National electricity price cap plan will see average family $230 better off a year

A new national plan to reduce energy bills has taken effect, with the average household set to be hundreds of dollars better off – but it will affect the state’s bottom line. See how it works.

QLD Politics

Don't miss out on the headlines from QLD Politics. Followed categories will be added to My News.

Queensland’s state-owned generators have been directed to sell electricity as though the coal burnt cost no more than $125 a tonne, kicking into gear a national plan designed to lower power bills.

The direction from the state government to CS Energy and Stanwell on Friday was a major part of the national cabinet deal to reduce power bills by capping the price of gas at $12 per gigajoule and thermal coal at $125 per tonne for at least 12 months.

Modelling by federal Treasury suggested households would be $230 a year better off than without the intervention, though price hikes will not be totally eliminated in 2023.

It is anticipated bills will rise 23 per cent next financial year instead of the previously estimated 36 per cent.

Urgent meetings of federal and NSW parliaments pushed through legislation to cap gas and coal prices respectively, but Queensland’s majority ownership of its energy assets meant the government could use its powers to direct the state-owned companies.

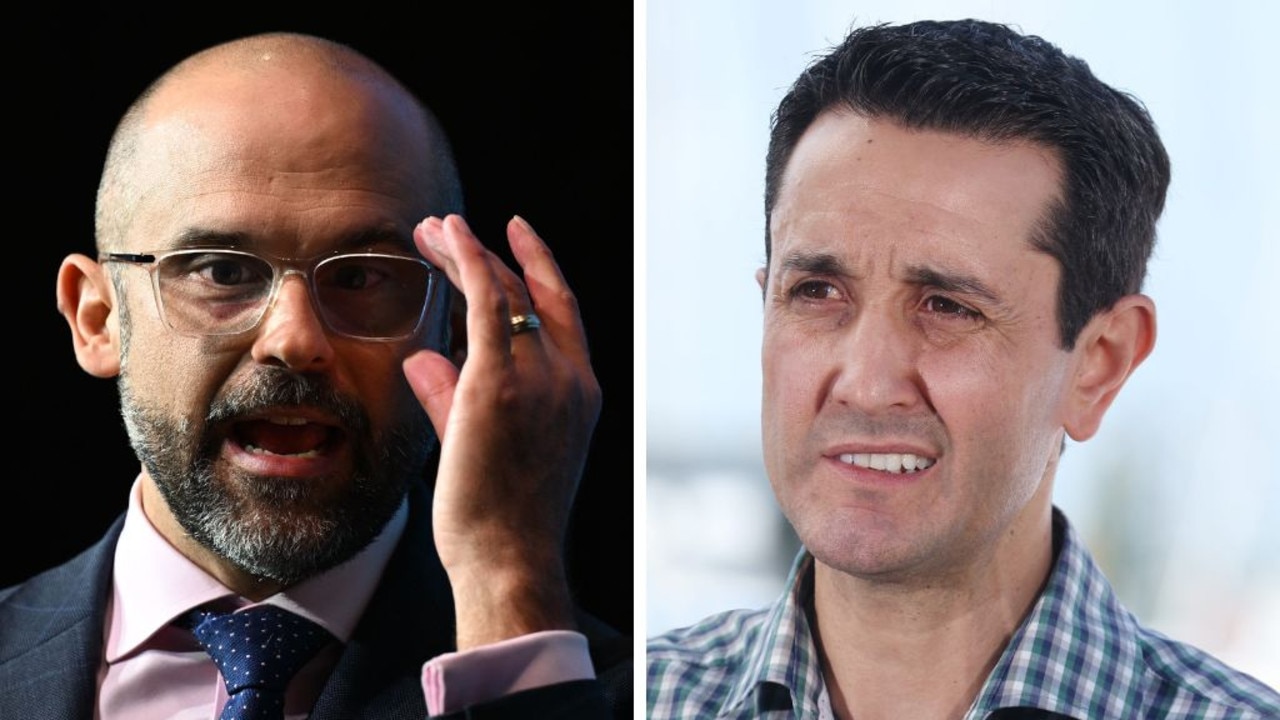

Treasurer Cameron Dick and Energy Minister Mick de Brenni, in their letter to the generators, said they should “bid into the National Electricity Market at a price consistent with a domestic coal price of AUD$125 a tonne”.

A number of Queensland’s state-owned coal fired stations, including Tarong and Kogan Creek, own the adjoining mines which supply the coal and thus get the resource for cheaper.

This means the impact of the direction will hit CS Energy and Stanwell when coal is bought on the spot market.

Gladstone Power Station, the state’s largest, is owned by a private consortium including Rio Tinto and largely services the nearby smelters — with CS Energy tasked with selling the excess electricity on the NEM.

Mr Dick and Mr de Brenni noted the direction would “have an impact on revenue” and signalled the government’s expectation the generators would place downward pressure on prices while ensuring the safe operation of assets.

The estimated financial impact on the generators is still unknown, and it’s understood the compensation mechanisms between the federal and state governments are still being negotiated.

A recent Queensland Audit Office report found state-owned energy companies were posting lower profits amid electricity market instability brought on by war, weather, power station breakdowns and transmission repairs.

Profit overall was $332.2m in 2021/22, down 31 per cent from the previous year.

But returns to customers, through regional customer support and rebates, had increased slightly to a total of $1.1bn in 2021/22.