NSW suburbs facing worst mortgage stress as interest rates rise

An interest rate rise is set to tip struggling homeowners over the edge, increasing mortgage stress for hundreds of Sydney households. See what suburbs will be hit hardest.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

With interest rates rising for the first time in 11 years, thousands of homeowners and renters across Australia are set to be hit in the hip pocket.

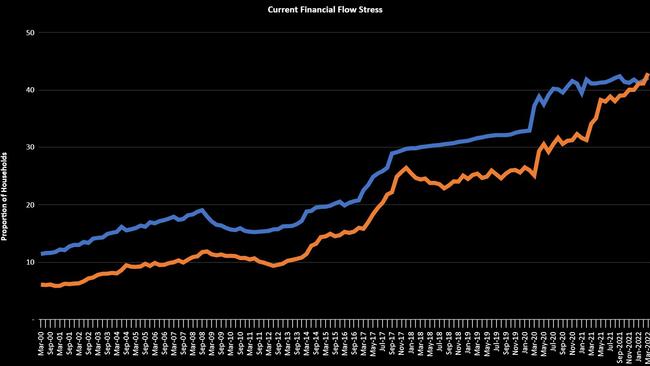

New data from Digital Finance Analytics has revealed a troubling picture of the suburbs set to be under greater mortgage and rental stress, with Sydney’s west and southwest leading the way.

An April report — which came through before the latest rate rises — revealed many Sydney and NSW postcodes had more than 80 per cent of households suffering under mortgage stress.

Suburbs impacted include Liverpool, Campbelltown and Blacktown, as well as suburbs in NSW’s central west.

Digital Finance Analytics principal Martin North said he doesn’t use the standard definition of mortgage stress — spending more than 30 per cent of your income on your mortgage — because everyone’s spending habits and income are different.

Instead he surveys households, comparing money spent against money coming in, including paying mortgages or rent. If people are living paycheck to paycheck, they’re classified as stressed.

“There are people spending half their income servicing their mortgage, and they’re okay,” Mr North said. “But when you don’t have enough money, you start prioritising.”

His company surveys up to 5000 households across Australia every month with the aim of reach 0.5 per cent of each postcode.

The Reserve Bank of Australia head Philip Lowe stated the body was aiming to get its cash rate to 2.5 per cent in the coming years. The cash rate was recently raised from 0.1 per cent to 0.35 per cent.

Mr North said reaching a 2.5 per cent cash rate would lead to as many as 400,000 additional households slide into mortgage stress.

Modelling from CoreLogic showed the rate rise — passed on by the big four banks — would add $118 to the average monthly mortgage repayment in Sydney.

That’s based on current housing prices, and a loan-to-value ratio of 80 per cent, paid off over 30 years.

CoreLogic head of residential research Eliza Owen said the biggest risk in coming years would be a widespread default on mortgages if people get too stretched.

“Even a two per cent rise would add $1000 to a typical monthly mortgage in Sydney,” Ms Owen said.

Ms Owen added Sydney was a uniquely unaffordable city with low levels of income to property values.

At the end of 2021, it cost new buyers 50 per cent of their income to pay off a mortgage in Sydney on average, according to ANZ-CoreLogic data.

Responsible lending laws require banks to prove mortgage holders can handle a 3 per cent increase to their rate as of October 2021.

“Households may be in trouble if we see cash rate increases beyond that serviceability buffer,” Ms Owen said.

Renters face the same pressure as mortgage payment increases are likely to be passed on.

Anglicare Australia released its annual Rental Affordability Snapshot last month, which compares listed rental properties with what Australians on low incomes can afford.

From 45,992 rental listings across Australia, only 2 per cent were affordable for a person working full-time on minimum wage, while 1 per cent were affordable for a person on the age pension.

Sydney’s growth corridor suffers from strain

In Sydney’s southwest, the next two years are shaping up to be a “slow moving train wreck”, according to Community Housing CEO Wendy Hayhurst, as households on already tight budgets face tough decisions.

“People buying in that (southwest) Sydney are often buying there because they can afford it,” Ms Hayhurst said.

“It has been very tempting to get into homeownership. You see prices going up and worry about how far they‘re gonna go up, so you squeeze every last bit out of your income to pay a mortgage.

“If you’ve got to make savings, that means you don’t use services, don’t buy as much, which goes to impact more people in your community.”

For Mr North, a lot of the problems are concentrated in southwest Sydney’s high-growth corridors.

“Southwest Sydney is the epicentre of this at the moment,” Mr North said. “Some of the most significant stresses are in the newly built houses that have been sold on the new estates.

“People have bought at the top of the market, there are a lot of first time buyers.”

Ms Hayhurst said the rate rise has reinforced existing problems. With some mortgage holders locked into fixed rates, the cost increases won’t come immediately but are inevitable.

“It’s a slow-moving train wreck,” Ms Hayhurst said.

“I don’t know where it occurs, but you can see it coming up the line.”

Originally published as NSW suburbs facing worst mortgage stress as interest rates rise