How Mackay weathered the COVID-19 real estate storm

Mackay property: See what your home is worth after coronavirus impacts

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

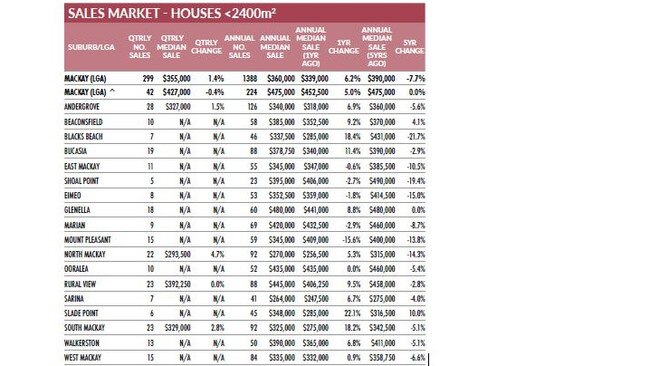

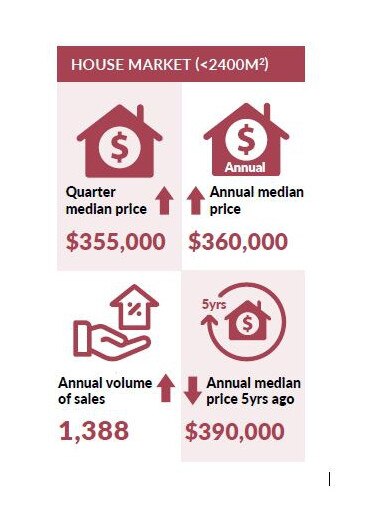

MACKAY house prices have shot up 6.2 per cent as the median house price hits $360,000.

It marks the second consecutive quarter the sugar city has been the best performer in the state for annual median house price growth.

The Real Estate Institute of Queensland says that price is inching ever closer to the region's top median price of $390,000 recorded in December 2014.

Slade Point had the highest annual growth, jumping 22.1 per cent from $285,000 to $348,000 median sale price in the past year, in the REIQ's Quarterly Market Monitor report for June.

Blacks Beach is close behind, jumping 18.4 per cent from $285,000 to $337,500, and South Mackay jumped 18.2 per cent from $275,000 to $325,000.

The Northern Beaches is showing strong growth with Bucasia growing 11.4 per cent, Rural View 9.5 per cent and Beaconsfield 9.2 per cent.

Mount Pleasant experienced the biggest drop at -15.6 per cent from $409,000 to $345,000.

REIQ CEO Antonia Mercorella said regional areas were performing well despite major banks, research firms and media naysayers predicting 'worse case' property price declines from the onset of COVID-19 - forecasting falls from anywhere between 20-40%.

"In 2019 Mackay experienced a very positive year of growth, not only in relation to property but for the local economy as well," Ms Mercorella said.

"A dynamic resources sector coupled with large infrastructure projects saw a boost in employment opportunities and population growth throughout the year.

"That momentum gained over the past year or two has certainly continued into the first three months of 2020 and is a great result for Mackay."

Subscriber benefits:

How to make the most of your digital subscription

Daily puzzles and Sudoku another reason to stay subscribed

HOUSE MARKET

REIQ Mackay Zone Chair Allison Cunningham said market conditions were solid as 2020 opened but the region's property market hit pause when coronavirus hit.

She said there was a drop in sales, listings and buyer activity during April, combining to insulate prices.

Ms Cunningham said by May, the market began to reignite with more people through open

homes and solid offers from buyers for listings.

She said with fewer listings available, buyers were not presenting low-ball offers but multiple offers were not as common as earlier in the year.

Ms Cunningham said the Mackay economy had weathered the pandemic well.

The QMM report for June, released on Friday, said: "Mackay's housing market was the strongest major region in the state over the past year.

More real estate stories:

Iconic Mackay hotel sells for millions at auction

Huge development opportunity in riverfront property

Who says size matters? Mini capitals on the surge

Real estate: Why Mackay is leading the pack

"The region's rental market was also in healthy shape, with vacancies falling even further during the lockdown as FIFO mining workers opted to stay put.

"The demand for rental properties prior to the pandemic had resulted in weekly rents continuing to rise over the past year as well."

UNIT MARKET

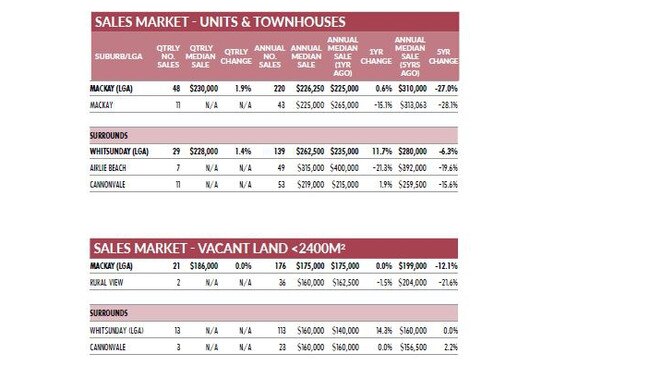

But the report suggests the future is a little less certain for buyers and sellers in the unit market.

The median unit price continued to strengthen in early 2020 - recording an increase of 1.9 per cent to $230,000.

Over the year ending March, the median unit price was up 0.6 per cent.

But median unit prices still remain lower than five years ago, down 27 per cent from $310,000 in March 2015.

"That said, Mackay's market more generally is well placed to restart its growth trajectory post-pandemic, which will ultimately benefit the region's unit market," the report said.

"According to a local valuer, Mackay's major industries were all declared essential services and continued to operate during the coronavirus crisis, which underpinned its economy and property market.

"The predominant impact on the market from the pandemic was the removal of 'tyre kickers' with almost all inquiries now from genuine purchasers looking to enter the market, the valuer said.

"The market has been in a 'holding pattern' with no real change in market values and it is expected that the momentum of the past 18 months will continue once the pandemic had passed."

RENTAL MARKET

The Mackay rental market was under-supplied during the March quarter.

The vacancy rate was 2.5 per cent - a significant improvement on the eye-watering 9.8 per cent recorded in December 2014.

Ms Cunningham said the number of vacancies had fallen further during the pandemic but it was not yet clear whether it was due to a permanent increase in demand.

She said there were only about 238 rental vacancies advertised in Mackay in early June, which was much lower than the number available at the start of the year.

Ms Cunningham said during the downturn about five years prior, there were commonly more than 1000 rental vacancies available.

She said the increase in demand for rental properties during the crisis may have been from FIFO mining workers who stayed put because of travel restrictions or fewer available flights.

The QMM June report said increasing demand for rental properties before the crisis had been driving up rents in the region.

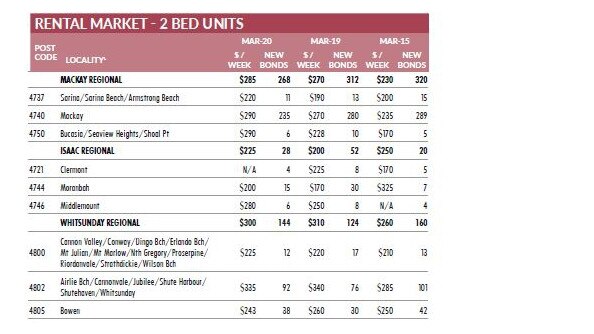

The median weekly rent for a two-bedroom unit increased 5.6 per cent to $285 between March 2020 and March 2019.

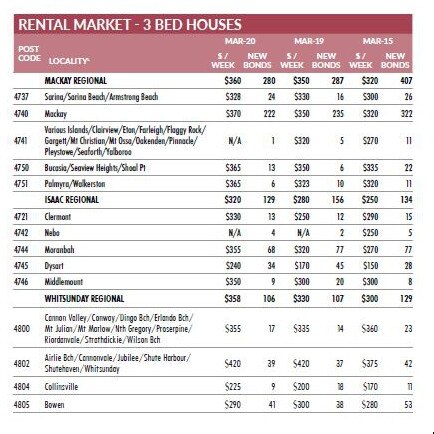

The median weekly rent for a three-bedroom house increased by 2.9 per cent to $360 over the same period.

Gross rental yields in Mackay held steady as well with 5.3 per cent and 6.4 per cent recorded for houses and units respectively.

WEEKEND SALES

Over the weekend, 23 homes were recorded as being sold at auction across Queensland while 768 sold as private sales.

In Mackay and surrounding regions, there were 29 sales over the past week.

- $660,000: 128-130 Apsley Way, Andergrove

- Price withheld: 9 Crescent Street, Armstrong Beach

- Price withheld: Site 68/40 Beaconsfield Road, Beaconsfield

- $30,000 (land sale): 43 Dinang Crescent, Glenden

- $350,000: 38/4 Nelson Street, Mackay

- $275,000: 25 Sophia Street, Mackay

- Price withheld: 16 Mooney Court, Marian

- $177,000 (land sale): 13 Treloar Place, Marian

- $500,000: 70 Mills Avenue, Moranbah

- $340,000: 26 Renier Crescent, Moranbah

- Price withheld: 18 Lawson Drive, Moranbah

- 21 Raven Crescent, Moranbah

- $347,500: 7 Moffatt Street, North Mackay

- Price withheld: 12 Michael Moohin Drive, Slade Point

- $320,000: 15 Osprey Close, Slade Point

- $210,000: 2/35 Hucker Street, South Mackay

- Price withheld: 2 Mattey Court, Walkerston

- $98,000: 4/301 Bridge Road, West Mackay

- $230,000: 310/1 Wilson Street, West Mackay

- $185,000: 23 Fuller Street, Proserpine

- $156,000: 22/11 Island Drive, Cannonvale

- $155,000: 49/28 Island Drive, Cannonvale

- Price withheld: 6 Scenic Ridge Drive, Cannonvale

- $197,500: 15 Blake Street, Collinsville

- $180,000: 5 Penrose Circuit, Blackwater

- $155,000: 25 Boronia Street, Blackwater

- $195,000: 14 Colleen Avenue, Emerald

- $190,000: 16 Martin Place, Emerald

- $410,000: 77 Patanga Place, Emerald