Great inheritance debate: Experts explain difference between ‘hand up’ and ‘hand out’

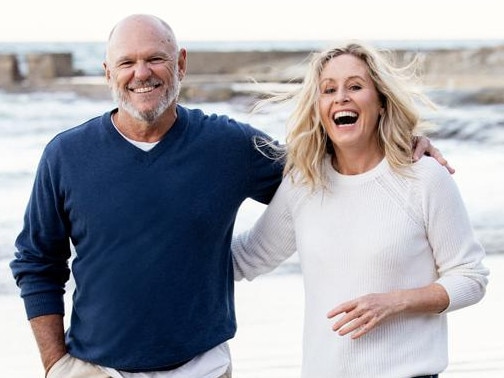

As our columnists, Angela Mollard and Rory Gibson, contemplate helping their kids buy their own homes, the experts weigh in with some excellent, and unexpected, advice.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

Turns out our kids love talking about money – especially when it involves the prospect of us handing some over. Honestly, not since Rory suggested a boys’ surf trip, paid by him, and I mooted a spa weekend to my daughters have they been so engaged in financial matters.

Last weekend we revealed we’re challenged by the same conundrum seven out of 10 parents say they are facing: should we give our children a warm inheritance to help them get into the housing market?

It would require sacrifice on our part, but having accepted that it’s much harder to purchase property than when we were young, we wanted to explore the pros and cons of such a strategy.

With three sons aged between 28 and 31, Rory is initially focused on his youngest boy, Will, 28, who desperately wants to buy a house with his partner Emma, 26. They have an 18-month-old son, Navy, and would love to have their own house so they can give him a baby brother or sister. The irony is that Will, a builder on the Gold Coast, is knocking up houses for other people but can’t afford one of his own even though Emma also works four days a week. As he says: “We’re paying $800 a week rent and a baby isn’t cheap to run.”

Meanwhile, I’m wondering how my daughter, Lilibelle, 21, will ever get on the housing ladder with a $40,000 HELP (formerly HECS) debt and skyrocketing rents and house prices in Sydney. She’s a good saver and determined to get ahead on her own but could money towards a deposit help?

Here the experts outline the implications of a “warm inheritance” for us and them and where financial help would best be directed.

THE FACTS – AND A STARK WARNING

A loan or a gift?

With housing affordability slipping out of reach for many young people, the Bank of Mum and Dad has become one of the biggest lenders in the country, says Noel Whittaker, author of Retirement Made Simple. Here’s his advice.

It’s only natural to want to help your children. But make sure it’s a hand up, not a handout.

If you give money to children who lack budgeting or financial skills, chances are it will be frittered away before it has a chance to do any good. The bigger question for parents is whether the assistance should be structured as a gift or a loan.

Both approaches can work. In our own family, we decided to make unconditional gifts, accepting the risk that in the event of a relationship breakdown, the partner might walk away with a share of the money. For us, it was more important to give with a warm hand rather than wait until we were doddery and the kids were of pensionable age.

But how do you protect the money if a relationship ends? No parent wants to see their hard-earned funds split in a divorce settlement. In this case, you can consider providing the funds as an interest-free loan, repayable on demand.

To be effective, such a loan must have a termination date (which can later be extended) to ensure it’s binding in the event of a future dispute. My legal contacts recommend a six-year term as a starting point, though this can vary. It’s essential to get proper legal advice and ensure the documentation is watertight – especially if you may need to enforce it down the track.

Another issue is Centrelink. If you’re planning to apply for the age pension, understand that a gift is counted under Centrelink’s gifting rules for five years. After that, it no longer affects your pension eligibility. However, a loan continues to be treated as an asset until it’s formally forgiven. Once forgiven, it’s treated like a gift and will continue to count for another five years.

One of the biggest traps I see is parents putting their name on the title deed to help the child qualify for a loan. This can have serious long-term consequences.

For example, suppose the house originally cost $500,000 and is now worth $1 million. If you’re on the title and later want to transfer your share to your child, you could face a hefty capital gains tax bill, as you are classed as a part-owner. And if you’re dealing with Centrelink, that half-share – now worth $500,000 – could wipe out your pension eligibility altogether.

These are not simple decisions, and the financial and legal implications can be far-reaching. Seek expert advice because it’s far easier to do it right the first time than to untangle a mess later.

RORY, WILL and EMMA

‘Know if there’s any strings attached’

It’s one thing to give your kid money towards a home deposit, but it’s not the only way you can support them, according to financial advisor and host of The Australian Finance Podcast Gemma Mitchell.

“I love that you guys didn’t dismiss that it’s harder for Will, Emma and Lilibelle’s generation to buy a house,” she says. “Acknowledging that it’s more difficult is a way of supporting them and for parents who can’t afford to help with a deposit, understanding their kids’ predicament goes a long way.”

However, before parents consider handing over money, it’s important their offspring starts a conversation with a mortgage broker or their bank. Building a relationship is critical, says Gemma, because lending rules and the market are always changing. As she says, currently banks assess that you must be able to service your mortgage plus a 3% buffer on the loan, which was not the case five years ago (Peter Dutton has pledged to relax this serviceability buffer if he is elected).

“Ideally you should be building a relationship with a broker four or five years before you want to buy. They can advise strategies on how to reach your goal and changes you can take advantage of. Parents can go along to the first meeting.”

When it comes to a warm inheritance, Gemma wondered whether Rory had considered a guarantor loan, where the equity in his own home provides additional security for Will and Emma, potentially enabling them to avoid lenders mortgage insurance (LMI), which can cost thousands. The downside to this approach is that if Will and Emma default on their mortgage, it becomes Rory’s problem. It also prevents him doing the same for his other sons until Will and Emma’s home rises sufficiently in value that he can be released as guarantor.

“It’s risky but hopefully their house rises quickly in value,” says Gemma.

She’s also concerned that while Will and Emma currently pay $800 weekly rent on the Gold Coast, a mortgage of, say, $750K could well end up costing them $1100 a week when you add in rates and insurance.

“They have to consider that buying a house might mean that their cost-of-living goes up and their quality of life goes down. Perhaps in that instance, instead of giving money towards a deposit, parents could chip in with $100 to $200 a week in living expenses if it fits in with their cash flow.”

As she says, helping out with regular small amounts rather than a lump sum might allow the parents’ nest egg to remain in superannuation, earning better returns to help on a week-to-week basis.

It’s also critical that your offspring have shown a solid ability to save. As one mortgage broker told us: “Kids can’t just take a hand-out, they must have some skin in the game. If they can’t come up with a 5% deposit, should they really be buying a house?” The broker also pointed out that if a parent gifts money to a child, it must remain in their account for at least three months to qualify as genuine savings.

Meanwhile Gemma warns against young buyers becoming so caught up in the free grants that they delay getting into the market. While first homebuyer’s grants, the First Home Guarantee, where the government owns part of the equity in your home, and saving for a deposit in superannuation are all attractive levers, Gemma says in some cases it’s better to jump into the market earlier even if it means missing out on something free. “They might miss out on $20 grand or have to pay LMI, but if you get into the market you may make that money back in six months’ time.”

She also advises young people like Will and Emma to really get their priorities clear. Are they prepared to live in a less desirable area, further from work, to buy their first property? If not, perhaps they consider “rentvesting” where they buy an investment property to let out while continuing to pay rent themselves.

Even if it takes Will and Emma a while to reach their goal, she says they’re refining their habits and learning to be responsible with their money. “They should also be staying away from gambling apps and “buy now, pay later” (BNPL), because they’re big red flags for banks,” she says.

Finally, she advises Rory, Will and Emma to be clear about whether a warm inheritance is a gift or a loan.

“Will and Emma have to know if there’s any expectations or strings attached. Ultimately, they may not become homeowners straight away but it doesn’t mean they can’t keep moving forward and get excited with a share or investment property portfolio.”

ANGELA AND LILIBELLE

‘It can be life-changing’

Lilibelle is still young to be considering home ownership but thinking about your goals early can set you up for the future, according to our experts.

Likewise, factoring in a “warm inheritance” early can also kickstart valuable conversations and behaviours that lead to a better outcome for all.

“With rising property prices, longer lifespans and a huge intergenerational wealth transfer underway, a lot of parents are thinking, ‘why wait until I’m gone to help my kids when I can support them now and actually see the impact?’” says Molly Benjamin of Ladies Finance Club.

Financially, she says, a “warm inheritance” can be a huge accelerator whether through fast-tracking a first home, kickstarting investing or achieving a major life goal. Emotionally, however, it can go either way.

“Done well,” says Molly, “it builds trust, connection and a sense of shared values. But if it’s not handled with care, it can lead to guilt, control and confusion – especially if there are unspoken expectations.”

So should Lilibelle be concentrating on clearing her HELP debt or saving for a home?

Since university debt falls into the “helpful” rather than “harmful” debt category, Molly says it depends on Lilibelle’s goals. In the first instance, she says she should be setting up an OMG fund – “aka your emergency fund for those ‘oh-my-God-why-did-my-car-break-down-just-before-the-rent’s-due’ moments”.

Once she has 3-6 months of living expenses set aside, and she’s determined to save to buy property or invest, then she’s better off focusing on that, according to Molly, who runs Zero to Investor Programs via her Instagram. “But some people are anti-debt and want it gone as fast as possible and that’s just as valid.”

As for the warm inheritance, Molly says it can be “life-changing”, reducing financial pressure during milestone years, such as starting a family or launching a business, but it’s not without complications.

“If it’s unplanned or emotionally loaded, especially in blended families or where there’s a lack of communication, it can cause tension. It can also create issues of fairness among siblings,” she adds, pointing out that it’s essential to involve an estate planner or financial advisor so everyone is protected and there’s support for both generations.

But there’s plenty Lilibelle can do in the meantime, including automating her savings the moment she gets paid, using round-up apps or micro-investing platforms such as Raiz or Spaceship, setting short, medium and long-term financial goals, and spending purposefully. While Angela raised an eyebrow at Lilibelle’s taste for $12 strawberry matcha lattes, Molly gave them the tick.

“If that’s your thing, go for it. But be intentional about your treats.”

She also advised against following the (brunch) crowd and having a “believe it’s possible” mindset when it comes to home ownership.

“Even if the headlines are saying it’s hard to get into the property market, don’t count yourself out. There are ways to build wealth, whether that’s buying to live in, rentvesting – renting where you want to live and buying where you can afford – or investing in the sharemarket.”

While the 20s can be a magic decade for getting ahead, she points out the magic isn’t just in the money, it’s in the learning.

“Saying ‘no’ now is often saying ‘yes’ to something even better later.”

Do you have a story for The Telegraph? Message 0481 056 618 or email tips@dailytelegraph.com.au

More Coverage

Originally published as Great inheritance debate: Experts explain difference between ‘hand up’ and ‘hand out’