Nine reasons you should buy in Mackay

The ‘misunderstood’ city would have city-dwellers crying ‘cash flow tears into their skinny lattes’.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

MACKAY'S property market is pegged to be the best performing in the state this year.

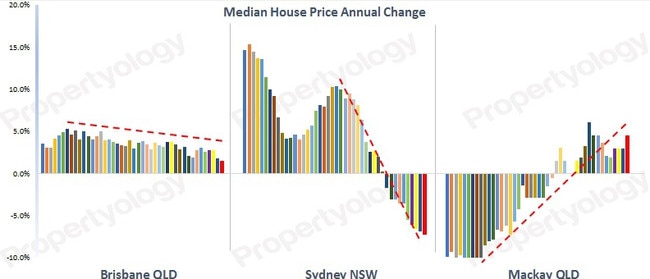

A new Propertyology report found the market made a strong recovery in 2019, and the growth cycle was expected to continue in the new decade.

Propertyology head researcher Simon Pressley described Mackay as "misunderstood" and not just a boom or bust mining town.

"The city has a population of nearly 120,000, it services a broader regional population of circa 200,000, there is economic diversity, it has all of the essential infrastructure, and one of our nation's most beautiful attractions is right on its very doorstep," Mr Pressley said.

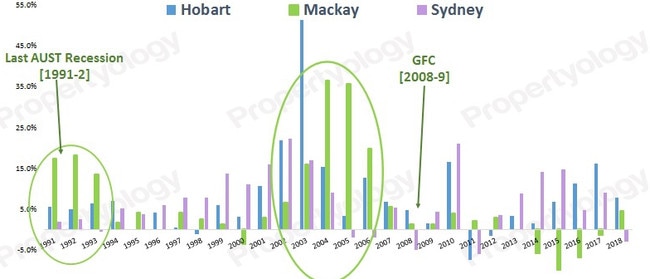

"Like all major locations, Mackay has experienced periods of real estate price growth and price contraction during its history.

"Mackay is Australia's 18th largest city yet its median house price is the 78th most expensive.

"In other words, Mackay's property prices provide a lot of bang for the buck."

READ MORE: Mackay's unit market is tops for investors

Mr Pressley expects growth in Mackay and surrounding regions will continue in 2020.

"Record low interest rates will be very kind to all property owners and the Federal Government's new first home deposit scheme is a great opportunity for new entrants," he said.

"Mackay's property prices are incredibly affordable, supply is tight, the local economy is strong, making it a safe property market.

"(This year) will be a great year for first home buyers, owner-occupier upgraders and investors. We anticipate Mackay rents to increase and double-digit capital growth."

Simon Pressley's top reasons why Mackay is a strong market:

- Over the 12 months ending October 2019, Mackay's median house price increased by 4 per cent, which was superior to every capital city in Australia. Mackay is in the early stages of a new growth cycle.

- Mackay's local economy is very buoyant, there is a staggering 450 major infrastructure project pipeline worth $30 billion. Housing supply is also very tight. With a few recent RBA rate cuts, an investor can acquire debt at around 3.5 per cent, purchase a quality asset at a price of $360,000 to $400,000, and the rent will cover the entire cost of the holding the asset.

- Mackay is a real city of substance. It's a coastal location with nice beaches, fantastic weather year-round, as well as having a youthful and hardworking demographic that loves sport. The Mackay Airport has dozens of direct flights to all corners of the country every day. The city has an attractive waterfront, quality retail facilities, good schools, a university campus and a good hospital - it's what I call a 'mini capital city'.

- Mackay sits at the front door to one of the world's most idyllic tourist attractions - the Whitsundays. It's also Australia's sugar cane capital, and Qantas recently hand-picked Mackay as one of only two locations in Australia for a new pilot academy. The city of Mackay plays an important role in providing goods and services for a large number of coking coal and thermal coal mines. Mackay has a diverse economy that employs tens of thousands of locals in different industries. That gives its employment sector, and its economy, a depth far greater than just a resources-dependent regional area.

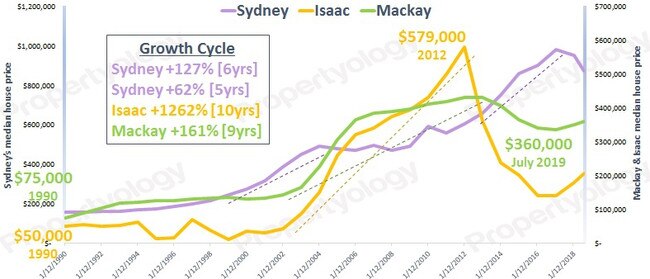

- Like everywhere else in Queensland, Mackay's property market has been disappointing for the past decade. But how Mackay's property market has actually performed over history is different to most people's perception. From the $75,000 median house price at the end of 1990 to today's $360,000, the average annual growth rate across the past 29 years is 5.6 per cent and only marginally behind greater Brisbane's 5.8 per cent.

- The plethora of property generalists in the world probably consider Mackay to be a boom-bust high-risk property market. That is certainly true for one-industry towns like Moranbah, but Mackay is a city of substance with a very different property trendline. Mackay's median house price increased by a whopping 161 per cent over the nine years ending 2012 - yes, that's a big boom. But a decline from $430,000 (at its late-2012 peak) to $335,000 (when it bottomed in late-2017) is not dissimilar to the values wiped off Sydney and Melbourne house prices during their recent downturn.

- With the size of a typical mortgage in Mackay being significantly lower than Australia's more expensive cities, the cost of housing places less stress on the budget. Not only that, the prospects for more growth are real because of its rebound in population as well as a looming under supply of property.

- If a strengthening house market wasn't enough, investors of Mackay real estate are already enjoying superior yields. In fact, their yields would make Sydney investors cry cash flow tears into their skinny lattes! While Sydney investors try to make up mortgage repayment shortfalls of hundreds of dollars every week, Mackay investors are often in positive cash flow territory from day one - plus they are investing in an asset with real price growth prospects. Mackay's vacancy rate is now just 1.5 per cent, which is into under supply territory.

- Right here, right now, I consider Mackay to be a safe property market. Housing being so affordable provides an important solid floor and arguably the biggest risk mitigant of all. Other solid fundamentals include a below-average volume of new housing supply in the pipeline, very low (and falling) residential vacancy rates, and solid job creation.