Mackay iCutter Industries to reconsider investments over coal royalty uncertainty

Mining giants have been sending warning flares for months that the state government’s new coal royalties deal could damage future investment into Queensland resources. And now one small Mackay supplier is also speaking up.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Mackay small businessman Dallas Morris has been in mining for 30 years and says the state government’s new coal royalties have pushed him to reconsider new investments in his growing drilling repair and distribution business.

“I am not going to invest in a new $1m CNC machine knowing that next year and the year after we are not developing our coal mines,” the iCutter Industries services manager said.

“It is not cost-effective.”

He said his uncertainty flowed out of fear the Bowen Basin’s big miners would pull back their own investments in response to Treasurer Cameron Dick’s new royalty tiers, which introduce a top royalty rate of 40 per cent when prices hit more than $300 per tonne.

“We follow the mines,” Mr Morris said.

“Whatever the big miners are doing, we follow them and we are seeing and hearing the investments are not going to be there.”

iCutter Industries started out in a garage in Hucker Street in South Mackay but has grown to encompass two warehouses in Paget, Mackay’s industrial zone, and nine employees.

The business counts behemoths like BHP and Yancoal as clients as well as Rockhampton-based business Coldwell Drilling.

Mr Morris said he wanted to expand but his outlook on the sector had darkened.

“We are actually at a point where we need to expand now but I’m looking at the market now and I am a bit hesitant to do that, to buy new space.”

Mr Morris said his concerns were widespread across the mining services community.

“We need to be communicated to,” he said.

“All businesses need to be communicated to.”

In its half-yearly report to investors, BHP has stated once again it will pause “significant new investments” into Queensland due to the government’s new royalty structure.

“We see strong long-term demand from global steelmakers for Queensland’s high quality metallurgical coal, however in the absence of government policy that is both competitive and predictable, we are unable to make significant new investments in Queensland,” the report states.

The latest statement follows months of clear signals of a pending investment collapse from the mining giant.

Queensland Resources Council chief executive Ian Macfarlane said other firms were also reconsidering their investments into the sector.

“You can’t overtax an industry, let alone Queensland’s most important economic driver, and expect business to continue as usual,” he said.

“We know other mining companies are also reviewing their investment exposure in Queensland.”

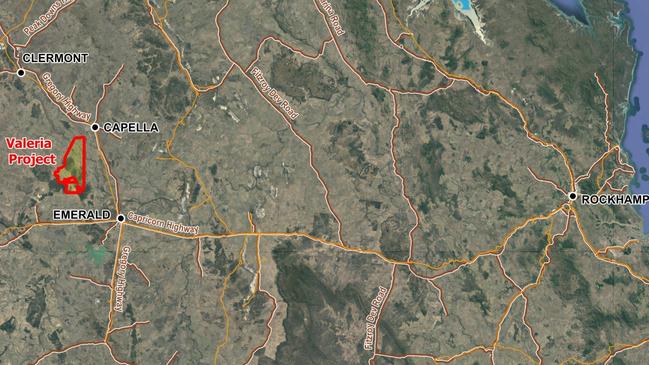

After cancelling its $1.5bn Valeria coal project near Emerald in December, Swiss behemoth Glencore cited royalties as a factor in its thinking, though it also stated the withdrawal was part of a general policy to exit coal globally.

Mr Dick has pledged to return earnings from the new tiers back into regional Queensland through a new $3bn consolidated fund.