Property transfer duties in need of review, says expert

Property Council of Australia executive director Queensland, Jess Caire says the state government has collected $3.5bn in transfer duties in the past three years and the system needs review. READ HER OPINION

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

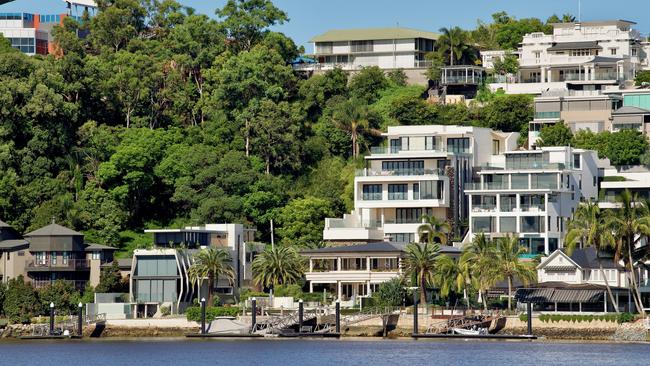

In March 2003, you could buy a house in Brisbane for around $230,000 … today that’s how much tax you’re looking at paying when buying a new home.

New research in the Property Council’s recently released Stacked Against Us report shows that a staggering 32 per cent of the cost of purchasing a new home is made up of government taxes and charges.

Don’t miss the Developing Queensland section, every Saturday in The Courier-Mail

Disturbingly, for Queenslanders it means the first nine years of a 30-year mortgage for a new house and land package of $730,000 will be spent paying off $233,440 in taxes, fees and charges – plus interest.

When you look at new apartments the research is even more concerning, with taxes and charges making up 33.3 per cent of the total cost.

There is no denying taxes are an important part of society – they fund our teachers, police, nurses, hospitals, roads and more.

However, as house prices skyrocket, so too have government revenues.

In fact, as home ownership becomes less affordable for Queenslanders, our research shows the State Government has collected a colossal windfall of $3.5bn in transfer duties in the past three years alone.

In the midst of an ever-worsening housing crisis, it is a bitter pill for Queenslanders to swallow.

This unexpected and unfathomable windfall for the government – when so many Queenslanders have been squeezed out of the housing market – reinforces that a holistic review of our antiquated and inefficient tax settings must be prioritised.

This must be on the table if we want to help more Queenslanders own their own home, while actively encouraging the investors who are essential in bringing more rental properties to market.

There are many levers the government can pull in reviewing its prohibitive tax settings, from moving thresholds for land tax and transfer duty to adjust for the bracket creep caused by rising property prices, to broadening Queensland’s build-to-rent land tax concessions to create a competitive environment with our southern neighbours and reducing taxes for global companies wanting to build apartments for our renters.

Our full suite of common sense recommendations can be found in the Property Council’s Stacked Against Us report and include a call for government to commit to no new taxes or charges being levied on property in the upcoming State Budget.

This, along with greater transparency as to where these tax windfalls are invested, will provide industry the certainty and confidence it needs to continue delivering a home for every Queenslander.