Budget Analysis: Debt no longer a dirty word

Queensland is borrowing big to fund the effort to claw us out of recession. But in some ways we’ll still end up behind other states, writes Steven Wardill.

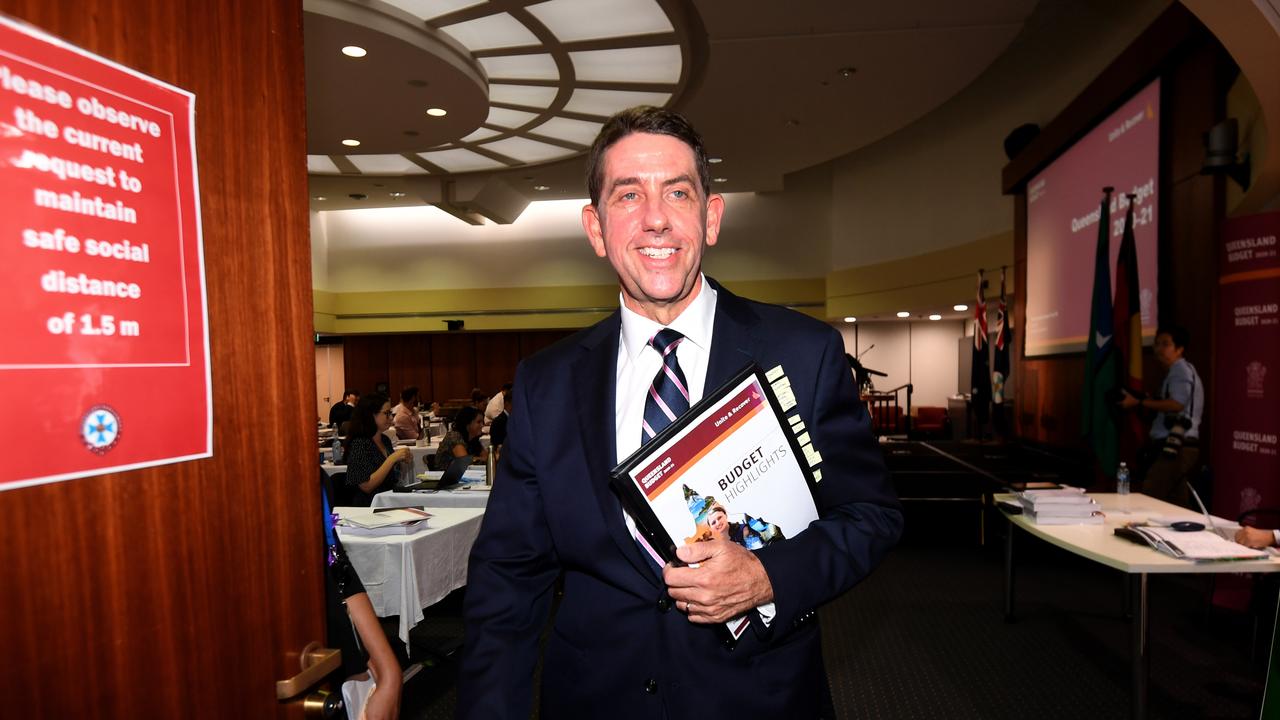

Debt, it seems, is no longer a dirty word.

Treasurer Cameron Dick is borrowing big to fund the re-elected Palaszczuk Government’s effort to claw Queensland out of recession.

The Sunshine State’s debt bill will hit almost $130 billion in four years’ time, well in excess of the $92 billion that Dick’s predecessor Jackie Trad was forecasting for a year earlier.

The radical increase in borrowings will help fund the $16.8 billion in deficits that the Government will chalk up this term as well as Labor’s $4 billion worth of election sweeteners.

Yet as Dick rightly observed, there’s never been a better time to borrow, with interest rates at record lows and the Reserve Bank not expected to budge any time soon.

The Treasurer revelled in pointing out that Queensland’s gross debt would still be much lower than New South Wales and Victoria in four years’ time, with both those states to have a borrowing bill of around $190 billion.

“To do anything other than borrow to rebuild would condemn our economy to years of austerity and a far slower and more painful recovery,” Dick insisted.

However, the problem with that argument is that Queensland’s recovery is still forecast to be slower than those states that Dick likes to compare us with despite opening our economy quicker.

From 2021 when a COVID-19 vaccine will be available, Queensland’s gross state product will trail behind Victoria every single year, an embarrassing outcome for a state which prides itself as Australia’s economic growth leader.

And by 2024, Queensland’s jobless rate will continue to lag behind both NSW and Victoria.

Those southern states might be borrowing more but they are achieving more for their economies.

And they can do it because they entered the COVID-19 pandemic in a far better financial state than Queensland.

Both have a AAA credit rating where Queensland’s was lost years ago, making borrowing more expensive.

They’re spending much more on infrastructure than Queensland to prime their economies.

Yet still their debt interest payment as a proportion of revenue remains around the same as the Sunshine State.

Queensland’s problem is that it’s hampered by an escalating public service bill.

While our population forecasts have been slashed, state employee costs will still hit $27.8 billion in three years’ time.

Dick could have borrowed more to build more but it would have left Queensland at risk of another credit downgrade.

Debt might not be a dirty word any more but Dick would be if Queensland morphed into a second-class economy.