Housing affordability such an issue, experts say apartments will next to surge in price

Housing affordability in Brisbane’s inner ring is such a problem, experts predict the stagnant apartment market will surge.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

Apartment prices are tipped to surge as owner-occupiers and investors, priced out of Brisbane’s overheated housing market, turn to more affordable options.

Experts have warned of a seismic shift from the dream home to the dream apartment within a 5km radius of the CBD as median house prices across Brisbane hurtle skywards.

House prices have increased at such a rapid rate that homeowners in Brisbane’s most popular inner suburbs are raking in up to $50,000 a month in capital gain.

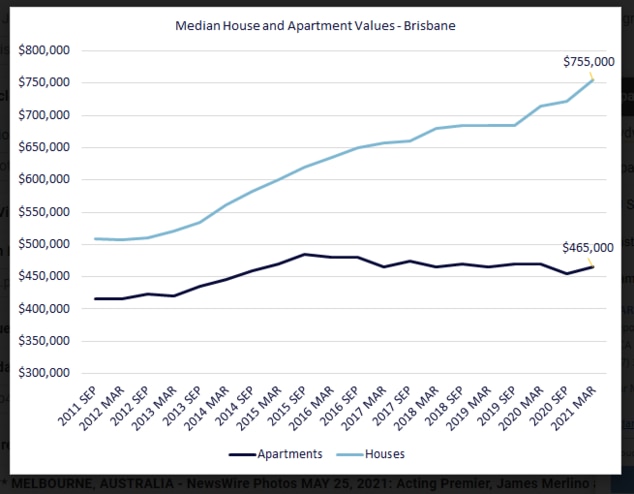

The unit sector is now wide-open for shrewd investors to cherry pick quality Brisbane apartments with the disparity between the median price for houses ($755,000) and a unit at a record 47.5 per cent, according to the latest Place Advisory data.

CoreLogic figures released this week show Brisbane house prices rose 2.2 per cent in May and 6.8 per cent over the past quarter.

Yet, unit prices have flatlined from a record high median of $485,000 in September 2015 to $465,000 in March.

In 2001, there was just a 15 per cent gap between Brisbane’s median house price ($219,000) and units ($190,000).

The downturn in pricing has been blamed on a glut of apartments coming onto the market in 2016 as part of the Brisbane City Council’s Urban Renewal Plan, says Place Advisory director of projects Syd Walker.

The gulf is extraordinary but not without reason and it will not last, he said.

“The gap should be somewhere between 20 to 30 per cent, between a house and apartments that are owner-occupier stock,” Mr Walker said.

He said the market was swamped with one-bedroom and, to a lesser extent, two-bedroom apartments five and it completely steamrolled the market with an oversupply of units.

Demand also punctured following a Royal Commission into banking and a decline in Asian investors, he said.

“The apartment market has been hammered over the last four or five years because there was an oversupply of one-bedders,” Mr Walker said.

“We are very much approaching a tipping point and now’s the time to be looking for an apartment and getting in on the ground floor before it takes off.”

He expects the resurgence in the apartment market to be swift and boosted by rising construction costs that will push up the asking price for new builds.

“The cost of new units coming onto the market is increasing and that will help push up the price of older units,” he said.

“If the market reacts in the same way it has for houses, it will happen within 18 months.”

The number of new builds is expected to rise sharply following a 35 per cent increase, year-on-year, in multi-level building approvals across Greater Brisbane.

There have been 6,929 approvals for unit complexes over the 12 months until March 21 compared with 5,134 in the previous year, according to Master Builders Association (MBA) Queensland data.

MBA policy and economics manager Dyan Johnson said the unit market had “benefited to some extent” from the federal government’s HomeBuilder scheme.

“Things are definitely pulling through for units which is encouraging,” said MBA policy and economics manager Dyan Johnson.

“They have to some extent benefited from HomeBuilder but not quite to the same extent as houses.

“Units have been struggling for a long time and I think we have reached the bottom of the market.”

Among the developments that have been approved, or under construction, are the plush residences within the Queen’s Wharf project in the CBD, Quay Waterfront, Newstead and Rivello, Hamilton.

Between the three premium sites, there are some 950 apartments with plenty of owner-occupier, two and three bedroom stock among them.

Market researcher Kent Lardner said there had been a notable shift in buying patterns across the east coast towards units because of housing affordability issues.

“They are going to rise, but I don’t know if the gap between houses and unit prices will close that much,” Mr Lardner, from SuburbTrends.com, said.

“I’ve seen a uniformed shift in demand across the unit market because of the affordability issue with houses.”

Crunch-time for owner-occupiers and investors being priced out of the housing market is nigh said Mr Walker, especially for those wanting to live within five to 10km of the CBD.

He said that would put upward pressure on three bedroom apartments, especially those with two car spaces.

“Owner occupiers are returning to the apartment market and we’ve got a big demand for three bedrooms, two-cars units because there is just not the supply out there,” Mr Walker said.

“All the signals are there and it’s the inner and middle rings of Brisbane that will take off.”

Brisbane Median: House / Apartment – disparity

2001: $219,000 / $190,000 – 15.2 per cent

2015 (Sept): $620,000 / $485,000 – 24.4

2021 (March): $755,000 / $465,000 – 47.5

Brisbane Apartment Developments:

Complex (Developer) Suburb: Apts -priced from – stage / cost to build

Queen’s Wharf Residence (Far East Consortium), CBD: 667 – 1br $550,000, 3br $1.85m – Open 2023 / $3.6bn (total build)

Albion Exchange (Geon Property), Albion: 253 – 1br $420,000, 2br $590,000, 3br $850,000 – Approved / $750m

Quay Waterfront (Mirvac), Newstead: 143 – 1br $382,000, 2br $672,500, 3rb $1.305m 4br $2.925m – Selling / $180m

Skye Apartments (Pikos Group), Kangaroo Point: 68 – prices not available – Approved / $200m

Waterfall (ARIA), South Brisbane: 216 – prices not available – Approved / $150m

Rivello (Brookfield), Hamilton: 150 – 1br $405,000 to sub-penthouse $1.995m – Selling / $144m Opens Late-2023

‘108 Lambert Street’ $350m (Pikos Group), Kangaroo Point: 273 – prices not available – Approved /TBA

600 Coronation Dve (Consolidated Properties Group), Toowong: 250 – prices not available – Planning

The Aviary (State Development Corp/White & Partners), Toowong: 145 – prices not available – Approved / $450m

The One (Shayher Group), CBD: 468 – 1br $518,000, 2br $677,000, 3br $2.143m – Selling / $300m

433 Queen St (Cbus Property), CBD: 264 – 1br $730,000, 2br $1.17m, 4br $2.55mn – Selling / $375m

Francis Apartments at Greville (Cedar Woods), Wooloowin: 58 - upwards from high-$300,000 – Launch mid-2021 / $180m Opens mid-2023

Yeerongpilly Green (Consolidated Properties Group), Yeerongpilly: 101 – 1br $450,000 to penthouse $950,000 – Selling / $850m Opens early- 2023

*total build of project