Energy firm gives Bundaberg Biohub 8-month extension on $6m debt repayment

Construction of a biofuel-powered industrial park on the banks of the Burnett River has come close to collapse due to construction delays and a spiralling $6million debt, but a new agreement has now been reached.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Construction of a much-vaunted biofuel-powered industrial park in east Bundaberg will begin after a two-year delay due to the developer’s failure to repay a $6million debt owed to its construction partner.

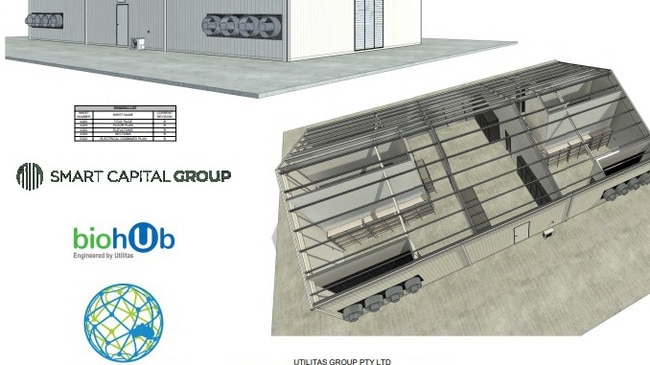

The decommissioned East Bundaberg Wastewater Treatment Plant was acquired by bioenergy developer Utilitas Group from Bundaberg Regional Council in February 2020.

MORE NEWS: Farmers warn new rules could force up fruit, vegie prices

Utilitas Group, now trading as Bundaberg Biohub Pty Ltd, is chaired by former federal Labor MP for Oxley Bernie Ripoll and has established a biogas refinery in the Hunter region of NSW in addition to biofuel projects with Sunshine Sugar.

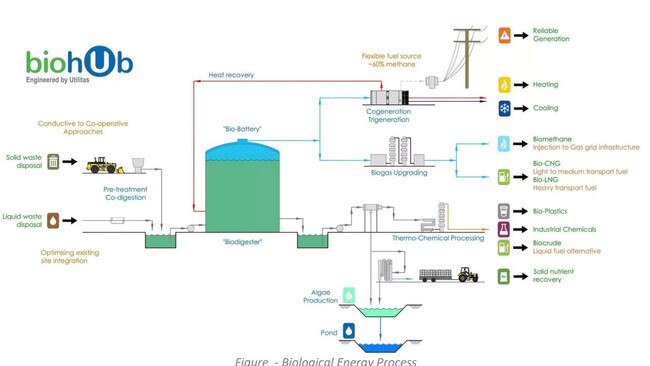

Bundaberg Biohub paid council $183,636 for the 3.8ha site on the banks of the Burnett River, with plans to establish an industrial park fuelled by a biogas refinery converting organic waste including from the nearby Bundaberg Rum Distillery and surrounding agriculture into green energy.

Speaking at an October 2020 event calling for expressions of interests for tenants to occupy the facility, Bundaberg Mayor Jack Dempsey said the Biohub project will see Bundaberg become “the bio-manufacturing capital of Queensland and Australia”.

Soon after lodging a development application for a data centre in January 2022, Bundaberg Biohub announced it had received $5.2 million in construction funding from embedded electricity provider Locality Planning Energy Holdings Limited.

Key to the arrangement with LPE was the latter’s links to cryptocurrency mining firm Stak Mining, the first tenant at the Bundaberg site, with LPE director Kathryn Giudes also sitting on the board of Stak Mining.

In its 2022 financial report LPE detailed terms through which the $5.2 million investment would be repaid by Bundaberg Biohub by October 2022, with Stak Mining expected to commence operations in that month.

However, in its 2023 annual report released in October, LPE said the repayment remained outstanding, and it expected the full debt including principal and 15 per cent interest to be repaid by the end of the month.

With the debt still outstanding at the end of 2023, LPE issued a statement on January 5, 2024 detailing an extension of Bundaberg Biohub’s repayment deadline to June 28 after receiving $230,000 as pre-payment of the Q1 2024 interest.

LPE said it would commence construction work on the facility in the first half of 2024, secured by a double mortgage on the former wastewater plant.

LPE Chairman Justin Pettett said the Q1 pre-payment and progress towards operationalising the Biohub facility meant the LPE board was “optimistic” that the debt would be fully repaid by mid-2024.

MORE NEWS: Health service investigates ‘metal’ found in Maccas ice cream

“The board has taken a flexible and pragmatic approach towards working with Bundaberg Biohub in order to secure a realistic pathway to ensure the $6.1m total debt is fully repaid together with the 15 per cent annualised interest rate,” Mr Pettett said.

Bundaberg Biohub and Stak Mining were contacted for comment.