REVEALED: Surprise suburbs leading CQ property price surge

In defiance of expectations, CQ’s properties have sold for higher prices during the coronavirus pandemic. Find out which suburbs were the star performers.

Rockhampton

Don't miss out on the headlines from Rockhampton. Followed categories will be added to My News.

THE property market in Central Queensland is sailing along in defiance of a predicted fall in property prices due to the COVID-19 pandemic, according the latest report from the Real Estate Institute of Queensland.

The REIQ's Market Monitor Report for the June Quarter identified a number of standout suburbs and towns around CQ with flourishing property values.

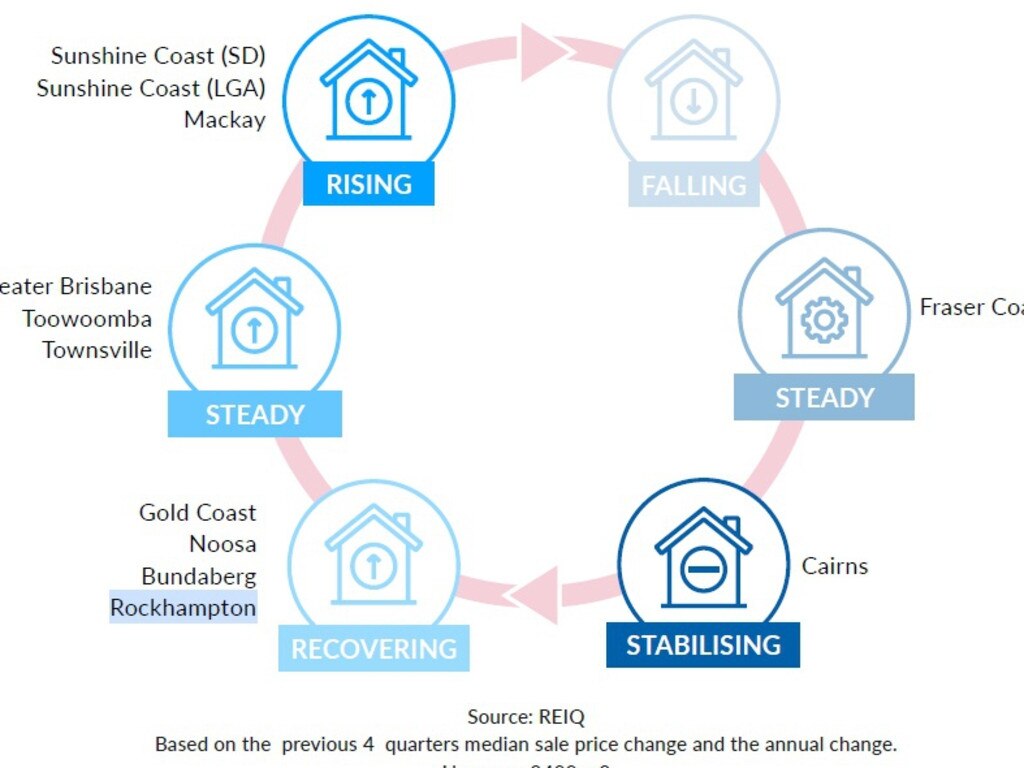

Rockhampton's housing is in the "recovering phase" of the property price cycle, registering a 0.8 per cent in its median sale price for the last quarter.

Over the past year, the city's annual median property values have risen from $256,000 to $267,000 - a lift of 4.3 per cent.

Leading the charge in rising property sale prices was the suburb Berserker with an increase of 26.4 per cent, Mount Morgan was up 13.6 per cent and Allenstown 13 per cent.

Livingstone was unchanged for the past quarter but looking at its annual median sales, it was slightly stronger than Rockhampton with its 4 per cent increase, up to $375,000.

Lammermoor was the standout suburb, registering an 11.8 per cent sale price increase - up 15.5 per cent compared to five years.

While property prices were up in Rockhampton and Livingstone, unfortunately the number of sales has diminished.

The burgeoning property prices in the Central Highlands is another success story.

They rose 2.9 per cent for the quarter and a total of 22 per cent for the past year, up from $210,000 to $256,250.

This was led by the Emerald which was up 3.3 per cent for the quarter and 14.4 per cent for the past year - up 6.9 per cent in the past five years.

REIQ Rockhampton Zone Chair Noel Livingston said the region had been the picture of resilience during recent months, with a diverse economic base being part of the solution.

"It's just powering on - it's been rock solid. We've had no real COVID impact on our market," he said.

"We're not tourist based at all, mining is very strong, and the rural economy is extremely strong. Cattle prices are through the roof so we're getting investment from the bush as well.

"It's all looking good for the next year or two here in Rocky."

He noted housing remained the city's primary property type with the strong appeal of detached housing among local stakeholders playing out in the availability of listings.

"We've now got a shortage of housing stock in certain areas, like The Range which is our old, established area near the hospital and the grammar schools. It's hard to find a listing, so prices are moving up there," he said.

REIQ's Chief Executive Antonia Mercorella said the latest report showed that Queensland's residential property market had remarkably stable results during the pandemic.

"Restrictions on auctions and open homes coupled with border closures, restricting interstate buyers as well as international investors, have certainly proved challenging for our market," Mercorella said.

"To counter this, the real estate industry proved itself highly agile, adapting to technology substitutes in place of live auctions and physical property inspections at almost lightning speed.

"And buyers and sellers were equally quick to embrace it."

She said what's helping drive price stability in the market was the increased demand driven by housing specific incentives such as the First Home Owner's and HomeBuilder grants.

COVID-19 has also accelerated interstate migration into Queensland, with predictions that a massive influx of Sydney-siders and Melbournites will make the move to the Sunshine State once border restrictions are eased.

"Prior to the outbreak of the pandemic, Queensland was the number one destination for interstate relocations - particularly from major metropolitan areas such as Sydney and Melbourne," she said.

"As this pandemic continues to affect us all, it's introduced many of us to the possibility of a 'new normal' way of working - that is, remotely from home.

"And spending more time at home is seeing more people considering their options."