What Federal tax changes mean for Wide Bay, Hinkler voters

An Australian Institute public think tank report has revealed that Wide Bay and Hinkler taxpayers will be footing the bill for tax breaks given to richer parts of the country. Read what it means for you and your hip pocket.

Gympie

Don't miss out on the headlines from Gympie. Followed categories will be added to My News.

A new report published by the Australia Institute public think tank has questioned why the National Party is supporting controversial tax changes the AI claims will leave regions like Wide Bay and Hinkler worse off.

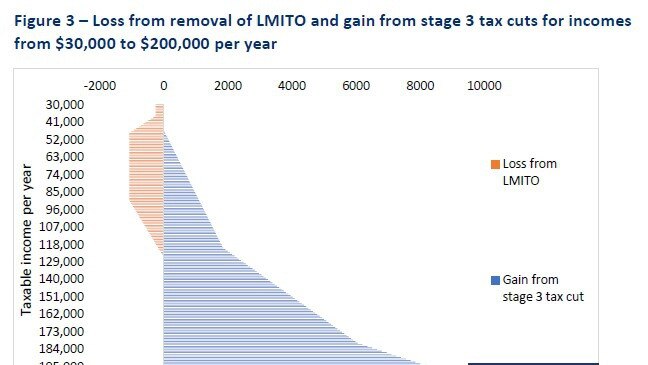

The report, published by economist Matt Grudnoff, breaks down which Federal electorates stand to gain and lose the most under looming changes to the Lower- and -Middle-Income Tax Offset and Stage 3 tax cuts.

“While Liberal Party electorates in the major capital cities will have the larger proportion of taxpayers getting the greatest benefit from stage 3, the rural National Party electorates will see large proportions that get no benefit at all,” Mr Grudnoff says.

The LMITO is due to end on June 30, 2022, with the last refunds to be paid out in the 2022-23 financial year.

It provides a tax cut of up to $1080 for eligible residents.

Mr Grudnoff said its scrapping would result in “90 per cent of taxpayers paying more tax”.

The 2024-25 financial year is expected to herald the Federal Government’s Stage 3 tax cuts “which mainly go to high income earners”.

Mr Grudnoff’s saaid that according to 2018-19 taxation statistics, the Wide Bay, represented by National Party MP Llew O’Brien, had the third highest proportion of residents earning less than $37,000 per year, at 49 per cent.

Hinkler, represented by National’s MP Keith Pitt, placed sixth, with a rate of 47 per cent.

Mr Grudnoff’s said it was easy to understand why the Liberal Party was in favour of the changes, but less the Coalition’s “junior partner” as “those getting no benefit from the stage 3 tax cuts are more likely to live in National Party electorates in poorer rural electorates”.

Mr O’Brien declined to comment on Mr Grudnoff’s claims.

“I don’t comment on reports about budget speculation but I expect the Government to deliver a tax plan in its 2022 budget that is fair and contemplates current economic circumstances,” Mr O’Brien said.

Mr Pitt had not replied by deadline.

The report said the National Party-held rural seats would be the ones with the least to show from the changes.

“The LMITO will benefit middle income earners who are more likely to live in Labor electorates on the edges of the large capital cities,” Mr Grudnoff’s report said.

“The stage 3 tax cuts are most likely to benefit high income earners who live in Liberal electorates in the wealthy areas of Australia’s largest capital cities.”

“With the LMITO benefiting more people than the stage 3 tax cuts, one might expect in a representative democracy that the LMITO would be preferred.

“But with the National Party’s support, the Liberal Party can cut taxes for taxpayers who are more likely to be in their electorates and raise taxes on people who are less likely to be in their electorates.”