Queensland convicted con artists of 2022 named and shamed

Queensland has been notorious for white-collar crooks and with thousands of cases tallied last year, here are the swindlers who made headlines. MAP

Ipswich

Don't miss out on the headlines from Ipswich. Followed categories will be added to My News.

From the self-described “international man of mischief” Peter Foster, known as Australia’s most prominent conman, to cash splash king Christopher Skase, Queensland has been notorious for white-collar crooks.

However, the Sunshine State’s links to shady characters dabbling in white collar crimes such as fraud, identity theft, credit card skimming, insider trading and forgery is not growing with Queensland recording nearly a 9 per cent drop off in those types of crime over the past year.

Last year’s floods, two years of a pandemic, interest rate hikes, the rise of cryptocurrencies and growth in online investing are believed to have all triggered a busy year for police in fraud squads across the state.

But the number of offences police dealt with dropped from 24,015 cases in 2021 to 22,053 last year.

This year, if figures for January and February are any indication, white-collar crime will drop even further after a low of 1361 offences in January, although final numbers may change after adjustments.

The South Brisbane Police District had the most number of fraud offences in 2022, recording 3642 cases of dodgy cheques, credit cards and identity theft.

The Gold Coast was still a hot bed of white-collar crime with more than 2500 cases in 2022, but those types of crime were down from a record high of 3470 in 2021.

Mackay posted a massive 33 per cent decrease in fraud over the year 2022 with Mount Isa also slashing its rate.

But the news was not all good, with Rockhampton experiencing a 14.5 per cent increase in white collar crime, mainly from credit card fraud.

Toowoomba and the Darling Downs also experienced a 14 per cent increase in white-collar crime in 2022 with a few cases of fraud by computer.

But the bulk of cases in that area were “other fraud” which include misappropriation of funds, tax evasion, obtaining financial advantage by deception, breaching directors’ duties, money laundering, embezzlement, bribery, blackmail, making false records or theft by an employee, and IT fraud.

Ponzi schemes, or pyramid investing, where fraudulent payments to existing investors are made using from funds from new investors, were becoming less popular.

From dodgy development deals to fleecing investors or the tax office, here are some of the Queenslanders busted for white collar crime in 2022.

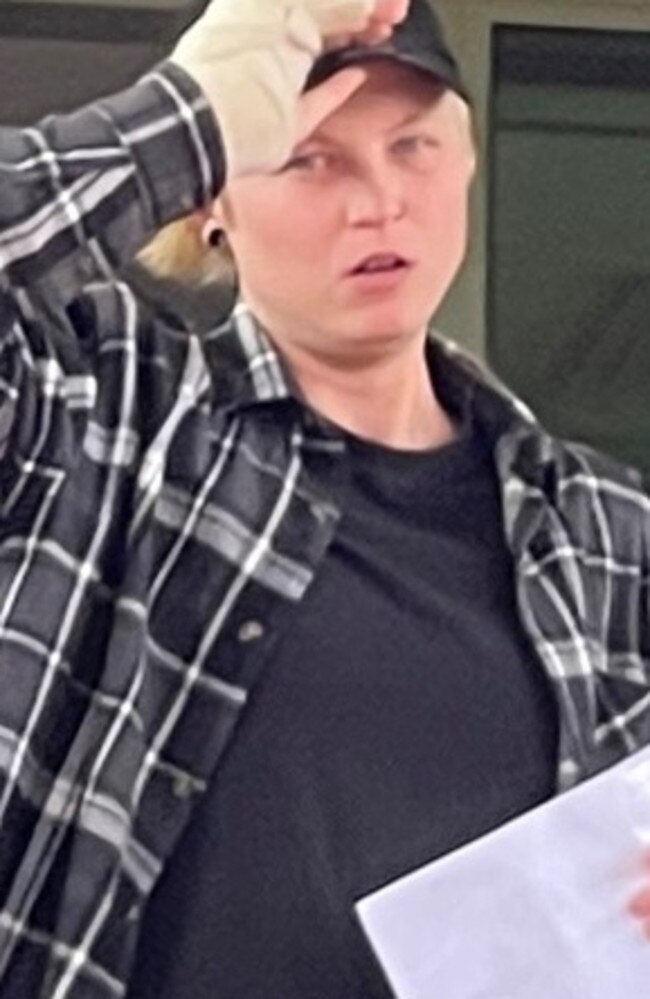

TOWNSVILLE: NIKKITA FAYE CLUTTERBUCK

Townsville pub worker Nikkita Faye Clutterbuck “impulsively” used her employer’s money to place a $30,200 bet on Keno.

Clutterbuck was 24 when she pleaded guilty to a fraud charge in Townsville Magistrates Court in October 2022.

The court heard she was working as the Vale Hotel’s gaming manager when she placed 22 credit bets, without making payment, during a shift in November 2021.

She cancelled $700 in bets and won $18,000, leaving the pub, which was owned by the ALH Group, with a loss of $11,500.

The next day, she returned to the hotel and confessed. Following a disciplinary meeting, Clutterbuck signed a resignation letter and authorised for $1685.95 in annual leave to be withheld.

Magistrate Ross Mack acknowledged it was an attempt to get out of financial trouble and sentenced her to 12 months’ imprisonment, wholly suspended for a two-year operational period.

A conviction was recorded and she was ordered to pay $9814 in restitution.

TOWNSVILLE: STUART DONALD MENZIE

Former Townsville car salesman Stuart Donald Menzie was sentenced to four years’ jail, after failing to pay back more than $230,000 to owners of cars sold on consignment.

Menzie, the former owner of Townsville 4WD Centre, pleaded guilty to four counts of fraud in Townsville District Court in May 2022.

The court heard that between July 31 and September 30, 2019, Menzie acquired 10 cars on consignment and sold them off, but did not pay back the proceeds of the sales. The court was told that four people fell victim to the fraud, with the total amount unpaid coming to $235,270. The most serious charge involved an amount of $151,500.

The court heard that Menzie would review ads, contact vehicle owners, and have the car’s registration transferred to him before selling it on.

At 71 years old, the offending was Menzie’s first, in a life otherwise lived walking on the straight and narrow, with the court hearing he had no criminal history.

Judge John Coker acknowledged Menzie’s remorse, and sentenced him to four years’ jail, to be wholly suspended after serving 10 months. A parole release date was set for December 24, 2022, with 77 days presentence custody declared as time served.

IPSWICH: ROBYN LORRAINE LAWRIE

Brassall’s Robyn Lorraine Lawrie, 50, pleaded guilty to defrauding a popular Queensland fishing magazine of $1.4 million, when she fronted Beenleigh District Court in January 2023.

Lawrie pleaded guilty to six counts of fraud.

The court heard Lawrie wrote cheques to herself from Queensland Fishing Monthly, where she had been a director for more than five years.

The court heard the total amount stolen was $1,395,63.50 between 2008 and 2013.

Lawrie was convicted and given a head sentence of seven years and ordered to serve 11 months in prison.

She will be eligible for parole on December 19 2023.

The court heard Lawrie was driven to the crimes partly because of her former partner’s alleged horrific, controlling relationship and that she had never gambled before meeting him.

The court heard that Lawrie would leave work early to use the fraudulently-obtained money to gamble at the Treasury Casino.

GOLD COAST: ANTHONY DAVID GRAY

Former Gold Coast solicitor Anthony David Gray swindled more than $12 million from loved ones and clients, including a friend of 41 years whose wedding he attended.

Anthony David Gray, 57, pleaded guilty to two fraud charges when he appeared in Brisbane District Court in May 2022.

He pleaded guilty to defrauding a client of $150,000, taking the money for a court-ordered settlement that was never made, while he was working as a barrister.

Judge Michael Byrne reduced Gray’s sentence because of his guilty pleas and his extra co-operation in revealing 14 names of potential victims unknown to police, after his arrest.

He ordered Gray be eligible for parole in July 2022 after three years behind bars for defrauding 46 people of $12.5 million through an investment scheme over eight years.

The court heard Alwyn Griffin, the father of Gray’s close friend Paul Griffin, invested half of a $550,000 compensation payout he received for asbestos-related cancer.

He died, aged 78, without getting a cent back.

Mr Griffin said his parents had also invested $100,000 and then $80,000, but none of the money was recovered before his mother died 18 months after his father.

Mr Griffin, a builder who had known Gray for 41 years, with the friends even at each other’s weddings, said he also lost $15,000 he had invested, when Tony Gray left Australia in 2017.

Crown prosecutor Steve Dickson said a total of $42.45 million had been put into accounts Gray controlled, through Synergy Gray Professional Services, including $18.3 million by the 46 complainants.

Mr Dickson said Gray had produced certificates of investment and monthly investment statements to keep the deception going.

The court heard $1.9 million went into Gray’s own accounts.

One woman who invested $1 million lost $70,000, and another man who invested $45,000 of an inheritance only got $15,400 back, while others lost everything.

Mr Dickson said Gray’s eight-year fraud started to unravel when a woman who had invested $2 million in the Ponzi scheme asked to withdraw $100,000.

When his company went into liquidation in late 2016, others tried to withdraw their money, but Gray left the country in February 2017.

SUNSHINE COAST: JODI LOUISE NUSKE

Noosaville mum Jodi Louise Nuske was jailed for seven years after she was found guilty of defrauding Hastings St restaurant Bistro C out of more than $600,000 when she appeared before Maroochydore District Court in December 2022.

A jury took less than two hours to reach a verdict bringing a 10-day trial to an end.

The court was previously told Nuske worked as a bookkeeper at the popular restaurant on the Noosa glitter strip between 1998 and 2016.

She was charged with fraud and pleaded not guilty.

The charge came after Bistro C owner Lorraine Banks was alerted to several unauthorised transactions from business accounts which Nuske controlled.

Ms Banks told the court she later confronted Nuske, who burst into tears, began apologising and offered to go to the bank and pay her back.

Ms Banks declined and Nuske’s employment was terminated.

The court was previously told she had swindled $768,888 and spent it on various payments and invoices, including school fees, tax payments and payments on a new home she was building in Noosaville.

She was ultimately sentenced on the basis of having taken $612,675.82.

Judge Gary Long found Nuske guilty of one charge of fraud by dishonestly gaining a benefit above $30,000.

He sentenced her to seven years behind bars and did not comment on a parole eligibility date.

MACKAY: GELRIA RAE FARAM

Townsville mother Gelria Rae Faram leveraged the tragic death of her son to manipulate a woman out of thousands of dollars in a shocking online scam involving expensive puppies.

Faram, 39, pleaded guilty to five counts of fraud which also included purporting to sell a mobile phone that was never sent after money was transferred.

She was jailed in November 2022 for two years after advertising puppies for sale online and pocketing the cash with the fraud totalling about $9400.

Mackay Magistrates Court heard Faram advertised British and French bulldogs online and pocketed almost $9000 from four victims between August 2021 and January 2021 – but never delivered the dogs.

The court also heard when two of the victims pushed back – including one man she had known for 25 years – she threatened to get bikies onto them.

The court heard Faram, 39, exploited one woman for $4655, which was “over and above” the cost of the dog, claiming her husband needed surgery and she could not afford her rent.

In January 2021, Faram was pushing for a new law after her three-year-old son Lucas died when his ventriculoperitoneal shunt failed and an internal Townsville Hospital and Health Service report revealed the little boy would have survived had the health facility completed a CT scan.

Magistrate Bronwyn Hartigan said Faram traded on her son’s death

She jailed her for two years with parole release after serving six months. Convictions were recorded.

HERVEY BAY: JESSICA LYNNETTE TARBUCK

A neighbour was not happy when she discovered the woman next door Jessica Lynnette Tarbuck had claimed a Domino’s delivery that was not hers.

Jessica Lynette Tarbuck pleaded guilty in Hervey Bay Magistrates Court to one count of fraud.

The court heard the incident happened on May 4, 2022 when one of Tarbuck’s neighbour’s failed to receive their pizza delivery.

The neighbour contacted Dominos and was informed their order, worth $40, had been delivered.

As the delivery person arrived, Tarbuck had gone to meet them and collected the pizzas herself, the court was told.

Police were called and Tarbuck made admissions that she had taken the pizza and she’d known it wasn’t hers but did it anyway.

Tarbuck was receiving Centrelink payments and as a result of her offending, it was going to be “an expensive pizza”, lawyer Daniel Hunter said.

Magistrate Trinity McGarvie said it was dishonest offending, telling Tarbuck she didn’t know what impact her actions would have as she did not know about other people’s financial circumstances.

Tarbuck was fined $300 and a conviction was recorded.

HERVEY BAY: BRAYDEN ALEX COOPER

Security guard Brayden Alex Cooper did the opposite of the job he was paid to do when he stole from his employer.

Cooper pleaded guilty in Hervey Bay Magistrates Court to one count of stealing as a servant in June 2022.

The court heard Cooper had been employed as a security guard at a marine services business when he took items, including various tool sets, from an area that could only be accessed with a pass.

Eventually, as others noticed the items were missing, Cooper was confronted by a manager at the business.

When police spoke to him, he told them he had taken the tools to “do some woodwork”, the court was told.

Cooper admitted he had taken items without the intention of bringing them back.

After his offending was discovered, the items were returned, the court was told.

Magistrate Trinity McGarvie said Cooper had been an employee and a person trusted with the job of stopping people from stealing items from the business.

“You were employed in a very particular role of trust,” Ms McGarvie said, adding Cooper had been on a community-based order for a fraud offence when he stole items from the business.

Cooper was fined $2000 and a conviction was recorded.

BUNDABERG: DYLAN SCOTT McCAW

A father of two, busted with dodgy bank and identification cards, has fronted court just months after appearing on a string of other serious charges.

Dylan Scott McCaw pleaded guilty to seven offences including fraud (dishonest application of property of another), obstructing police, two counts of possessing dangerous drugs and three counts of receiving tainted property when he appeared before Bundaberg Magistrates Court in June 2022.

The court heard on March 25, 2022 McCaw received a debit card which he had reason to believe had been tainted and used it to purchase cigarettes.

On March 26, he received a Medicare card and licence which he had reason to believe was tainted and on that same day, he took off from police because he was on parole and did not want to go to jail.

When police caught up with McCaw, they uncovered small amounts of cannabis and meth.

It was further heard that McCaw had been sentenced over a “large volume” of similar offences on February 28.

However, Magistrate John McInnes said McCaw’s most recent list of offences was not “enormous” as the spree which landed him before the courts earlier in 2022.

Mr McInnes said McCaw had made some positive steps while on parole and some lapses into reoffending were “not uncommon” while going through rehabilitation.

McCaw was sentenced to one month in jail for each of the seven offences, to run concurrently, suspended for nine months.

TIN CAN BAY: LLOYD JOHN TREE

Tin Can Bay man Lloyd John Tree was jailed after it was revealed he scammed the federal government out of more than $330,000.

The 79-year-old pleaded guilty to five charges, including defrauding the commonwealth, giving false or misleading information in relation to an Australian travel document, and three charges of obtaining financial advantage by deception when he appeared in Gympie District Court in July 2022.

The court heard how Tree spent nearly two decades using a false identity to obtain a second passport and numerous government benefits.

Tree, who was 58 at the time, first assumed the identity of Russell Graham Tree in 1998, after the real Russell Tree died in Western Australia almost 50 years earlier in 1948.

The court heard Tree used the false identity to obtain a second passport, and proceeded to scam the government out of $337,313.77 in social security benefits, while already receiving social security benefits in his own name.

The court heard Tree even appealed a decision to reject a disability support pension application under the false identity during this time.

This continued for more than 18 years, until Tree was caught on August 20, 2019, while making an application for a new passport using his real identity.

The court heard he was undone with facial recognition technology from the Australian Passport Office, which launched an investigation.

He was arrested on October 1, 2019, aged 76.

The court heard Tree had already repaid $8973.30 in restitution.

He was jailed for four years, but will be released on parole on January 18, 2024.

A conviction was recorded.

HERVEY BAY: MARGARET JOYCE HULL

Margaret Joyce Hull, 67, pleaded guilty to two counts of fraud when she faced Hervey Bay District Court in 2022.

Hull had been an administrator at Richardson and Wrench since 1996, a real estate agency which was owned and operated by popular and prominent businessman Trevor Cecil.

But in 2010, after Hull informed Mr Cecil the business was in financial trouble, money was taken from 29 of the body corporate accounts managed by the business to help keep it afloat, the court heard.

The fraudulent transfers amounted to about $1.1 million and occurred over a period of about seven years, with some of the money used to keep the business afloat and some used for personal benefit.

The exact amount that Hull had personally benefited from was not known, the court heard.

In addition to the fraudulent funds, the court heard there had been a payment of $700,000 made to her account following Mr Cecil’s death. That payment was not the subject of any charges, the court was told, because it was not known what agreement she and Mr Cecil had.

The court heard the offending came to light after Mr Cecil’s death from a stroke on October 14, 2017. The last fraudulent transfer had been made out of a body corporate account the day before his sudden death, the court was told, at which time Hull had stopped offending.

Hull had no prior criminal history and was caring for her husband, who had ongoing health issues.

Judge Nathan Jarro said misplaced loyalty to Mr Cecil had seen Hull become involved in the fraudulent activities.

Hull was given a head sentence of five-and-a-half years in prison, and will be eligible for parole from October 27, 2023.

Convictions were recorded.

BRISBANE: RODERICK GEORGE HALLIGAN

Brisbane stockbroker Roderick George Halligan, who fraudulently fleeced his clients of millions of dollars, was sentenced to 11 years’ imprisonment in January 2023.

Halligan, 59, pleaded guilty to four counts of fraud and one of attempted fraud when he appeared in Brisbane District Court.

The court heard that between July 2008 and October 2020, Halligan had successfully defrauded two women clients of $1.2 million of stocks.

He attempted to defraud a third client of almost half a million dollars but failed, the court was told. The loss caused to the clients due to the increased prices of the shares was estimated to be far greater, with projections putting just one victim’s losses at up to $2.52 million.

The court was told Halligan had repaid some of the money he had fraudulently obtained but his victims were still owed significant amounts.

The court also heard Halligan went to extreme lengths to hide his crimes, including forging dividend statements and creating fake contracts, all while reassuring his victims their stocks were safe.

When his deceit was eventually discovered in 2020, he told one of his victims: “I thought this would come out one day but I didn’t think it would take this long”.

After being caught, he paid back $400,000 to one client between October and December 2020.

Judge Brad Farr SC noted Halligan had lost his marriage, career and home as a result of crimes but said his victims had also suffered significant losses, with at least one victim now suffering financial hardship.

Halligan was sentenced to 11 years’ imprisonment. He will be eligible for parole on September 23 2026.

TOWNSVILLE: ANTHONY VIVIAN DICK

Anthony Vivian Dick, a former financial adviser based in Townsville, took more than $1.1m from vulnerable clients’ superannuation and retirement funds over 11 years.

On 2 October 2020, Judge Julie Dick, sitting in the Queensland District Court in Townsville, sentenced the 55-year-old former Townsville financial advisor to eight years imprisonment with a non-parole period of two years and eight months.

The sentence followed pleas of guilty by Mr Dick to 11 offences of dishonestly applying clients’ funds to his own use contrary to s. 408C (1)(a) of the Criminal Code (QLD).

In his 2020, Townsville Supreme Court sentencing, the court heard that Dick had lied to customers, forged their signatures, disguised bank transfers and used blank signed documents to access superannuation, pension and savings accounts.

Dick’s crimes came to a halt as the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry approached, and handed himself in to investigators.

He was sentenced to eight years in jail.

In April 2022, Dick’s application to have his sentence appealed was quashed with a judge finding he had no “substance” to his argument.

Dick is eligible for parole from June 1, 2023.

CAIRNS: TONI MAREE BABICH

Cairns woman Toni Maree Babich, who defrauded her employer of $48,796, dissolved into tears after she was sentenced in Cairns District Court in June 2022.

Babich, 49, pleaded guilty to employee fraud.

The court heard she worked as accounts manager for Seeter Pty Ltd – trading as Great Barrier Reef Tuna – when between May 9, 2018 and September 11, 2019, she made direct debit payments and transferred the funds to her PayPal account, disguised as payment to suppliers.

The court heard the direct debits totalled $35,070 and other amounts were used for payments to her personal credit card, housing payments, Telstra bills and a Spotify subscription.

The court was told bank statements showed Babich holidayed at Peppers Resort in Tasmania and that she had a similar previous conviction involving $13,000 in 2001.

She had received three years’ probation for that offence.

Judge Dean Morzone sentenced Babich to three-years-and-three months’ imprisonment to be suspended after nine months, with four years’ probation.

IPSWICH: CINDY LEE KENNY

Ipswich gambling addict Cindy Lee Kenny, 50, who fraudulently obtained almost $140,000 from customers of her insurance company, also stole from a charity and a popular Brisbane private school, a court heard.

Kenny, from South Ripley, appeared in the Brisbane Magistrates Court via video-link from custody in October and pleaded guilty to stealing from women’s rights charity Zonta and fraudulently obtaining money from Brisbane school St Peters Lutheran College between June and August 2018.

The plea came a week after Kenny was sentenced in Rockhampton District Court for crimes she committed while company director of Eight Mile Plains insurance company OneSure.

She received a 4.5-year prison term, to be suspended after serving 15 months, for transferring nearly $140,000 of client funds into her own personal bank accounts. But OneSure customers were not her only victims.

The Magistrates Court heard how Kenny stole an additional $7580 from Zonta while acting as president of the Greater Springfield branch by, once again, transferring funds directly from the organisation to her own bank accounts.

Magistrate Julian Noud said the gravity of Kenny’s offending was aggravated by the fact she stole money from a charity that was no doubt intended for people who were in dire need.

She was also in a position of trust at the time.

He said her actions were “devious and despicable” and surely brought her great shame.

Kenny was sentenced to 12 months’ imprisonment for stealing from Zonta and three months’ imprisonment for the fraud against St Peters.

The sentences will run concurrently and with the sentence imposed by the Rockhampton District Court.

Kenny is to serve three months in prison before the sentence is suspended for an operational period of two years.

The time Kenny spent in custody between August 31 and October 18, a period of 49 days, was declared time already served under the sentence.

TOWNSVILLE: LESLEY-LEE HILL

Lesley-Lee Hill, 30, pleaded guilty to nine charges when she appeared before the Townsville Magistrates Court via video link from the Townsville Women’s Correctional Centre in May 2022.

Hill’s son Lucius Hure-Hill was one of four children killed when a stolen car crashed into a traffic light.

Four of the charges related to a November 2021 incident in which Hill used her twin sister’s identification to book and take a flight.

The charges were fraud; dishonestly gain benefit or advantage; obtain or deal with another entity’s identification information and false identification information; and constitutional flight offence.

The remaining charges related to the possession of drug paraphernalia and the operation of a motor vehicle while unsupervised after Hill was charged on February 24, 2022.

Hill was in possession of a pipe, a hypodermic syringe, clipseal bags and a spoon, and a knife on Fulham Rd, Pimlico, in addition to driving unsupervised while using a learner licence.

Magistrate Scott Luxton described Hill’s actions as “serious offences of dishonesty” before sentencing her to three months of imprisonment with convictions recorded for all offences.

“What is also relevant is you were subject to a suspended sentence imposed in this court on April of 2021. Two orders of suspended imprisonment were made on that date and both were for offences of dishonesty.”

Hill had already served 71 days of her sentence and will be released on parole on May 23, 2022.

ROCKHAMPTON: JENNIFER VON GLEICH

For about a quarter of a century, Rockhampton woman Jennifer Von Gleich used a false identity and elaborate stories to fraudulently obtain $377,279.41 in age pension payments.

Von Gleich, 76, was sentenced in Rockhampton District Court on June 24, 2022.

She had pleaded guilty on April 22, 2022 to one count each of defrauding the Commonwealth and obtaining financial advantage by deception.

Federal prosecutor Roman Micairan said Gleich used a false identity, which had been used by her late husband, to obtain age pension payments.

He said Gleich committed the offence between September 2, 1994 and March 21, 2019 while aged between 48 and 73 years old.

Judge Jeff Clarke noted that Von Gleich had provided a “raft of excuses and reasons” why that person wasn’t able to make personal contact with Centrelink.

Mr Micairan said the only reason Von Gleich’s offending ceased was because she got caught.

He said there was “no suggestion” her offending was carried out due to need.

He said Gleich owned three properties, including a house on Mount Archer, and had previously worked as a nurse and had an income.

Judge Clarke said Gleich provided a story that a stepson, who was an outlaw bikie, was benefiting financially from the money she was gaining and that she kept receiving the money after he left the country.

Defence barrister Jordan Ahlstrand said his client, who had no criminal history, had paid back $133,500 as of June 14, 2022 through monthly payments of $1500 to Centrelink.

Judge Clarke said Gleich’s offending was “born out of greed” and sentenced her to five years’ prison with a non-parole period of 18 months.

She was ordered to repay the Commonwealth of Australia $243,779.41.

IPSWICH: PETER MARK CULLEY

Businessman, acclaimed astrophotographer, and father Mark Peter Culley was sentenced to two years’ imprisonment after facing an Ipswich court in May 2022.

Culley was charged with defrauding $23,000 from a photographic organisation where he was both president and treasurer.

Ipswich Magistrates Court heard Culley, then 52, used Photoshop and other computer applications to forge bank statements and financial reports to cover his tracks.

He pleaded guilty to five charges including two counts of forgery and uttering related to bank statements, one count of fraud, and two counts of uttering a financial report.

The court heard the offending was carried out between June 2016 and November 2019, while Culley was a member of the Professional Photographers’ Association of Queensland.

The Ipswich dad defrauded the association of $23,180.63 over 59 transactions while in a “position of trust”, the court heard.

The court also heard Culley had a “relevant but dated” history, his offending was protracted, and he made concerted efforts – going so far as to forge financial documents – to hide evidence of his offending.

Culley, a photographer for more than 20 years, owned both Brisbane Jumping Castle Hire and a photography business.

While in positions of office, the court heard Culley had control of the association’s bank accounts and transferred more than $23,000 directly into his own personal and business bank accounts.

The court heard Culley used Photoshop and other computer applications to forge financial reports using other people’s names, including that of an accountant he had dealt with.

Magistrate Robert Walker described the means Culley used to “cover his tracks” as “devious”, and sentenced him to two years’ imprisonment, wholly suspended for the operational period of three years.

Culley was ordered to pay $23,180.63 compensation to the photography association.

Convictions were recorded.

BRISBANE: DECLAN JAMES MURPHY

Company director of three prominent building companies Declan James Murphy was sentenced to jail after he swindled $3.3 million from company accounts to feed his online gambling addiction.

Murphy faced the Brisbane District Court, charged with fraud in excess of $100,000 in March 2023.

Murphy had lived in Palm Cove, Cairns, and was the director of construction companies Mayford Contracting Pty Ltd, Mayford Carpentry Pty Ltd and HSEA Pty Ltd, between November 2011 and March 2019, the court heard.

He was in charge of payroll, bookkeeping and accounts, while his business partner managed staff, clients and materials.

According to the Mayford Contracting LinkedIn profile, the companies had ties with construction giants Laing O`Rourke, Lend Lease, Grocon Group, Sunland Group, Mainland, Brookfield Multiplex, Fleetwood, Hutchinson’s Builders, Condev, Cockram Constructions and Kane Constructions.

But after a falling out with a former accountant in 2014 following a $500,000 payroll audit, company finances took a dip, triggering Murphy’s chronic online gambling addiction, which eventually sent all three of his companies into liquidation.

He was found out by his business partner, who in May 2019, discovered 853 company transactions had been made to seven different online gambling accounts under Mr Murphy’s name including TAB, UBET, LuxBet and Sportsbet.

The court heard Murphy placed bets of up to $200,000 on races.

The gambling theft totalled more than $3.3 million over a three-year period and sent Murphy bankrupt and ended his marriage.

His business partner, who was also his close friend and godfather to his daughter, was left $1.2 million in debt and had his building licence cancelled for life, the court heard.

The Australian Securities and Investments Commission released a statement in 2022 revealing the three companies owed $10,739,423 to unsecured creditors, including $562,000 in employee entitlements and $5,216,904 to the Australian Taxation Office.

The court heard Murphy pleaded guilty to the fraud following negotiations with police.

Judge Ian Dearden said Murphy’s large transaction sums were “breathtaking” and sentenced him to 10 years’ imprisonment with a parole eligibility in two years and nine months.

Judge Dearden said his sentence was a “modest reduction” of the maximum penalty of 12-20 years.

Murphy’s 124 days spent in pre-sentence custody was counted as time served.

He will be eligible for parole on July 27, 2025.

ASIC banned Murphy from managing any corporation for five years.

BRISBANE SOUTH: JODY KIMARA WRIGHT

Former Brisbane childcare centre director and mother-of-nine, Jody Kimara Wright, who defrauded the business of $34,582, will spend four months in prison.

Wright, 46, was bankrupt when she stole the money from Nido Early School at Woolloongabba in 2020, using it to pay for her youngest son’s private school fees.

She pleaded guilty to defrauding the childcare centre of more than $30,000 when she appeared in Brisbane District Court in April 2022.

Judge Vicki Loury said Wright, who was director of the childcare centre, was responsible for submitting staff pay claims for wages.

Judge Loury also said Wright, who occasionally employed a daughter as a casual staff member, made it look, at times, like wages were being paid to the daughter.

However the daughter was not employed in the position for which the wages were paid and over eight months, in 18 transactions, the money was paid into an account Wright accessed.

The court heard the daughter was not aware of the fraud and is not accused of any wrongdoing.

Judge Loury said there was some sophistication involved in the fraud as Wright had to create a biometric account for the daughter, use a biometric reader and sign in for her.

Judge Loury said Wright offered to pay compensation when the fraud was uncovered, but the employer rejected that offer then and since then nothing had been repaid.

Wright was sentenced to two years’ jail, suspended after four months, operational for four years.

SUNSHINE COAST: DANIELLE DAWN DARBEN

Ex-medical student and serial fraudster Danielle Dawn Darben has continued to steal from strangers with her latest shopping spree totalling more than $1400.

Darben was placed on a suspended prison sentence in Maroochydore Magistrates Court in April 2022 after pleading guilty to five charges of fraud, four charges of stealing, three charges of possessing dangerous drugs and two charges of possessing utensils.

She was also charged with breaching her probation order and was therefore resentenced for her previous fraud matters.

The court heard police found the 37-year-old with 2g of methamphetamine, 4g of marijuana and a glass pipe at IGA Maroochydore on August 26, 2021.

Police then searched her backpack and found mail that had been stolen from Coastal Developmental Paediatrics, Sunstate Strata and Sunwest Construction on August 26, 2021.

Some months later in October, a victim was checking their NAB bank balance when they saw a transaction totalling $771 taken by the Catalina Apartments on Sixth Ave, Maroochydore.

The transaction was for rental of a room for three nights from October 31 to November 3, 2021. When Darben went to check in to the booking she had made at the apartment building, police met her there and arrested her.

The court heard that in January of 2022, Darben used a stolen credit card at a convenience store in Maroochydore spending $65.84, before booking a hotel room worth $410 online at the Cotton Tree Modern Apartments.

Darben also spent $90.96 at Chemist Warehouse and $65.65 at the BP in Kawana.

She was resentenced for one count of wilful damage, five counts of fraud, two counts of attempted fraud and other drugs matters.

Magistrate Matthew McLaughlin said the prior offending involved Darben using a credit card to buy items and vandalising letter boxes for a year.

Mr McLaughlin revoked Darben’s probation order and she was resentenced on the original charges as well as the fresh ones.

She received three months’ prison suspended for a year. Convictions were recorded.

IPSWICH: STEFANO HAMISI

An elderly Queensland woman was scammed out of $1 million when she tried to make a settlement payment on a property.

Ipswich man Stefano Hamisi, whose bank account the money landed in, was jailed for withdrawing $134,310 and spending it.

Hamisi pleaded guilty to fraudulently and dishonestly obtaining over $100,000 when he fronted Ipswich District Court in April 2022.

Judge Anthony Rafter said it was accepted Hamisi was not involved in the hacking and sentenced him to serve six months’ imprisonment of a two-year jail term.

The court heard the woman’s conveyancer’s email was hacked and the online criminals discovered the woman was yet to make a $1,054,392 settlement payment.

Crown prosecutor Matthew Le Grand said the hackers sent an email to the 84-year-old asking for the money to be deposited and included the bank details of a then 21-year-old Ipswich man Hamisi.

The court heard Hamisi received the money in September 2019, and transferred a sum into another account.

He was caught on CCTV in Redbank Plains making a number of withdrawals in the four days after the money was transferred.

Mr Le Grand said Hamisi initially told bank investigators that he knew about the money being there and assumed it was Bitcoin profits sent from a Dubai investor.

Judge Rafter said it was problematic and nonsensical to accept that Hamisi had no idea how $1 million landed in his account.

The court heard the bank was able to recover a large sum of the money although the woman was still out of pocket by $96,400.

GOLD COAST: KARTHIK PAPPU

A man who was part of a syndicate that allegedly stole identities before laundering millions of dollars through jewellers and a coffee shop left his fingerprints on a book with 71 pages of handwritten notes.

Karthik Pappu was identified by police investigating a cold calling scheme in which police allege that people gave victims provided offenders with access to their computers before being tricked out of money, a Brisbane court was told in September 2022.

The court heard the then 36-year-old admitted being part of the group that transferred money into accounts they opened using the details of 190 identity theft victims.

Police alleged money mules swiped bank cards associated with the accounts or conducted Apple Pay transactions at two jewellers and a coffee shop in Brisbane, but received no goods or services.

After the businesses received the funds, money, excluding a 20 per cent cut, was allegedly delivered to syndicate members.

Pappu was also involved in that aspect, once collecting $15,000 cash and delivering it to a Surfers Paradise, Gold Coast, property on the instruction of syndicate members in India.

Detectives found Pappu’s fingerprints on a book containing 71 pages of handwritten notes with information about 305 bank accounts and 68 compromised identities.

There were also phone SIM cards stuck in the book and photos of them on Pappu’s mobile.

In February 2021 Pappu made a credit card application pretending to be a person whose identity had been stolen.

After setting up Apple Pay linked to the National Australia Bank account a $7000 transaction was conducted at one of the jewellers.

Chief Judge Brian Devereaux said Pappu could be linked to the laundering of $562,490, but it was impossible to determine how much he made.

The total amount allegedly laundered by the syndicate during the 12-and-a-half months Pappu was involved was about $2.685 million.

Judge Devereaux said without Pappu’s plea of guilty to one charge of money laundering his role in the syndicate’s operations would call for a sentence of eight to 10 years.

The Indian national, who first came to Australia to study in 2005, then returned later before moving to Brisbane in 2018, is set to be deported after serving the time behind bars.

He will be eligible for parole on June 22 2023, after having been in custody for 462 days including 20 in the Brisbane watch house after his arrest in June 2020.

He is the first of four co-accused to have his case finalised.

BILOELA: NATHAN MICHAEL DAWES

A Central Queensland man has faced court after he admitted to being involved in an online drone selling scam.

Nathan Michael Dawes, 37, pleaded guilty in Biloela Magistrates Court on February 8, 2023 to fraud.

Police prosecutor Kelvin Boyd said the victim responded to an advertisement placed on Australian online marketplace Gumtree by Dawes on April 28, 2022.

Dawes advertised a drone for sale for $2000.

Mr Boyd said Dawes told the victim the drone “had just been sold” and the victim then offered to pay an extra $300 if Dawes sold it to him.

Dawes agreed and provided his bank details for the funds to be transferred to.

The victim made a cash deposit of $2300.

On May 4, the victim received a package in the mail from Dawes.

“The package contained a book and not a drone,” Mr Boyd said.

Mr Boyd said the victim received numerous other messages over the following days, but Dawes eventually stopped communicating with him.

Dawes was subsequently charged.

The court heard Dawes had stealing and fraud offences on his criminal history.

Dawes said he was willing to pay restitution.

Magistrate Philippa Beckinsale said with Dawes’ history, a term of imprisonment was appropriate and sentenced him to six months’ jail, wholly suspended for 12 months.

Dawes was ordered to pay $2300 restitution and a conviction was recorded.