre, 38-62 Moreton Bay Rd, Capalaba.

Opening hours: Monday to Thursday: 9.30am – 4pm | Friday: 9.30am – 5pm

Facilities: SmartATM, teller services, business change machine, business deposit machine, coin deposit machine

CLEVELAND CLOSES: Harbourside Shopping Centre, 91 Middle Street, Cleveland will shut on Thursday, September 14.