Liquidator says it’s unlikely former pub owner will repay $200k+ owed to creditors

A Gold Coast company directed by a self-proclaimed psychic has folded with more than $200,000 owed to staff and creditors of a popular Biggenden pub.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The former owner of a popular Burnett hotel has gone bust with more than $200,000 owed to staff and creditors.

Australian Hoteliers Pty Ltd, a Gold Coast-based company that owned Biggenden’s Commercial Hotel, was declared insolvent by the Supreme Court of Victoria in October 2023.

The company, run by mother and daughter directors Rahni Newsome and Kristi Horvath, opened the Commercial Hotel in May 2021 and sold it to the current owners in August 2022, after which they took over the Royal Oak Hotel in Cessnock, New South Wales.

Ms Newsome’s LinkedIn profile states she is a former head of digital strategy at Australian Radio Network, is currently a freelance digital consultant and senior digital product manager for life insurance firm MetLife Australia.

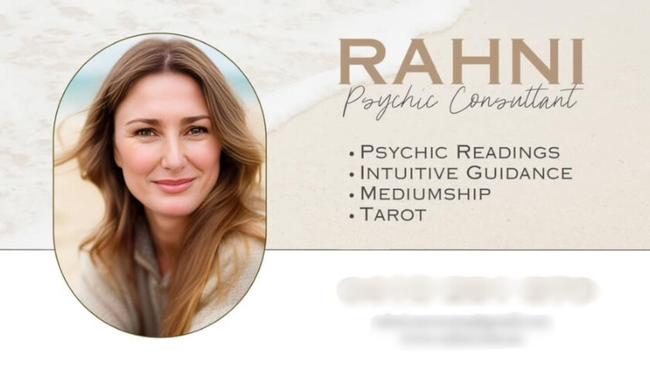

She has also advertised her services as a psychic consultant on social media.

As detailed in the report to creditors issued by liquidator PCI Partners in January 2024, Australian Hoteliers was unable to generate a profit from either business and made a payment to the landlord of the Cessnock hotel to secure an early release from the five-year lease in February 2023.

The liquidator’s investigations revealed $217,022.23 was owed to creditors, including $98,898 to short-term business lender On Deck Capital Australia Pty Ltd, the plaintiff in the Supreme Court action that precipitated the liquidation.

Other debts include $69,350 in unpaid taxes and outstanding superannuation payments owed to former employees totalling $26,949.

Stephen Mitchell, the agent handling the liquidation for PCI Partners, said the failure of Australian Hoteliers was due to losses incurred by both hotels, and the directors had not made any meaningful progress towards paying their debts and the costs of liquidation.

It is unclear as to whether the employees owed superannuation, who were treated as priority creditors and will be repaid should sufficient funds be raised through the liquidation, worked at the Biggenden or Cessnock hotels or both businesses.

Apart from the former employees, Mr Mitchell indicated it was unlikely other creditors would be repaid given the age of the debts and the cost of any recovery action outweighing the financial return to the liquidation.

“At this stage of my investigations, I consider it unlikely that sufficient recoveries will be made to enable a dividend to be paid to creditors,” Mr Mitchell said.

Following his review of the company’s “limited” books and records, he said Australian Hoteliers may have traded whilst insolvent, potentially making the directors personally liable for the company’s debt under the federal Corporations Act.

MORE NEWS: Spotlight scammer: Bus driver’s cunning click and collect trick

Further investigations will determine whether the insolvent trading claim is viable, which may need to be funded by the creditors.

Mr Mitchell said the liquidation was expected to be completed by the end of 2024, and called for any other outstanding creditors to contact him with proof of debt by February 12, 2024.