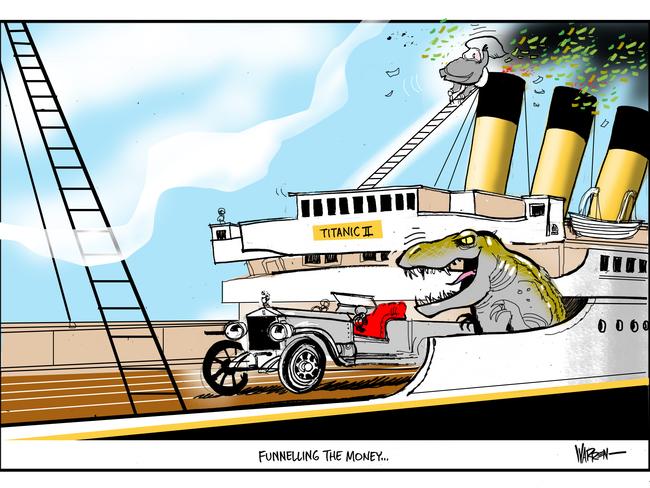

Queensland Nickel was Clive Palmer’s secret ‘piggy bank’

UPDATE: Curtis Pitt believes Queensland Nickel could have operated for a further five years if cash hadn’t been siphoned off. It comes as Mr Palmer has fired back at administrators.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

- Clive Palmer to release Queensland Nickel documents

- Queensland Nickel workers promised federal assistance

TREASURER Curtis Pitt believes Queensland Nickel could have operated for a further five years if cash hadn’t been siphoned off, declaring the Government would not “let Clive Palmer get away with it”.

Mr Pitt said yesterday’s administrators’ report showed the company may have been able to “ride out” falling nickel prices and continue employing locals for longer, if money hadn’t been taken out to fund other projects.

“It is a damning report that shows that money has been taken out of the business for various reasons, including political donations, luxury cars and of course other hobby horses of Mr Palmer,” he said.

“What we’re now going to be very closely looking at is what would have happened in this scenario if those things hadn’t been taken out of the business. From everything we can see and what the report details, if the money hadn’t been taken out, there would have been another four or five years’ worth of work opportunity, at least.

“Potentially they may have been able to ride out the world nickel price collapsing. I agree with Mr Palmer that no one can control the world market but what you can control is the way that a business is run.”

Mr Pitt, who said the Government was still hoping for a situation in which the refinery could continue operating, was adamant the Government would not be walking away from the issue.

“We aren’t, as a Government, aren’t going to let Clive Palmer get away with it,” he said.

Mr Pitt said the report also appeared to vindicate the State’s decision to not provide assistance to Queensland Nickel.

“I’ve said for some time that we weren’t getting the information we needed to even assess the situation with Mr Palmer,” he said.

“This report lays that out very much in their way, which shows that there was no way that the Queensland Government could entertain supporting an operation that (wasn’t) being forthcoming with information required to even assess it.”

“The truth of the matter is the administrators are embarking on a campaign to secure more funds for their exorbitant fees,’’ Mr Palmer said in a statement this morning.

“They have already paid themselves $4 million and are seeking to liquidate Queensland Nickel to pay themselves another $5 million.”

Prime Minister Malcolm Turnbull has weighed in on the issue, calling on Mr Palmer to put his money where his mouth is and pay up his ex-workers.

“Mr Palmer really should make good on the entitlements of these workers,” he told Perth radio 6PR.

“He’s built himself up as a great business leader and a great philanthropist.

“The revelations about Queensland Nickel, which he says are all lies, well, let’s just see Mr Palmer put his money up.

“There are men and women there in Townsville who have lost their jobs, they are entitled to payments as a consequence of their termination.

“Mr Palmer should make those good.

“That’s the very least he can do in these circumstances and I call on Mr Palmer to do just that.”

Mr Turnbull said if Mr Palmer decided to run again at the upcoming election, he could expect a “stern judgement” to be cast by his electorate.

OVERNIGHT: Palmer milked his firm dry

CLIVE Palmer siphoned dry his “piggy bank’’ – Queensland Nickel – to fund his eccentric lifestyle, which is believed to have sparked a referral to the corporate watchdog for possible prosecution.

Instead of repairing his ageing plant and providing enough money for workers’ entitlements, Mr Palmer bought planes and vintage cars and bankrolled his political party, an explosive report released yesterday has found.

The company was found to be insolvent from about November 27 last year, although it only went into administration on January 18, after it made 237 workers redundant. A further 550 have since been sacked.

Finding that Mr Palmer and his director nephew Clive Mensink (inset) “appear to have been reckless, in exercising their duties and powers”, administrators FTI Consulting have laid the foundation for further investigations by the corporate watchdog.

However, it is understood the Australian Securities and Investments Commission is already investigating whether Mr Palmer acted as a shadow director of Queensland Nickel and whether he and Mr Mensink acted recklessly. The charge, which is very difficult to prosecute, carries a sentence of five years’ jail and almost $400,000 in fines.

FTI Consulting’s John Park said yesterday the issue warranted more investigation. He also pointed to the near annual “loan forgiveness’’ days, where money owed to Queensland Nickel by Mr Palmer’s other companies no longer had to be paid back.

“The view is basically yes, at a very high level we saw Queensland Nickel as the ... piggy bank, the treasury, it was the money coming through Queensland Nickel in the better times and it was being dissipated among the Palmer empire entities as and when it was required.”

The findings, which also point to possible breaches of the Corporations Act, are a blow to workers who once saw Mr Palmer as their saviour for buying the refinery.

“They (Messrs Palmer and Mensink) directed and/or authorised QN to enter into transactions with related parties which do not appear to have been in the best interests of QN, or for a proper purpose,” the report says.

The report recommends Queensland Nickel should be liquidated to repay some of the $100 million it owes.

A vote on the recommendation will be held for creditors in Townsville on April 22.

Questions remain as to the voting proportion that will be given to workers owed $73 million and to Mr Palmer and his companies.

Mr Palmer and Mr Mensink, who refused to return calls yesterday, have strenuously denied any wrongdoing.

Shockingly, Queensland Nickel forked out more than $200 million in loans to Mr Palmer’s related parties in the five years to January this year. About $190 million of the loans was forgiven.

The report found that the $200 million taken out of Queensland Nickel could have seen the plant operating for another couple of years, despite battling lower nickel prices.

Mr Palmer’s Mineralogy was given more than $100 million and Palmer Leisure Coolum more than $60 million.

“Between August 2012 and June 2013, QNI Resources purchased 60 vintage cars from Australian and overseas dealers, which were then transported to the Palmer Coolum Resort to establish the Motorama Museum,’’ the report says.

QN paid for the purchase of the vehicles through the QN bank account, recording the acquisition as a “Major Capital Purchase” by QNI Resources.

“The vintage cars were sold by QNI Resources as a whole to Mr Palmer on February 3, 2014 for $5 million, a 17 per cent premium over the original cost of the vehicles (before accounting for transport costs, taxes, Customs levy etc),” the report says.

“Neither QN nor QNI Resources received the $5 million cash payment. However, consideration received by QN for the sale was recorded by way of a transaction in the Mineralogy loan account.

“A loan forgiveness transaction for $5 million was later recorded in the Mineralogy loan account on 30 June 2015.”