Lendlease gets foreign review board green light to sell 12 estates in $1.3bn deal

Approval for a developer to sell off 12 of its housing estates, including four in South East Queensland, will boost the supply of new dwellings.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

South East Queensland’s supply of new housing will get a boost, with developer Lendlease given the green light to sell off 12 of its estates, including four in Queensland.

Shoreline in Redland, Yarrabilba in Logan, Springfield Rise in Ipswich and Kinma Valley in Caboolture will be sold in a $1.3 billion deal with shopping centre developer Stockland and its Thai affiliate Supalai.

Lendlease had been waiting for approval from the Foreign Investment Review Board after the Australia Consumer and Competition Commission said it would not oppose the takeover bid last month.

It took more than a year for Lendlease to get the go ahead to offload the communities as part of a streamlining initiative to return the company back to its core basics.

Lendlease, under the leadership of CEO Tony Lombardo, has embarked on a strategic shift away from single-dwelling houses towards high-rise projects, aiming to capitalise on the downsizing trend among Baby Boomers.

The transaction is expected to be completed in the second quarter of this financial year, subject to landowner consent. Financial outcomes of the sale will be updated upon completion.

The sale marks a significant shift in the landscape of property development in Australia, particularly in Queensland, where Stockland-Supalai is poised to become a leading player in the housing market.

The FIRB’s approval follows a rigorous review process, ensuring that the transaction aligns with national interests.

Stockland, an ASX-listed diversified property group, and Supalai, a Thai-listed property developer, formed a joint venture in 2022 for the acquisition.

The ACCC’s approval was contingent on Stockland selling its Forest Reach masterplanned community in the Illawarra region to address competition concerns.

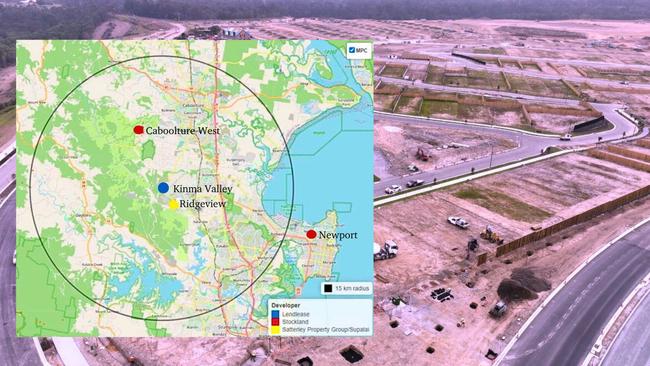

The ACCC’s five-month investigation into the deal revealed initial concerns regarding potential impacts on competition and housing prices, particularly in the Ipswich and Moreton Bay regions.

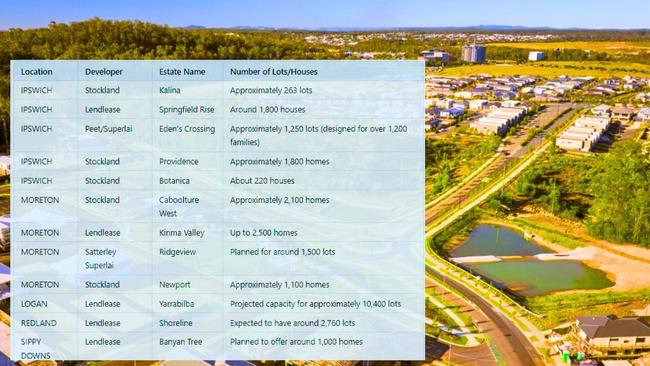

Stockland already had a significant presence in these areas, controlling masterplanned communities such as Kalina, Providence, and the upcoming Botanica estate.

An initial ACCC report in July indicated that removing Lendlease as an independent competitor could potentially lead to higher housing prices and reduced competition, adversely affecting consumers.

Specific concerns were raised about the Springfield Rise estate in Ipswich, which is currently the most established estate in the region.

Despite the concerns, the ACCC concluded in October that the acquisition would not adversely affect competition in other regions, including Redland and Logan, due to the presence of alternative competitors.

The acquisition by Stockland-Supalai is expected to provide greater investment security across 11 housing estates in City of Moreton Bay, Ipswich, Logan, and Redland.

The move is anticipated to address the state’s housing crisis by boosting the supply of new homes in these regions.

Stockland’s expanded portfolio will eventually include estates such as Kalina, Springfield Rise, Eden’s Crossing, Providence, and Botanica in Ipswich, as well as Caboolture West, Kinma Valley, Ridgeview, and Newport in Moreton Bay, along with Yarrabilba in Logan and Shoreline in Redland. Collectively, these estates are expected to house over 200,000 people.

The Property Council of Australia has voiced concerns over state tax policies that have reportedly driven away international capital, thereby impacting housing delivery.

The council has called for a review of these policies to support developers and enhance housing stock.