Why Wide Bay real estate prices are still on the rise

House prices across the five Wide Bay Burnett regional areas are still climbing as the state’s property market continues a run dubbed ‘impressive’ by one industry expert.

Gympie

Don't miss out on the headlines from Gympie. Followed categories will be added to My News.

House prices across the five Wide Bay Burnett regional areas are still climbing as the state’s property market continues a run dubbed “impressive” by one industry expert.

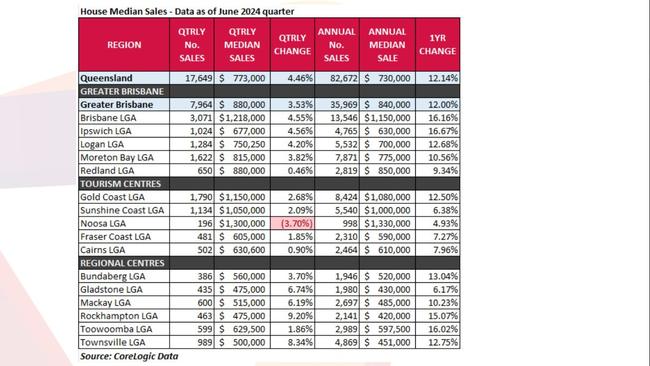

Figures released by the Real Estate Industry Queensland show the median sale price at all but one of the region’s council areas had risen in the quarter ending June 2024.

The highest three-month increase was in the South Burnett, where the median house price across the three months was $410,000.

This was up 9.33 per cent on the previous quarter.

Average prices across the year in the South Burnett were up 7.97 per cent to $367,114.

Gympie’s house prices are the highest of the five council areas, averaging $610,000 across the April-June quarter.

This was up 6.1 per cent.

The average price across the 12 months ending in June was $600,000, up 6.19 per cent.

Bundaberg’s median prices increased 3.7 per cent bringing its quarterly average to $560,000.

Its 12-month average was $520,000, up 13.04 per cent.

The Fraser Coast’s increase for the quarter was a more modest 1.85 per cent, with prices averaging $605,000, although its yearly jump was 7.27 per cent thanks to a median price of $590,000.

The only drop in the region was recorded in the North Burnett, where prices dipped by 1.92 per cent across the quarter to $255,000.

However, this figured was derived from a lower number of sales than in other areas.

The North Burnett’s median across the year was up 9.22 per cent to $245,750.

Queensland’s average median price rises were 4.46 per cent for the past quarter, and 12.14 per cent for the year.

Inside boutique wedding ‘barn’ to open in Noosa hinterland

Damning report reveals cost of fixing bloody Bruce Hwy

The median quarterly price across Queensland was $773,000, and the 12-month average was $730,000.

REIQ chief executive Antonia Mercorella said in a media release accompanying the figures the excitement around Brisbane’s development and future was having a run-on effect.

“The optimism for our capital city is contagious, creating a ripple effect right across the state – great news for all Queenslanders,” Ms Mercorella said.

The robust price increase was however countered by another issue in the market: A widening deposit gap.

“In Queensland, a 20 per cent home deposit for a first home now represents 1.64 times the average annual earnings,” she said.

“With the annual median house price in Brisbane now $1.15m, the median deposit is now $200,000, putting the dream of home ownership out of reach for many.

“High rental costs make it incredibly difficult for individuals to save for a home purchase, and when you also factor in the additional costs of stamp duty, potential lender’s mortgage insurance, and other buying costs, the prospect of owning a home can seem impossible for first home buyers.

“The REIQ has proposed several measures to the Queensland Government to help homebuyers overcome this significant deposit gap in our recently launched state election policy platform.”

Cost of living challenges were hitting young people trying to enter the market hard, too.

“The data shows that all age brackets from 20 to 44 are seeing a deterioration in their savings by at least three per cent,” Ms Mercorella said.