Brisbane flood insurance jumps up to 10 times after alarming new Council maps

Homeowners across Brisbane have been slugged with massive insurance rises, some up ten times what they had been paying, after the release of new council flood maps.

QLD News

Don't miss out on the headlines from QLD News. Followed categories will be added to My News.

Brisbane homeowners are being slugged up to $32,000 for home insurance, with new council flood maps being used by insurers to hike up prices, even for houses that have never been inundated with floodwaters.

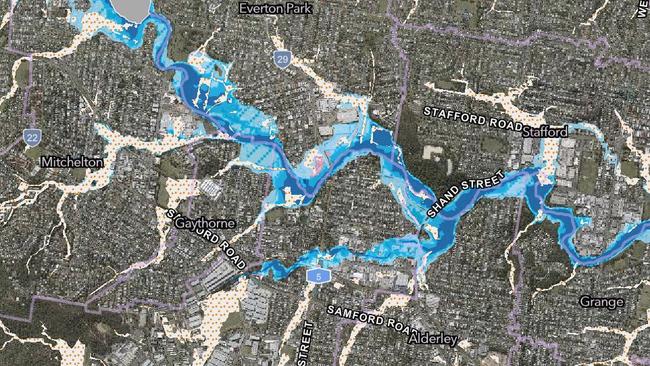

A large section of Cheviot St in Grange, on the city’s northside - where former Broncos captain Darius Boyd and his wife Kayla last month sold their home for $4.55m - is now considered within a 1:2000 flood event boundary, despite only minor problems at a few houses in the 2022 and 2011 floods.

One homeowner on the street learned of the new mapping only after their insurance went from $3000 to $32,000.

Another Cheviot St buyer, who declined to be named, said he faced a $12,000 bill once his new build was finished, up from an estimate of about $2000 last year.

“We put a contract on a 1950s house in September which we knocked down, but then we heard about the new flood map in December — a cheeky little Christmas present,’’ he said.

“The government has got an inquiry on where one recommendation is to stop people from being allowed to opt out of flood cover.

“Some insurers refuse to touch this street. QBE was a favourite along here but they won’t look at it now.

“Council is very quick to blame the insurers, but they’re just going off the data Council and the State Government are generating.

“This is after Council actually lowered our risk by widening and dredging Kedron Brook and even putting in different plants to slow down the flow and let the water spread out.

“That addresses the big risk here which is short, intense downpours.’’

Residents from across the city are reporting similar insurance blowouts - some up to 10 times what they had been paying - off the back of the new Council flood maps, with many homes that have never flooded now included in one of the doomsday once-a-millennium climate change scenarios.

It comes as insurance complaints across Australia have skyrocketed and insurers claw back to profitability after a horror year in 2022 due to natural disasters.

Suncorp, for example, recently posted a $1.19 billion full-year profit and 13.9 per cent jump in premiums on the back of a lower than expected natural catastrophe budget.

Another northside woman says she found out on the day she settled on a house - which she planned to knock down for a new build - that it was on Brisbane City Council’s latest online map — and only after a neighbour texted her.

“I freaked out. It came as a real shock,’’ the woman, who does not want to be identified, said.

“The buyer’s agent and solicitor I used found nothing in their searches.

“When I did some digging I was told this map came out the week before December, but people are only finding out now their insurance policies are up for renewal.’’

Jon Marshall from Salisbury, on the city’s southside, said he and his neighbours also became aware they were on the map only after receiving their latest insurance bills.

“I was paying monthly. It went up from $400 a month only two years ago to $800 — $10,500 a year,’’ he said.

“I simply can’t afford that and switched to Allianz, which let me drop flood cover. Without that they would have charged about the same.

“A lot of others (insurers) wouldn’t allow me to drop flood cover, or refused to cover me at all.’’

Dr Marshall, ironically a freshwater ecologist, said Rocky Water Holes - near his property - had not even reached within 25m of his house in 2011.

Since then a Council backflow valve had kept water levels more than 100m away in the 2022 flood.

“When a neighbour in a lowset house closer to the creek pulled up their lino, they found newspapers lining it from 1963 which had no water damage,’’ he said.

“But now my property (is deemed) a high likelihood of creek flooding, five per cent in any year, and I’m highset on stumps. It’s ridiculous.’’

One of his neighbours, who declined to be named, said despite her home never flooding since she bought in 2006 the flood component of her RACQ premium went from $1209 to $3400.

“RACQ told me it was because of the flood mapping,’’ she said.

Other insurers quoted her up to $8363 while GIO, Youi and Budget Direct all said they would not insure her at all because of her location.

An elderly couple in Yeronga who specifically bought in an area not mapped as floodprone also found out recently they were now inside the new flood boundary after investigating when their premium doubled.

At Indooroopilly a family was told recently they would have to raise their house 1.8m, after already spending a fortune on flood resilience.

Councillor Steve Griffiths, whose ward covered low-lying parts of Salisbury, Oxley and Rocklea, said it was unacceptable that ratepayers had not been alerted to the changed mapping.

“It smacks of secrecy. The first anyone realises something has happened is when they’re hit with a big insurance rise,’’ he said.

But Council said flood mapping was regularly updated to raise awareness of potential future risk and help people better prepare.

Council Environment and Sustainability chair Tracy Davis said allegations insurers were attempting to “exploit minor flood mapping changes’’ were very concerning.

“It doesn’t pass the pub test that residents are being quoted these massive insurance premiums when their updated flood risk is as low as a 1-in-2000-year event,’’ she said.

“A map flagging a property may flood once every two thousand years simply doesn’t have the detail required to justify up to a tenfold increase in insurance premiums.’’

Brisbane City Council was now writing to the Insurance Council of Australia to express concerns its flood awareness maps were being exploited to increase premiums.

An ICA spokeswoman said it encouraged customers to shop around to find a policy that best suited their needs.

“The Insurance Council has long advocated for a consistent and accessible national database that provides a clear overview of current and future extreme weather risk,’’ she said.

An RACQ spokeswoman said premium increases were industry-wide and reflected increased frequency and severity of weather.

“Every RACQ Home and Contents Insurance policy covers loss from storm, flood, hail, fire and theft,’’ she said.

“This creates certainty at claim time. RACQ does not permit exclusion of flood.

“RACQ calculates insurance premiums for our members on an individual basis that more accurately determines our members’ likelihood to lodge a claim and how large that claim may be in the future. We believe this is the fair thing to do.’’

It used a range of sources to price for flood risk, including the National Flood Information Database, but conceded “no model was perfect’’.

“All flood models rely on access to up-to-date information which can include council flood maps,’’ she said.

“No two flood events are the same, which is why the risk determined by the model is not necessarily the same as where flooding has occurred in the past.

“It is also possible a property previously subject to flooding will not be rated as higher risk in the model.’’

A Suncorp spokeswoman said its premiums were calculated on a “comprehensive assessment’’ of risk factors.

“We consider a range of factors such as geographic location, construction type, building foundations, age and flood mapping data,’’ she said.

“We endeavour to have the most accurate and up-to-date information for pricing flood risk by utilising our extensive claims history along with hydrological studies.

“All our home insurance policies include flood as standard.

“To moderate premiums in the long term and help customers recover and reduce future losses from flood, we need to see action from all levels of government to improve mitigation and resilience.

“Initiatives like the Queensland Government’s Resilient Homes Fund is a great example of where government investment can help support property raises, retrofits, and buybacks.

“To further enhance flood resilience, we also need increased investment in data collection and analysis for all natural perils. This will enable us to identify flood-prone areas, support targeted mitigation measures and prevent future development in high-risk communities.’’

Lord Mayor Adrian Schrinner announced after the 2022 flood that council would update its online mapping at least once a year, before the summer storm season, to help residents better understand their property’s risk level and to prepare.

A Senate Select Committee on the Impact of Climate Risk on Insurance Premiums and Availability held a public hearing into the issue in Brisbane earlier this month.

The committee was due to present its final report by November 19 after submissions closed last month.

A recent Actuaries Institute report found that one million Australian households were currently experiencing extreme home insurance affordability pressure, with premiums in excess of four weeks of gross income.

One in nine had reduced their overall coverage and one in 20 people had been told by their insurance provider that they could not be insured.

The Australian Financial Complaints Authority this month said complaints about general insurance were at a record high, increasing 4 per cent in the year to June on top of a 50 per cent jump last year.

The Financial Rights Legal Centre has recommended the Federal Government create a standing General Insurance Pricing Monitor to address large price rises.