What inflation rise means for your mortgage payments

Mortgage repayments are set to shoot up as early as next week following the nation’s largest rise in inflation in 20 years which is expected to trigger a super-sized interest rate hike from the Reserve Bank.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

Mortgage repayments are set to go up as early as next week – with the average homeowner needing to find up to an extra $100 a month – after massive inflation of 5.1 per cent was recorded.

It was the largest rise in inflation in 20 years, since the GST was introduced, as households feel the pinch on soaring groceries prices, petrol, child care and more.

While interest rates are at a historic low of 0.1 per cent, there are predictions the runaway inflation could see a super-sized rate hike from the Reserve Bank of Australia next week to 0.5 per cent.

It would be the first increase in 10 years but will not be the last in the coming months, with predictions the cash rate could increase to 1.25 per cent be early next year.

A rise in interest rates will be felt by homeowners who borrowed big in the past two years during the property price boom.

It would be a blow to the Coalition’s claims of economic management in a campaign where that has been one of its biggest focuses.

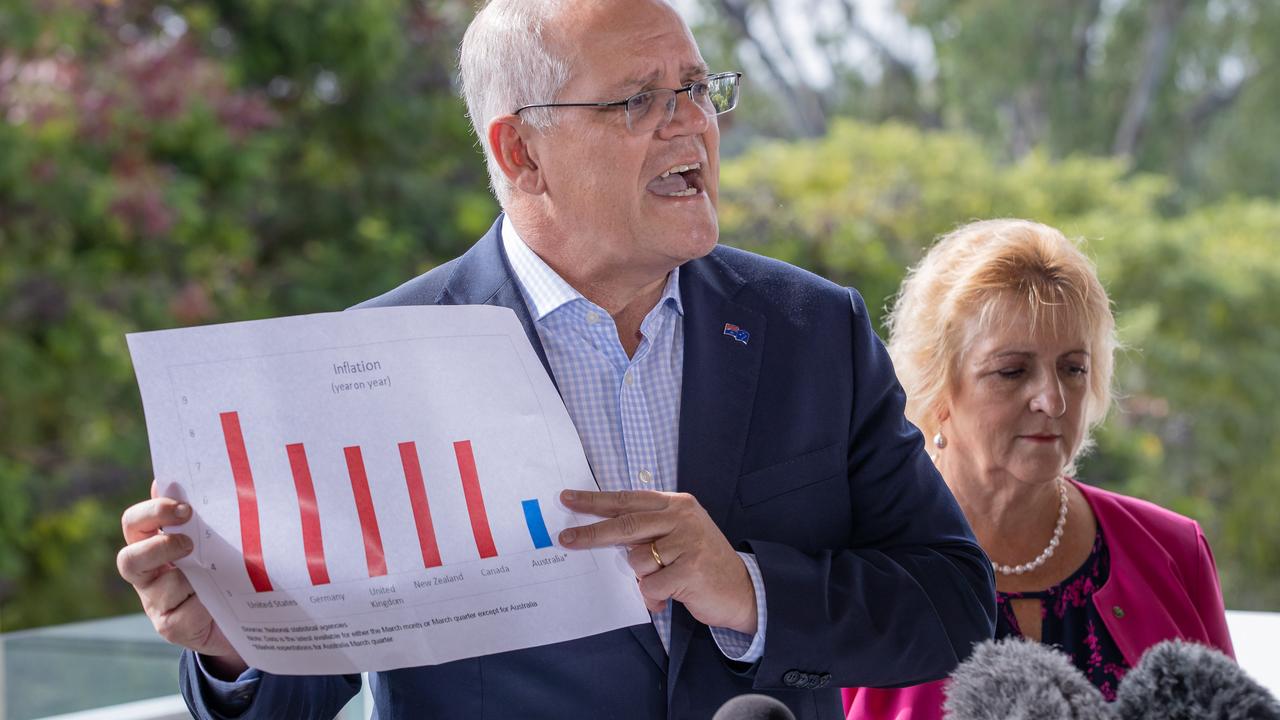

The inflation blow out sparked a political battle, with Prime Minister Scott Morrison showing Australia’s was still low compared to other nations like the US and Opposition Treasury spokesman Jim Chalmers pointing to the rising cost of living in recent months.

Brisbane also recorded the second highest inflation of a capital city in the country, 6 per cent, with petrol prices and new home purchases to blame.

An average Brisbane mortgage of $516,000 at a 3 per cent variable mortgage, currently paying about $2450 a month, would see this increase by $41 a month with a 0.15 per cent rate rise or $109 a month with a 0.4 per cent rate rise, according to RateCity's mortgage calculator.

AMP Capital’s chief economist Shane Oliver said he was expecting the RBA to hike rates by 0.4 per cent from its next meeting on May 3.

“The latest inflation blowout adds significant pressure on the RBA to immediately start raising rates and to do so more aggressively than initially thought likely,” said Dr Oliver.

Commonwealth Bank head of economics Gareth Aird said he expected the RBA to hold off on lifting rates until June, as there had not been the rising wages that it wanted to see.

“A lot of people have borrowed under the impression interest rates would not be rising until 2024 at the earliest,” Mr Aird said.

“A smaller increase (of 0.15 per cent) would decrease anxiety in the housing sector.”

He said he expected interest rates to rise several times in the coming months, reaching 1.25 per cent by early next year.

“Inflation is quite a bit stronger than wage growth at the moment. The average person is going backwards,” Mr Aird said.

Treasurer Josh Frydenberg said housing, food and transport costs all helped drive the inflation, including fuel prices driven by the war in Ukraine.

“Today’s higher inflation figures are a reminder to Australians that we are living in a complex and volatile economic environment,” Mr Frydenberg said.

“Today’s inflation numbers are a reminder to all Australians of the importance of strong and effective economic management.”

He said the Coalition’s was helping with short term cost of living with a $250 payment for pensioners and welfare recipients, as well as a $420 tax break for low-and-middle income earners.

Mr Chalmers said the Mr Morrison had dropped the ball on managing inflation.

“This is his triple whammy of skyrocketing costs of living, rising interest rates and falling real wages,” he said.

“The cost of living pressures have been building since before the war in Ukraine.”

He said Labor supported the government’s short term cost of living measures, but would seek medium term action through lowering child care and power prices.

Emily and Luke Deguaro said they were already feeling the pinch without a rates rise.

The Sunshine Coast couple have a family of six, with children Beau 8, Lily 5, Ryder 4 and Evelyn 2.

“We are definitely spending more money on groceries,” Ms Deguaro said.

“We already pay too much in rent so I’m really concerned that rent could go up (if rates rise).

“We are saving roughly $200 a week from our salary each week.

“Inflation has already had an impact on us. There are lots of things that we don’t do now with the kids just because the price has gone up.”

While New Farm local and real estate agent, Ben Collins, said interest rates can only go up.

He said his family was looking at ways of saving money and ways to combat rising inflation.

“We are shopping at our local supermarket and are spending less on takeout or fancy dinners out,” he said.

“There are options such as refinancing or fixed interest rates, which are all options we would consider if needed.”