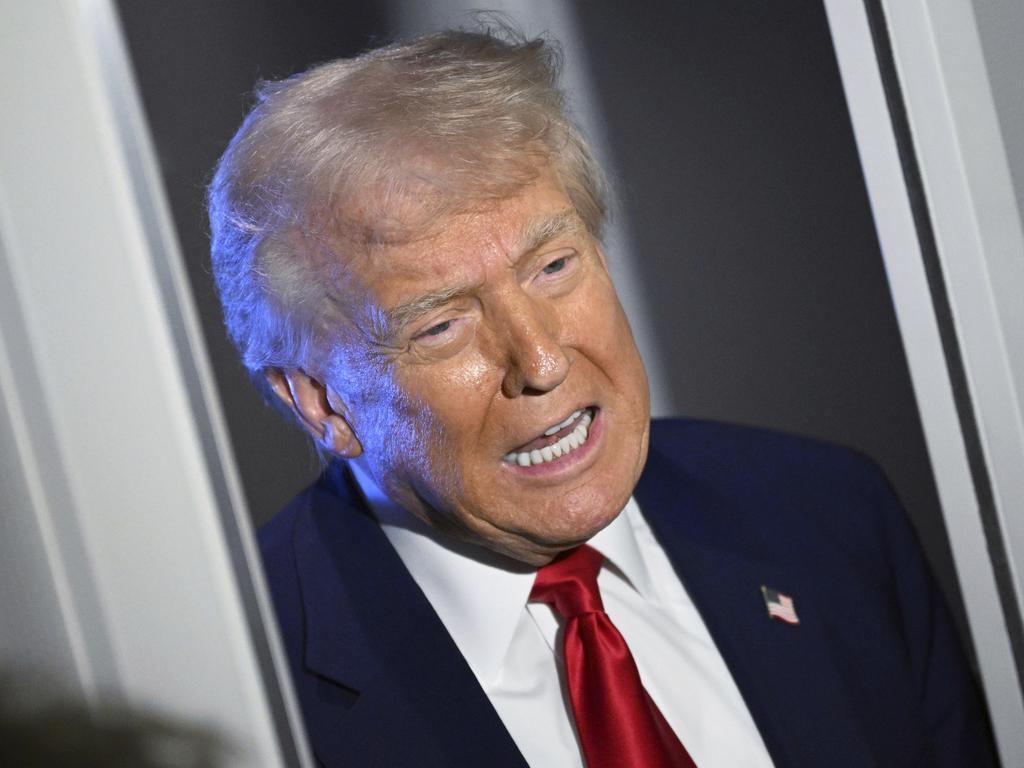

Madonna King: Forget tariffs, the hidden Trump factor is our declining super balance

Huge drops in the super balances of retirees are being felt in a direct consequence to Donald Trump, writes Madonna King. Are you worried? VOTE IN OUR POLL

Opinion

Don't miss out on the headlines from Opinion. Followed categories will be added to My News.

Forget the tariffs. The hidden Trump factor in Australia today - in the middle of this election campaign - is the declining balance in our super accounts.

This is a real cost of living issue, and it’s hitting the pockets of the fastest growing segment of our population. Retirees.

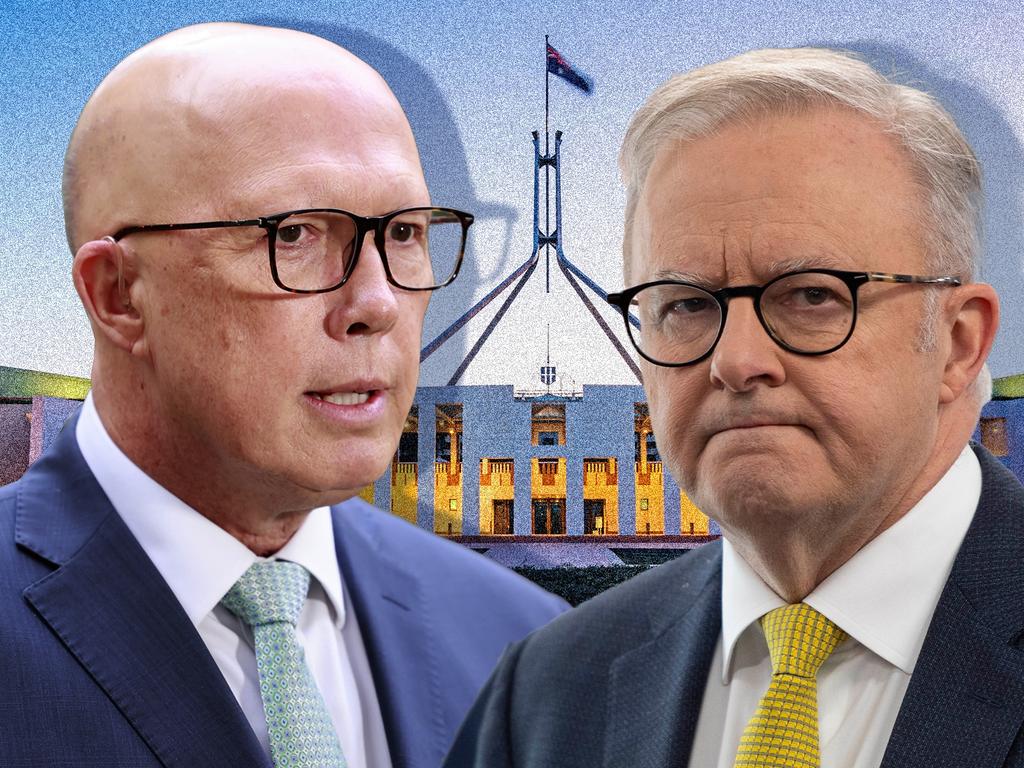

And yet, both those vying for the big house to live in - whether it’s in Canberra or Sydney just means there is a selection of homes to choose from - are silent.

If you haven’t been drawn to look at your balance, don’t. It’s not a good way to start the day. But in short, drops of almost 10 per cent are now being seen in the balances of those heading for retirement.

That is the real consequences of Donald Trumps tariff, and more broadly, chaotic economic policies. And surely it must soon prompt rusted-on Republicans, seeing their own savings disappear, to question the path to making America great again.

But despite how cautious Australians have been with their Super plans, the slide in recent weeks - a consequence of Trump’s policies - is forcing many difficult questions around the dinner table.

Should I push back my retirement planned for this year? Will I be able to retire in two years? How do we finish paying off our home now?

Cost of living is not only about how we spend the money we have; it’s also a matter of how much we actually have. And in the middle of an election campaign - where both sides of politics promised we’d keep money in our pockets - there hasn’t been a single word.

Do they think we are stupid?

Retirees are the fastest growing demographic group and the superannuation they have accumulated through more than three decades of compulsory saving is their passport to a prosperous and happy retirement.

That’s been the promise, and those now retiring have been able to watch their nest egg steadily increase in value, thanks to their own contributions and the investment returns created by largely stable financial markets.

In recent years, those returns have been in the high single figures, all incurring minimal tax.

But now, we are seeing the reverse - at the same time that some uncomfortable truths are merging about our retirement system.

The Australian Securities Commission last week dropped a report of more than 300 pages, setting out the failures of some very large super funds at paying death benefits to the families of dead members. This came on top of previous criticisms of the funds’ preparedness to help the same members manage their retirement savings.

And it was stacked on top of serious revelations about the standards applied to how some big funds ran themselves, and how much they paid to the unions who dominate their boardrooms.

This has not been something that has encouraged our anger - mainly because we are not aware of them. Super funds, unlike the big banks, only attract minor scrutiny from regulators and consumer advocates.

And to be fair, it’s probably also easy to ignore or forgive the failings of funds generating the healthy returns we have seen previously.

But the Trump-generated falls in super balances make such forgiveness less likely. Not only will super members see their accounts go backwards this year, they will now be more alert to the poor service they have been receiving from their super funds.

Look as hard as you like at your superannuation balance and you will still struggle to see how it is investing your money, how it is spending your money on administration and how much it is paying the armies of consultants and managers who feast off a system fed by compulsory contributions from millions of workers.

You will also find it hard to discover how you can have any say at all in how your money and your fellow members’ money is spent.

That is because these weighty decisions are made by “trustees” who have a legal, but largely unchallenged, obligation to act in members’ best financial interests.

Is this enough for a system that will soon top a trillion dollars in value (although markedly less than a few months ago)?

That’s a question Anthony Albanese and Peter Dutton should ponder, as they travel the nation’s electorates promising to make our lives a touch easier.

They need to make super funds more accountable. They need to ensure they act with more rigour. They need to protect us from orchestrated hacking as some members discovered on Friday.

And the debate needs to be deeper than whether young people should be able to access super to enter the housing market.

Right now, we have more say over who runs our local bowls club than who manages our path to an independent retirement. And for my money, that’s wrong.