NSW households see 900 per cent increase in home and contents insurance premiums amid fires, flood

Homeowners are being forced to spend tens of thousands of dollars for flood insurance they may never need – with premiums increasing by 900 per cent in ten years. See the reasons here.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Homeowners are being slugged tens of thousands of dollars for specialist flood insurance they may never need – with home and contents insurance premiums increasing by 900 per cent over the last decade amid a spike in damaging storms and repeated floods.

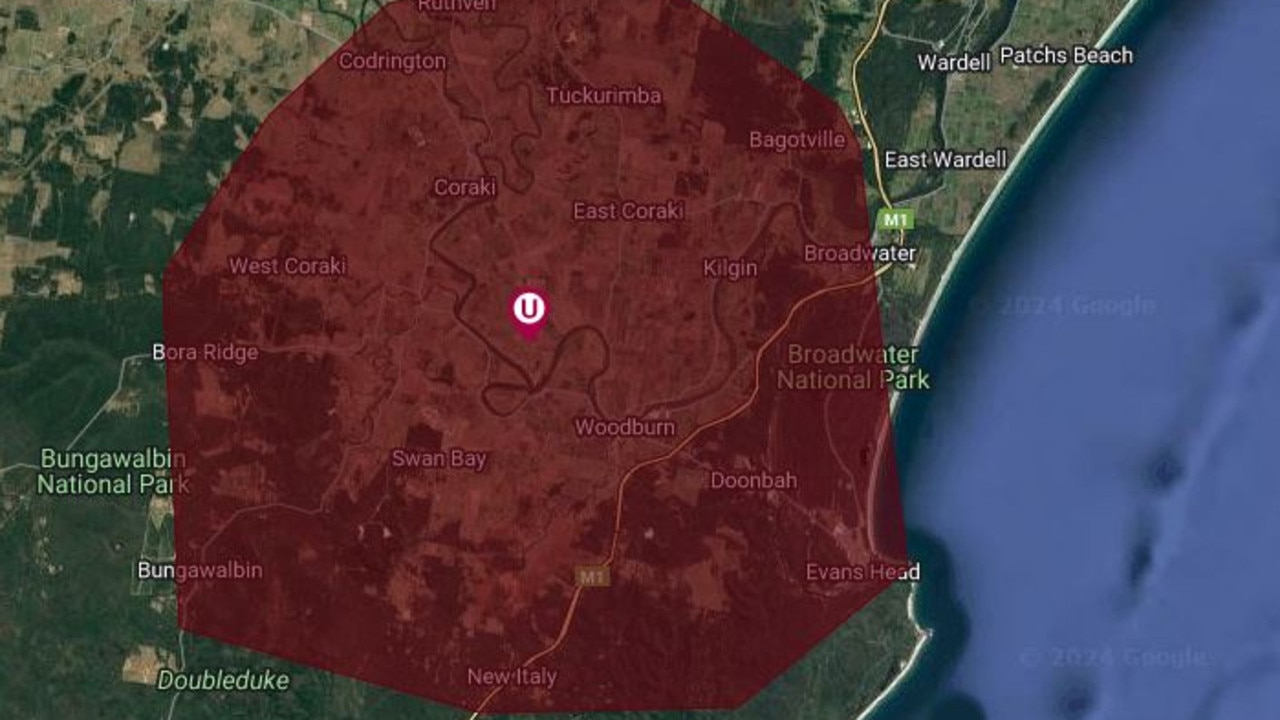

Western Sydney residents surrounding the Nepean River are sounding the alarm over major price hikes, with quotes for insurance premiums reaching massive new highs, while flood-ravaged communities in the state’s central west and northern rivers say their premiums have increased to over $30,000 a year.

Emu Plains resident, Gai Maher, told The Saturday Telegraph she wasn’t expecting the $10,000 quote she was issued by multiple companies for her insurance premiums last year, and was “fearful the figure will rise again” when her policy expires this month.

“We have lived here for the past decade and when we moved in out home and contents insurance, including flood coverage, was around $1000, now we are getting quotes between $7000 and $10,000 a year,” she said.

“Our home is close to the Nepean River, but we have experienced three foods in two years and our home has never been under threat.

“Despite this we either get refused by insurers altogether, or are told that we will have to pay skyrocketing premiums.”

Ms Maher said she has been told by insurers that premiums have risen across the country as a result of mass flooding in Queensland, and even Covid lockdowns.

“The assessment should be based on historical data which shows wether a house has flooded in the past, not a one-size-fits-all for everyone,” she said.

“Insurers strike fear in their customers, we know our house is safe from flood but they tell you have to have coverage then charge us an arm and a leg.”

But a representative of the Insurance Council of Australia said western Sydney residents weren’t alone, with major increases in quotes experienced in households across the state.

A spokeswoman blamed skyrocketing premiums as a result of the “escalating costs of natural disasters”.

The representative said inflation was also pushing up building and vehicle repair costs, as well as the insurers’ increasing cost of doing business.

“Wherever you live in Australia – whether you’re exposed to extreme weather or not – premiums have been increasing,” she said.

“Flooding is Australia’s costliest extreme weather event and right now there are around 230,000 properties that face a one-in-20 risk of a catastrophic flood each year, with more than half of these properties in NSW.

“Investment in mitigation infrastructure, changes to land use planning and building standards, and the removal of unfair taxes and levies are all needed to stabilise insurance premium costs.”

While each insurer has its own methods of widespread calculating premiums for suburbs or postcodes, individual addresses can also see differences in prices with “sophisticated” risk analysis. This means that while one homeowner might be slugged tens of thousands of dollars for their coverage, a neighbour might see a nominal fee or a small increase.

The insurance council representative said companies assess prices based on the risk of damage or loss.

“For customers who live in high-risk flood areas, we strongly encourage shopping around and comparing policies to find the best deal,” she said. “They can also explore simplifying their policy and lifting their excess to help moderate the cost of their insurance premiums.”

More than 20,000 homes were impacted by extreme weather events in 2022, according to data from the NSW Reconstruction Authority.

A spokesman for the NSWRA said the department has launched the nation’s “first ever plan” to reduce the risk of future disasters, while also banning the development of new or expanded residential towns on high-risk flood plains.

“The NSW State Disaster Mitigation Plan is a crucial step towards ensuring every dollar invested by government towards mitigation reduces risk, helps people get back on their feet and reduces the cost of future disasters,” the spokesman said.

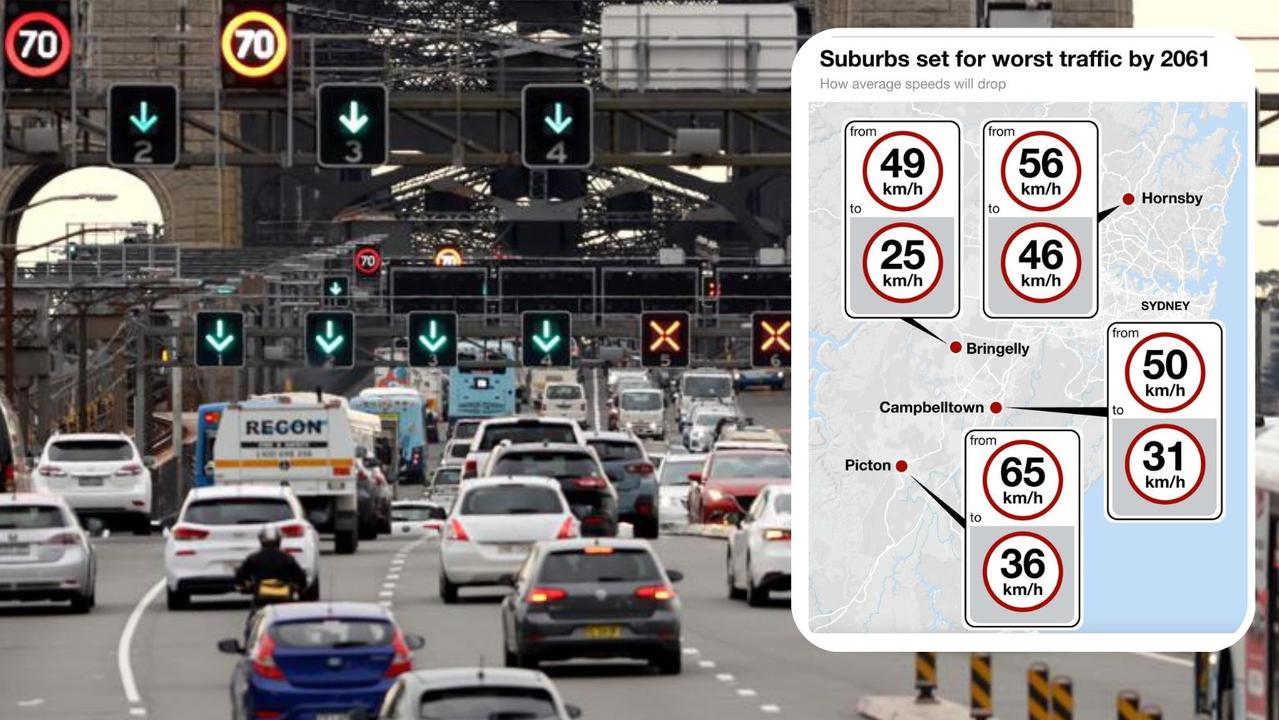

NSWRA research has found the cost of building and infrastructure damage from natural hazards, such as fires and floods, is set to hit $9.1 billion per year 2060.

The state’s newly developed State Disaster Mitigation Plan also works with the National Emergency Management Agency and the insurance sector to reflect risk reduction and adaptation initiatives into insurance pricing.

Meanwhile, NSW Government reforms to remove the Emergency Services Levy from insurance premiums could bring quotes down by as much as 18 per cent for residential properties.

Originally published as NSW households see 900 per cent increase in home and contents insurance premiums amid fires, flood