Post flood: Where to next for house prices in southeast QLD

History has shown Brisbane’s property market is resilient, with house prices soaring up to 123.4 per cent since the last big flood event. SEARCH INTERACTIVE

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

The recovery could take months but history has shown that Brisbane’s property market is resilient, with house prices soaring by as much as 123.4 per cent in the decade since the last big flood event in 2011.

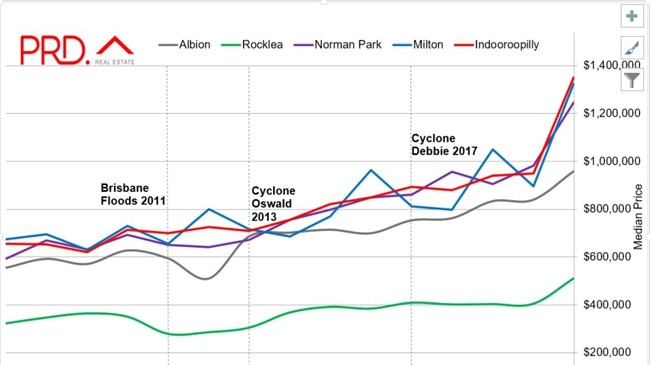

An analysis of median house prices and flood forecasting tools shows that many of the city’s most flood-prone streets were also among the city’s top price performers – such is the lure for a waterfront lifestyle.

RELATED: Plea for sparkies to inspect flooded homes

Dire warning as construction industry falls into crisis

Hawthorne had 199 addresses listed as ‘likely to flood’ in the Brisbane River Flood Forecasting Report, but the suburb as a whole has seen price growth of 123.4 per cent in the decade since the 2011 floods, when the river peak was even higher.

And while not every house was affected in the 2011 floods, or the most recent rain bomb event, the data shows how quickly memories fade, and how quickly the perception of a flood risk eases in the minds of buyers.

The Hawthorne median house price rose from $789,500 on January 31, 2011, to $801,250 a year later – a small rise of $11,750, new data from REA Group shows.

But five years later, and the median house price soared to $1.035 million and then accelerated to $1,763,500 in January this year.

It was a similar story in Auchenflower, where 207 addresses were identified as ‘likely to flood’ when the Brisbane River peaked on Monday at 3.85m.

House prices there have soared 108.8 per cent in a decade – up from $713,500 in January 2011 to $825,000 in January 2012 and almost doubled to $1.49 million in January this year.

While some suburbs saw median house values fall in the year after the 2011 floods, all have since experienced significant price growth.

There were 261 addresses identified as ‘likely to flood’ in Fig Tree Pocket during the most recent flood event, with many of those also affected during the 2011 event.

House values dipped $67,500 in the 12 months after the 2011 floods, but have soared 107.1 per cent over the decade to reach $1.75 million, according to the data.

Herron Todd White Brisbane managing director and valuer Galvin Hulcombe said the impact on prices after the most recent event would be variable, and dependent on just how much inundation was experienced in each suburb.

The impact on values in the short term could be as much as 30 per cent in the extreme, he said, but many of the affected suburbs would also remain among the most desirable locations for buyers.

”Anecdotally, two to three years after the 2011 event, the value losses were pretty much negligible across many of the affected suburbs (in 2011),” Mr Hulcombe said.

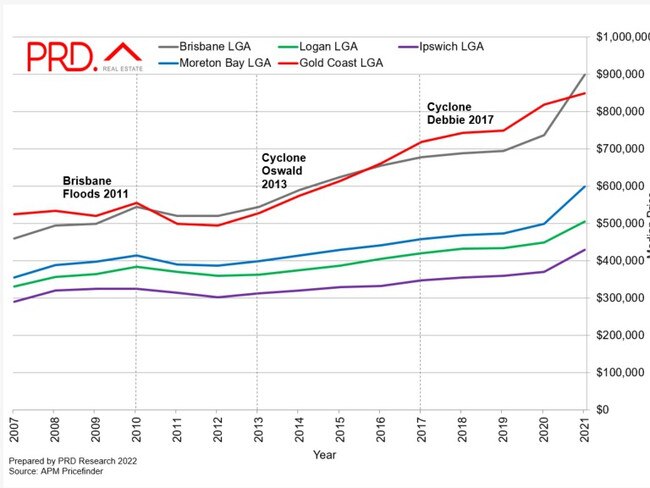

Similar analysis by PRD, using different metrics, also backed the resilience of the market.

Looking at five of the currently impacted LGAs – Brisbane, Logan, Ipswich, Gold Coast, and Moreton Bay – the research found that median house prices in those regions were only negatively impacted for around one year after the 2011 floods.

“There was a recovery in 2013, which was not deterred by Cyclone Oswald, and continuous price growth stood against Cyclone Debbie in 2017,” the report by PRD chief economist Dr Asti Mardiasmo said.

“The floods might hit house prices and shake confidence temporarily, however history shows that the property market is highly resilient.”

BuyersBuyers CEO Doron Peleg added that their own market research after the 2011 floods had shown that out the top 20 suburbs impacted by floods in 2011, 19 of them had outperformed the Brisbane house price growth benchmark over the following five years.

“There was a perception after the floods that flood-prone areas might be perceived negatively or experience poor capital growth, but that did not prove to be the case,” he said.

“Part of the reason for this was that many of the suburbs were located close to the river, with water often being a drawcard for buyers in Australian real estate.”

On the Gold Coast, hinterland and canal suburbs took the brunt of the recent wild weather event.

But like Brisbane, the region is resilient.

Palm Beach house prices have soared 165.5 per cent since 2011, while Elanora recorded a 101.9 per cent jump.

Merrimac, another suburb which is often inundated during major weather events, jumped 89.4 per cent – from $485,000 in 2011 to $805,000 in 2022.

While Hope Island initially dropped in value the year after the 2011 floods, it has also jumped 36.5 per cent to a median of $1,242,500.

The Hinterland suburb of Tallebudgera, which also had water tear through it, has seen a massive price growth jump of 85.6 per cent in the decade since the 2011 floods.

REIQ Gold Coast zone chair Andrew Henderson said the Coast had undergone significant flood mitigation work over the years.

“It’s the same low-lying streets that go under and I feel most people know that those areas go under,” Mr Henderson said.

The Sunshine Coast has also seen extraordinary price growth, with no signs of it slowing.

REA Group executive director of economic research Cameron Kusher said the 2011 flood event coincided with the end of a property boom and rising interest rates, so it was difficult to say just how much impact the disaster had on values.

“But it is a bit different this time I think,” he said. “In 2011 there hadn’t been a major flood since 1974.

“This time, the duration between major floods was much shorter, a decade, so I am not sure whether buyer behaviour will be different this time around.

“Buyers may be more concerned about when the next flood event might come, and about the effects of global warning.

“However, on the flip side, a lot of the affected suburbs are also among the most desirable.

Mr Kusher said he also expected even fewer listings to hit the market over the next few months, which might push up prices elsewhere.

“But generally the consensus is that Brisbane will remain strong and prices will grow, albeit likely at a slower rate,” he said.

Stay up to date with all the latest breaking alerts on flood coverage at The Courier Mail.