Huge project pipeline delivers massive job opportunities

FULL LIST: Nine major projects will generate the need for more than 4200 workers, with one occupation highly sought after

Mackay

Don't miss out on the headlines from Mackay. Followed categories will be added to My News.

Nine major mining projects in the Bowen and Galilee Basins will generate the need for more than 4200 jobs with one occupation identified as the most in-demand.

The Australian Resources and Energy Group's workforce forecasting report, released today, quantified the need for skilled workers across the mining and energy sectors to propel the COVID-19 economic recovery.

Using a number of industry-verified modelling techniques, the Australian Mines and Metals Association's Resources and Energy Workforce Forecast (2021-2026) report detailed the operational labour demand required for new mining and oil and gas projects scheduled for completion between 2021 and 2026.

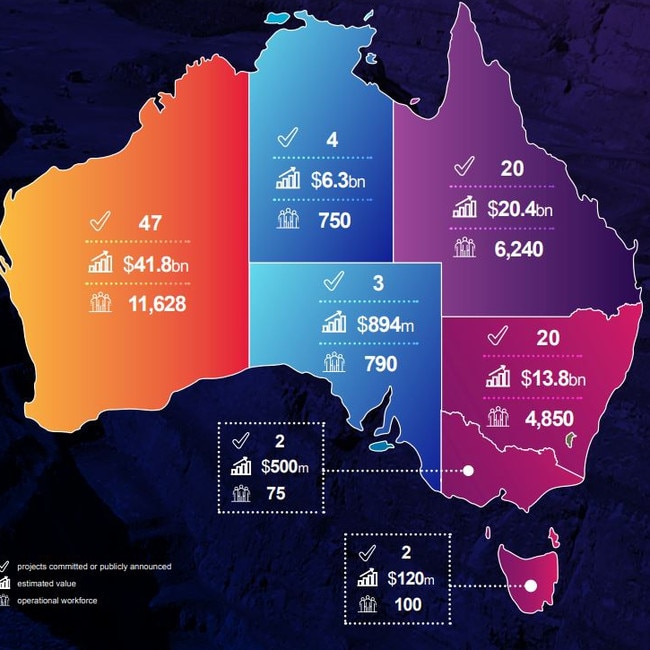

Nationwide, the pipeline of job-creating projects was worth $84 billion and more than 24,000 jobs.

It finds 98 projects worth $83.8 billion, either 'committed' or considered 'likely' by the Australian Government's Department of Industry to be completed within that timeframe, would demand a forecasted 24,433 production phase employees by 2026.

The report identified Queensland's resources and energy industry directly employed 63,7000 people as at August this year, representing 26.5 per cent of the industry's workforce.

"There are 20 new or expansion projects either already committed or considered 'likely' to proceed in Queensland between 2021 and 2026 year-end," the report found.

More stories:

Coal mine expansion securing 200 jobs reaches next stage

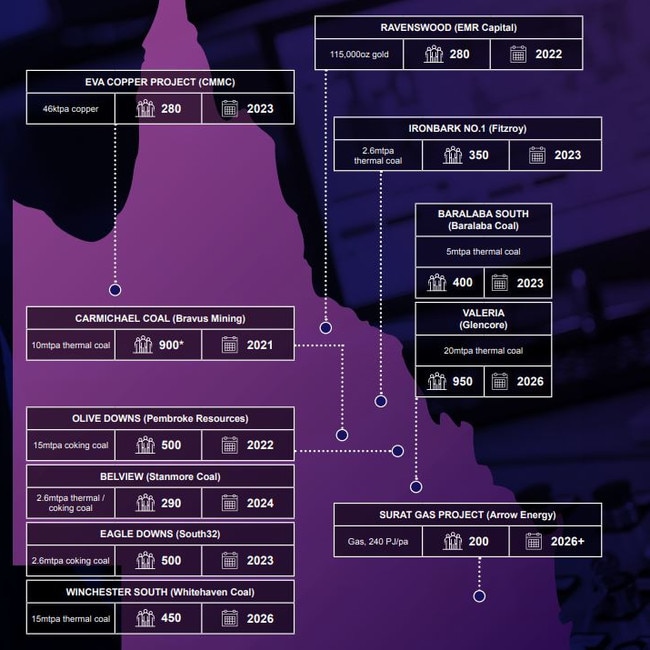

All but one of the anticipated coal mines were in the Bowen or Galilee Basins with 4240 new jobs set to be generated.

"Collectively these projects are forecast to create demand for 6240 production-phase employees, lifting the state's direct resources workforce 9.8 per cent to about 70,000.

"Coal will be the largest driver of growth, with 22 projects forecast to create around 8000 new production jobs."

Plant operators would be the most in demand with 2474 needed, followed by mine engineering, technical and geology workers (1213 jobs) and supervisors, management and administration positions (1160) in the mining sector.

About 800 heavy diesel fitters would be required, while 334 jobs were classified as "other trades".

"New workforce demand will be driven overwhelmingly by coal projects," the report said.

"In total, the 10 coal projects advanced in the development pipeline (eight of which are new projects), will account for 74 per cent of the state's total forecast new workforce demand to 2026 (4640 direct employees).

"Seven of these projects (2950 employees) are expected to be operational by end of 2023, another one by the end of 2024 (290 employees) and one large new project - Whitehaven

Coal's Winchester South - scheduled to reach production beyond that (950 employees in 2026).

>>SCROLL DOWN FOR THE FULL PROJECT BREAKDOWN

AMMA chief executive Steve Knott said the new workforce report showed what the growth cycle could mean for employment in Australia's resources and energy industry, and what occupations would be in the highest demand.

"This forecast for over 24,400 new operational-phase employees is highly conservative," he said.

"It only factors in projects either already committed or very close to receiving final investment decision.

"When considering the construction workforces required to build these projects and the flow-on effects throughout the supply chain, it's reasonable to expect the true impacts of this investment pipeline to be well over 50,000 jobs."

Mining news:

Hard-line approach needed on China coal ban: Christensen

Macmahon inks $250m mega CQ mine deal

Wake of Grosvenor tragedy gives hope for burns survivors

Mr Knott said it was positive to see investment and employment growth driven by an array of commodities, including coal, gold, LNG, iron ore and a variety of other metals and critical minerals.

The modelling showed the national resources and energy workforce would experience 10 per cent growth in direct employment over the next six years, exceeding 260,000 employees for the first time since February 2014.

"This data shows the huge opportunity for Australia's resources and energy industry to lead the country's economy and labour market out of the COVID-19 recession," Mr Knott said.

"But the industry needs long overdue regulatory reform to assist in securing these opportunities.

"Last week the Productivity Commission released its Resources Sector Regulation report identifying a range of areas where regulatory processes can be streamlined and unnecessary barriers to investment removed."

Share your thoughts on this issue through a letter to the editor:

He said the "most obvious report of huge benefit for future major resources and energy projects" was the Project Life Greenfields Agreements which would stabilise industrial relations agreements for the duration of major project construction phases.

"The importance of this reform to securing final investment decision on new major projects cannot be overstated," he said.

"This simple improvement will make a massive difference to getting the $84 billion worth of advanced projects, and their potential to bring more than 24,400 new jobs, over the line.

"It will also work wonders for the 197 additional major resources and energy projects in Australia's investment pipeline considered too early in development stages for inclusion in AMMA's new report.

"Major resources and energy projects massively stimulate the highly mobile national construction workforce, create thousands of long-term jobs associated with the production phase, and pump billions of taxes and royalties into state and federal revenues."

Bowen and Galilee Basin projects:

10km east of Blackwater

Operational: 2024

Workforce: 290

Galilee Basin, 160 km northwest of Clermont

Operational: 2021

Workforce: 900

25km southeast of Moranbah

Operational: 2023

Workforce: 500

30km northeast of Moranbah

Operational: 2023

Workforce: 350

Moranbah

Operational: 2022

Workforce: 200

40 km southeast of Moranbah

Operational: 2022

Workforce: 500

27 km northwest of Emerald

Operational: 2026

Workforce: 950

45km northeast of Emerald

Operational: 2023

Workforce: 100

30km southeast of Moranbah

Operational: 2026

Workforce: 450