Where to buy to ride Mackay’s meteoric property prices

See how each Mackay, Isaac and Whitsunday suburb ranked for property growth and rental increases

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

BUYERS are looking to Mackay for a home and a future with the region's property market defying COVID-19 expectations.

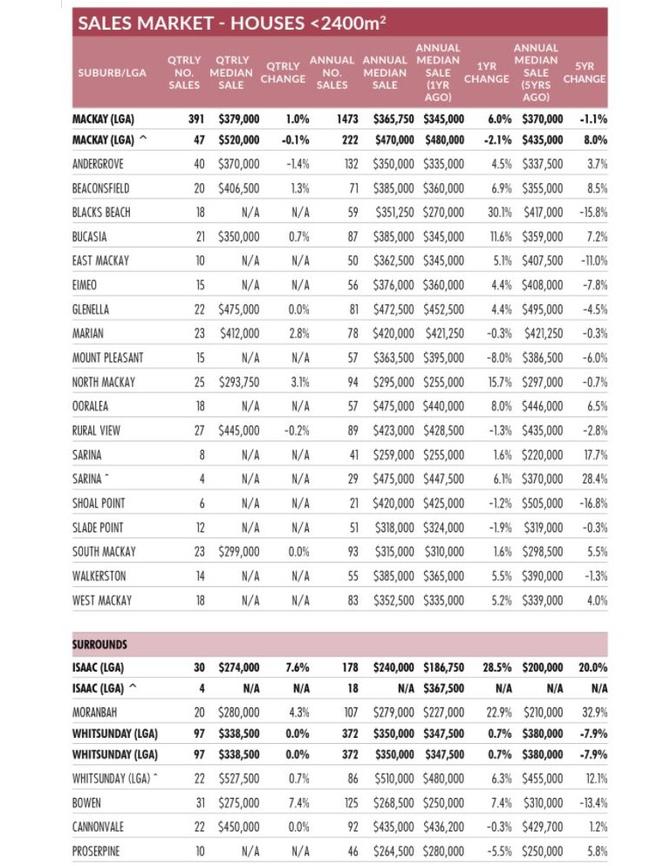

The December Real Estate Institute of Queensland market report found Mackay house prices rose by 6 per cent over 12 months, making the region one of the best performers in Queensland.

"The Mackay region has been waiting longer than it should have for improving market conditions, but it appears they have well and truly arrived," REIQ said.

REIQ said buyers were snapping up the increasing number of homes going to market, with the number of house sales increasing by nearly 13 per cent.

From September 2019 the region's median house price rose to $365,750.

REIQ Mackay zone chair Allison Cunningham said the renewed market was generating spectacular sales.

Ms Cunningham said the sale of a Dolphin Heads ocean front home for $1.95 million in August was the biggest deal since 2012.

REIQ said the best performing suburb was Blacks Beach, where median house prices increased by 30 per cent to $351,000.

It said the second-best performer was North Mackay, where the median house price grew by 15.7 per cent to $295,000.

For apartment living the best performing suburb for units was North Mackay, which posted price growth of 27 per cent to about $216,000.

Read more:

'Grinch' stashes vibrator in pants in sex shop theft

New homes push opposed: 'When does development end?'

Plan to kickstart Mackay's sluggish housing market

"It appears that vacant land is back in vogue with buyers in Mackay, with the numbers of sales increasing strongly over the September quarter," the REIQ report said.

Herron Todd White director Michael Denlay, a real estate appraiser, said almost all the major estates in Mackay had sold out of existing stock, with the race on now to develop more allotments.

But for those yet to get on the property ladder, the changes could further squeeze them out of the rental market.

"The woeful rental market conditions of a few years ago in Mackay are now a distant memory, with a critical under supply of dwellings available to lease," REIQ said.

"The Mackay rental market is the tightest in the state, with rents rising significantly."

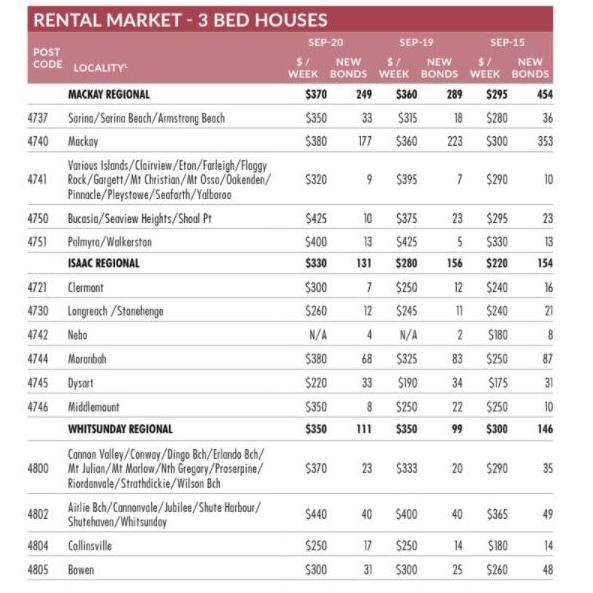

The Mackay vacancy rate was just 0.6 per cent in the September quarter, with rents rising in the under supplied rental market.

REIQ said the weekly median rent for a two-bedroom unit increased by 11 per cent over the September quarter, to $300 per week.

Subscriber benefits:

Five ways to get more from your digital subscription

WATCH: Your guide to reading the Daily Mercury online

Your questions about the new Daily Mercury format answered

The median weekly rent for a three-bedroom house in the Mackay region rose by $10 a week to $370 per week.

But rent hikes have not hit the region evenly, with renters in Shoal Point facing $50 a week price increases.

Sarina residents had their rents increase by $35 a week, but Farleigh and Walkerston renters had their rents reduced.

Renters across the Isaac region saw prices increase, with Middlemount the worst hit with $100 a week increases compared to 2019.

Whitsunday residents in Cannonvale and Airlie Beach had about a $40 per week rental hike.

REIQ chief executive officer Antonia Mercorella said Mackay and Rockhampton's housing markets were Queensland's biggest growth stories.

"Remarkably, it's regional Queensland that's really lead the charge, with the market so hot some buyers are purchasing houses without even seeing them in person," Ms Mercorella said.

"Queensland's property market continues to defy COVID-19 predictions, with median house prices rising yet again for a second consecutive quarter for much of the State."

Ms Mercorella said Queensland's resilience was clear, with not one single region recording a reduction in median house prices over the July-September 2020 quarter.

"Between record-low mortgage rates, low stock availability for sale, improvements in consumer sentiment and Queensland's lifestyle drawcard, we're likely to see broader increases in values in 2021," she said.

Ms Mercorella said Queensland had benefited from an unusually high net interstate migration over the past few years.

She said in 2019 Queensland had a net gain of nearly 23,000 people, with Brisbane attracting 70 per cent of those new interstate migrants.