‘Epic policy fail’: lead economist unloads on cigarette tax

One of the county’s leading economists has criticised the tax hike on cigarettes as “an epic policy fail”. It also explains the rise in overseas packs across Australia.

NSW

Don't miss out on the headlines from NSW. Followed categories will be added to My News.

One of the county’s leading economists has criticised the Federal government’s tax hike on cigarettes as “an epic policy fail”, arguing it has driven smokers to the black market.

Rich Insights economist Chris Richardson took to X, formerly known as Twitter after Tuesday’s federal budget was released, saying the government’s policy of massively taxing tobacco had failed to bring benefits to the economy while damaging health outcomes.

Foreign cigarettes - such as the Chinese brand Double Happiness - can be bought online for as little as $15 a pack, which is more than half the price you would pay for a pack at an Australian retailer.

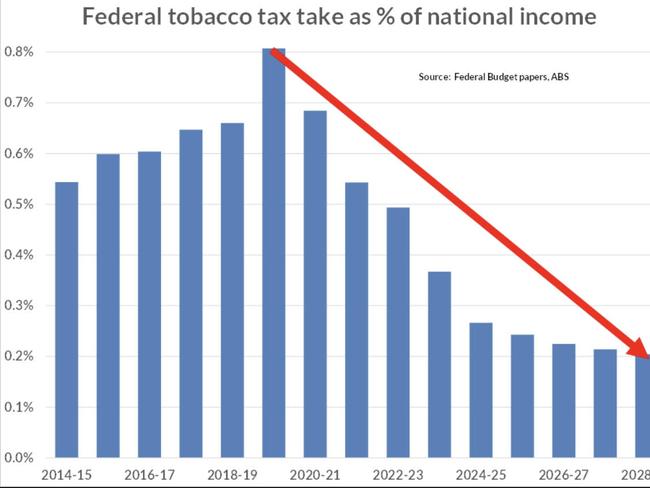

This comes as the budget papers revealed that the predicted tax intake from the tobacco excise had crashed 18.5 per cent in 2025-26.

In the five years to 2028–29, tobacco taxes will bring in $34.7 billion, $6.9 billion less than originally predicted.

“The expected tax take has halved in a handful of months,” Mr Richardson wrote.

“We’ve managed to worsen the health of Australians by making smoking much cheaper than before.

“It’s hard to imagine a more epic policy fail.”

Mr Richardson said if the black market for illegal tobacco had not cost the economy $10 billion per year, the extra money could have been spent giving families tax cuts of $25 per week instead of $10.

“That black market has been rocket fuel for organised crime – as lucrative as heroin, but at much less legal risk for those involved,” he wrote.

“We need to raise enforcement funding – tobacco taxes have gone up by a factor of five, but our enforcement hasn’t kept pace.

“The gap between where we’re taxing and how we’re enforcing is catnip for criminals, terrible for tax take and it’s hurting our health.”

Originally published as ‘Epic policy fail’: lead economist unloads on cigarette tax