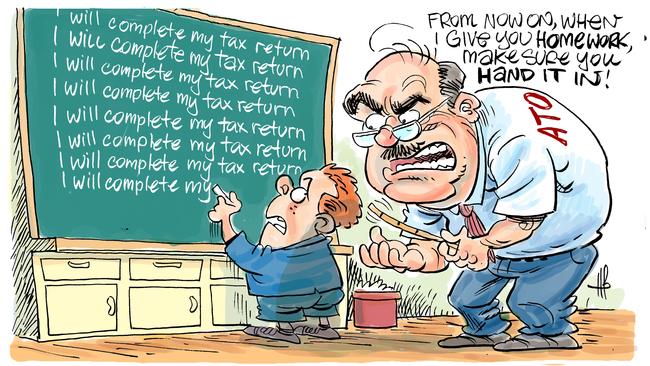

Here’s what can happen if you fail to lodge your tax

A Mackay father of three failed to do his taxes for five years.

Mackay

Don't miss out on the headlines from Mackay. Followed categories will be added to My News.

A SINGLE father of three who failed to do his taxes for five years has been dealt a hefty fine with convictions recorded.

It's a timely reminder of the possible consequences to anyone who does not lodge their tax return paperwork.

The Mackay dad agreed his actions were not worth it "in the long run", especially considering he received a $7500 payout once his tax claims had been lodged.

More stories:

Jobseekers get leg-up with free service to help find work

End of an era: plan to destroy iconic Mackay building

Bowling alley 'fed up' with paying highest rates in Aus

BATTLE OF THE MINES: David and Goliath tussle over coal land

"Better in your pocket than the government's," Magistrates Damien Dwyer said as Ronald Francis Ryan was sentenced.

"There was no point to it … It's now all done and he's actually received a refund of $7500.

"I'm going to discharge him without conviction."

However Commonwealth prosecution, appearing on behalf of the taxation office, pushed for a fine arguing it was "not a trivial offence".

Ryan pleaded guilty to five counts of failing to furnish an approved form or any information to the commissioner when required to do so under taxation law.

Subscriber benefits:

How to make the most of your digital subscription

Daily puzzles and Sudoku another reason to stay subscribed

Mr Dwyer asked Ryan if having a conviction would impact him and he said no.

As a result, Mr Dwyer imposed a $1000 fine. When asked if he had anything to say, Ryan replied with "will do my taxes from now on".