Qld’s AA+ credit rating on chopping block amid spending spree

A new report by S & P Global revealed Queensland’s spending is unsustainable, prompting warnings that without spending cuts the state faces a credit rating squeeze.

QLD Politics

Don't miss out on the headlines from QLD Politics. Followed categories will be added to My News.

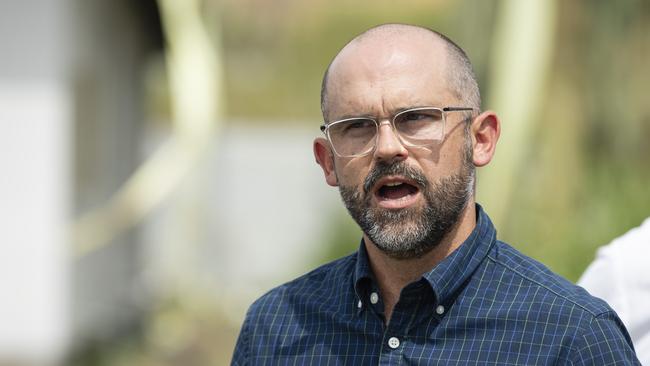

Treasurer David Janetzki said he has a clear challenge ahead after credit rating agency S & P Global warned that Queensland’s AA+ credit rating was on the chopping block if its “pandemic-sized” spending spree is left unchecked.

A new report by S & P Global revealed Queensland’s spending is unsustainable, with operating expenses rising by 51 per cent since 2019, prompting a caution that, without spending cuts, the state faces a credit rating squeeze.

The report criticised the former Labor government’s “generous” cost-of-living rebates and “lavish” election commitments, including the continuation of 50 cent public transport fares.

“(States) have failed to rein in pandemic-sized spending, choosing instead to priorities voter-friendly expenditures,” the report said.

While the report slammed Queensland’s spending spree, it acknowledged the state’s significant contribution to Australia’s revenue windfall through strong coal royalties.

The report does not, however, account for Mr Janetzki’s Mid-Year Fiscal and Economic Review (MYFER), which revealed an additional$2bn in operational spending and a $45.8bn debt surge under the new LNP government.

Queensland’s major revenue streams royalties and GST are also forecast to dramatically decline by $2.7bn (5 per cent), including a $421.4m fall in coal royalties, according to the MYFER.

Mr Janetzki said the report confirmed his claims about Labor’s “debt and deficit” budget strategy.

“Queenslanders have been left to pay a high price for a decade of Labor budget blowouts, expensive failures,” he said. “The challenge ahead is clear, but the Crisafulli government is restoring respect for taxpayer money by delivering projects on time and on budget.”

The Treasurer refused to answer questions on whether he would need to cut back spending to avoid a credit rating downgrade, nor would he confirm if the government would discontinue cost-of-living relief measures.

He would not be drawn on whether a declining US dollar would further impact Queensland’s royalty revenue ahead of the June budget.

The Opposition has maintained that Mr Janetzki “juiced up” the MYFER figures by failing to detail how debt increases, including a $23.4bn spend on “underfunded legacy issues and other adjustments,” would be managed.

Shadow treasurer Shannon Fentiman defended Labor’s cost-of-living relief spending in its 2024-25 Budget, arguing the LNP had agreed to adopt it “without seeing a single line”.

“Now he is trying to run two budgets at once, Labor’s budget and his budget which included $7bn in election commitments, $7bn in savings which he has no chance of delivering, freebies for landlords, and tax cuts for multimillion-dollar home buyers,” she said.

As of January 30, Queensland retains its AA+ stable credit rating.