Ex-RGD boss Ron Grabbe avoids bankruptcy with $100,000 deal

The ex-director of a failed building firm has dodged bankruptcy as creditors prepare to receive less than 10c in the dollar.

Regional news

Don't miss out on the headlines from Regional news. Followed categories will be added to My News.

The former director of a major building firm which collapsed with debts of about $31 million has avoided bankruptcy with creditors to receive between 0.4 and seven cents in the dollar.

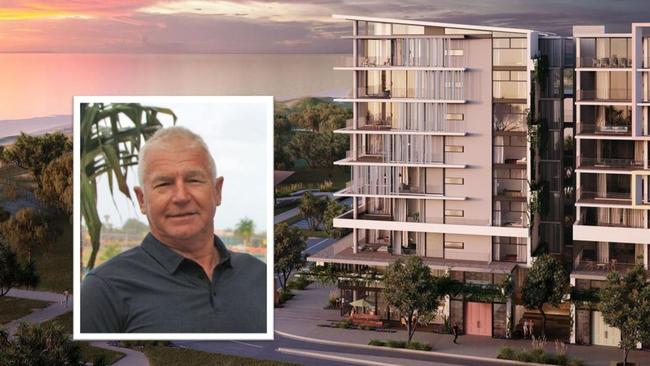

Former RGD Group Pty Ltd and RGD Constructions Pty Ltd director Ron Grabbe entered into a Personal Insolvency Agreement with creditors of his estate in mid-November, avoiding bankruptcy after a dramatic collapse of his building empire earlier this year.

The agreement was carried out on December 9, with creditors now given until January 7, 2021, to lodge a proof of debt, to claim between 0.4 cents and seven cents in the dollar of the dividend set to be declared.

Mr Grabbe, a prominent Coast businessman and outrigging identity, offered up $100,000 of his share of his father's deceased estate, as well as his interests in property at Birtinya and Parrearra as part of the agreement.

Two major unsecured creditors, Greg Clark and YFG Shopping Centres Pty Ltd, had agreed not to make claims for any dividend, allowing other unsecured creditors to claim as much as possible, according to documents.

Based on the documents prepared by the Personal Insolvency Agreement trustee Bill Karageozis of McLeod and Partners, it was estimated Mr Clark, a renowned tech guru, had walked away from about $20 million or more worth of debts.

Clark Group Constructions had taken on a number of key RGD projects and personnel in the wake of the companies' collapse, with construction now under way on the $78 million Seanna Residences luxury apartment project at Bokarina Beach.

Under modelling carried out, the potential returns to creditors in a bankruptcy was estimated to be between 0.98 cents in the dollar and zero, as opposed to the guaranteed returns in the Personal Insolvency Agreement.

YFG Shopping Centres and Mr Clark had waived claims on dividends from their debts estimated to be about $40 million between them.

As of November 4 Mr Grabbe was listed at an address in North Adelaide, South Australia, and had claimed to be an unemployed builder, developer and consultant.

Mr Grabbe had been identified as a director and previous director of many entities including several companies with Sunshine Coast links.

The trustee found there was little chance of making recoveries from the various companies, nor were there many prospects of retrieving funds out of several trusts related to Mr Grabbe.

Mr Karageozis noted he hadn't been provided with all books and records required.

The documents also revealed a fleet of muscle cars owned by Mr Grabbe which had been held by Mr Clark as security for the debts owed to him.

The vehicles were sold at auction last weekend.

They included a 1965 Plymouth Belvedere which sold for $20,000, a 1964 Buick Special show car which sold for $100,000, a 1956 Cadillac Fleetwood show car which sold for $100,000, a 1967 Camaro drag car which sold for $46,500, a 1964 Buick drag car which sold for $36,000 and a 1968 Monaro GTS sold for $114,000.

The documents stated Mr Grabbe was liable to pay Mr Clark a debt of about $23.9 million, and Mr Grabbe had been in the process of applying for the Aged Pension, which was expected to bring him $900 a fortnight.

Mr Grabbe had been living off a $100,000 loan facility.

More than 7000 pages of evidence had been provided of Mr Clark's debt.

The trustee also identified eight proofs of debt with valid claims in the estate, totalling more than $17.12 million.

No recoveries were expected to be made from several property transactions also examined.

Mr Grabbe offered $100,000 of his $374,000 interest in his father's deceased estate and pledged equity in properties at Birtinya and Parrearra.

The trustee recommended creditors would be better served agreeing to the Personal Insolvency Agreement than pursuing bankruptcy.

Total debts claimed by secured and unsecured creditors had topped $50.77 million, made up of $17.55 million claimed by unsecured creditors.

During the three months prior to the trustee's appointment several phone calls, emails and meetings took place with Porter Davies Lawyers, Ron Grabbe and his wife and McLeod and Partners.

The trustee had claimed about $50,000 in remuneration for the Personal Insolvency Agreement.

The Daily has attempted to contact Mr Grabbe for comment.

Originally published as Ex-RGD boss Ron Grabbe avoids bankruptcy with $100,000 deal