Hottest property in Qld revealed: 50 per cent hike in a year

Home values have soared in one Qld suburb by almost 50 per cent in 12 months with homes on the market for just 11 days – the fastest in the state. SPECIAL REPORT

Central Queensland

Don't miss out on the headlines from Central Queensland. Followed categories will be added to My News.

Home values in one Rockhampton suburb soared almost 50 per cent last year as the region recorded an overall 23.6 per cent rise to be the hottest property market in the state.

The Real Estate Institute of Qld report for December shows the Rockhampton Region median price for 12 months was $476,000 from 2179 sales while sales in the December quarter recorded a median price of $525,000 based on 452 sales.

The top performing suburb for the 12 months was Rockhampton City which almost leapt by half its previous price with a 48.9 per cent surge to $350,000 based on 78 sales while West Rockhampton climbed 39.1 per cent to $462,000.

Other standouts were Koongal with a 33.8 per cent spike to $440,000, Park Avenue surged 32.9 per cent to $426,000 while Berserker’s annual increase was 30.4 per cent to $390,000.

The fast growing town of Gracemere shot up 26.9 per cent to $495,000 based on 404 sales while Depot Hill rose to $260,000 (54 sales) after a rise of 26.8 per cent.

REIQ Zone Chair Noel Livingston said investors across Australia had zeroed in on the Rockhampton market.

“We’ve been the bull’s eye on the dartboard and the main action was up to about $600,000,” he said.

“We had a lot of interest from buyers’ agents from Sydney because our (rental) yields were as good (over 5 per cent) as you would find anywhere up to about that point.

He said there was significant competition between investors and first home buyers which was forcing the steep price rise.

“You’ve got all these people investing in that area in competition with the first home buyers and that really had an effect on those medium priced figures. Once you got above that figure, the market was still strong, but you are more restricted to local buyers, people coming into the area or people upgrading from that bottom part of the market.

“So it was still affected by that, but it was like it was a two-paced market. It was a 100 miles an hour up to $600,000 and then only 80 to 70 miles an hour above that.”

The median days for houses on market for the 12 months was just 11 days, which was the fastest selling rate in the state and almost half the 20 days recorded in the previous 12 months to December 2023.

Mr Livingston said there was no signs demand had slowed in the first three months of 2025 with job growth from a strong pipeline of major projects either underway or in planning and development stage in Central Queensland.

“There’s a lot of people coming to Rockhampton (job opportunities) and we’ve got significant housing shortages in the rental market (vacancy rate under one per cent),” he said.

“I did a tour of the Alliance Airlines operation at the Rockhampton Airport the other day and they’ve got a lot more people coming.

“Some of these (major projects) are going to have to look at worker camps and things like that as a way of housing their workers, their workforce, particularly those involved in the ($1.7 billion) Rockhampton Ring Road and those sort of projects.”

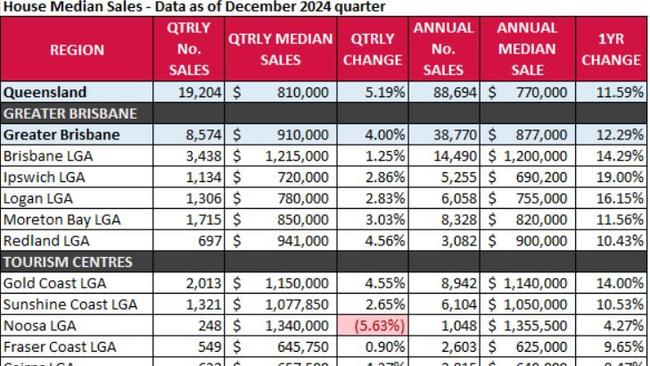

REIQ CEO Antonia Mercorella said while Brisbane’s median house price had crept up by a modest 1.25 per cent, the largest gains were scattered across the Sunshine State.

“What is evident from the data is that the growing local economies of areas such as Ipswich, Moreton Bay, Logan, Toowoomba, Townsville, Rockhampton, Gladstone and Mackay, among other regional areas, are sustaining strong housing markets,” she said.

“It also suggests that demand is gravitating towards more affordable housing, as people search for value outside of the capital city, a trend further supported by stronger price growth in Brisbane’s surrounding regions.”