Treasurer Jim Chalmers will hand down a $9.3bn surplus amid concerns Labor’s budget fuels inflation

Treasurer Jim Chalmers will hand down a $9.3bn surplus, but economists are warning Labor’s budget is set to cause homeowners more pain. Watch the budget speech below.

National

Don't miss out on the headlines from National. Followed categories will be added to My News.

Treasurer Jim Chalmers will on Tuesday sell a budget Labor claims will help struggling households, but a growing chorus of experts warn the plan will also keep crippling mortgage repayments higher for longer.

Help in the budget for Australians struggling to make ends meet comes at the “cost” of higher inflation and interest rates say economists, warning Treasury’s forecast of a major drop in prices by December is very “optimistic”.

As Mr Chalmers prepares to hand down a $9.3 billion in the black for 2023-24 in the federal budget on Tuesday – the first back-to-back surplus in almost two decades – economists say Australian households should “really hope” Treasury’s forecast that inflation will be within the target range for a rate cut by the end of the year are right and the RBA’s more conservative figures are wrong.

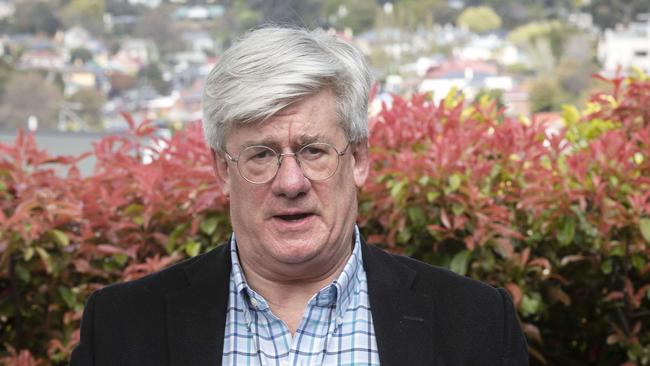

Economics Professor and former Treasury official Dr Steven Hamilton said the RBA’s forecast of 3.2 per cent inflation by June 2025 was already “about as optimistic as you could get away with and still be credible,” describing Treasury’s forecast of 2.75 per cent as “even more optimistic”.

Dr Hamilton said it was “absolutely” disingenuous for Labor to say its budget was putting downward pressure on inflation.

“The decision taken in the last two budgets and the decision that have been announced for this budget so far, push aggregate demand up, which is what we would think of as expansionary, what the Reserve Bank would think of as expansionary,” he said.

Dr Hamilton said Labor should be “upfront” that cost of living support like widely anticipated slashing of energy bills for low-income Australians, “comes with a cost” for other Australians.

“I think it’s perfectly legitimate for governments to want to help the most vulnerable people in a cost of living crisis, but the more help they provide, the greater the cost borne by everybody else,” he said.

“That cost is higher inflation for longer, and higher interest rates for longer.”

Dr Hamilton said interventions like energy and rent subsidies and also stage three tax cuts push up demand and ultimately work against the Reserve Bank’s efforts to bring inflation down.

“The Reserve Bank is not interested at all in whether the energy subsidies increase or lowers the CPI, what they care about is demand, and more money in people’s pocket means more demand, means higher inflation, higher interest rates.”

After holding interest rates at 4.35 per cent earlier this month RBA governor Michele Bullock said it was too early to declare “victory” over inflation.

“Inflation at the moment is still declining, but it’s declining less quickly than we thought it would,” she said.

Ms Bullock said she would have to see the detail of the federal budget before considering how it might impact the RBA’s forecasts.

Independent economist Chris Richardson said it was the Reserve Bank and interest rate hikes that were doing the heavy lifting on inflation, not Labor’s budget.

“The key isn’t subsidies, the key isn’t’ really anything you will hear about in the budget, the key inflation fighter is the Reserve Bank and its interest rates, and we’ve made good progress but we’re not there yet,” he said.

“Every should really hope that the Treasury is right, and the Reserve Bank is wrong, because there is nothing more fundamental to family finances than getting inflation down.”

Independent economist Saul Eslake said he believed it was “plausible” for Treasury to forecast lower inflation because it could factor in budget measures the RBA was not yet aware of.

“Energy bill relief or rent assistance can have a mechanical impact in shaving off CPI,” he said.

“But really it’s what the budget doesn’t do, rather than what it does do that might help the fight against inflation.

“The best contribution the government can make is to avoid materially stimulating domestic demand but not throwing lots of cash around.”

Mr Chalmers has said Labor’s budget “will put downward pressure on inflation, not upwards pressure” as it was revealed Treasury had forecast a return to the inflation target range by Christmas this year.

“Our budget will be part of the solution to cost of living pressures, not part of the problem,” he said.

“Inflation is moderating in welcome ways but it’s not mission accomplished because people are still under pressure.

“Inflation is still the big near-term challenge in our economy which is why the government is doing its bit in the budget.”

Finance Minister Katy Gallagher said the Treasury forecasts were based on decisions taken in the budget.

“We don’t think that the inflation challenge is complete or that the job’s done,” she said.

“There is more work to do.

“We recognise that, which is why we’ve been mindful of it. It’s been one of those kind of primary areas of focus for us in the decisions that we’ve taken.”

Budget in the black two years running

Australia’s federal budget bottom line will be $9.3 billion in the black as Treasurer Jim Chalmers delivers the first back-to-back surplus in nearly two decades.

But even with the significant turnaround since Treasury forecast a wafer-thin deficit of $1.1bn six months ago, the budget will slip back into the red next over the forwards amid rising spending and higher unemployment.

It comes after the federal government delivered its first surplus of $22.1bn last financial year, with Mr Chalmers describing the second positive result as a “powerful demonstration” of Labor’s responsible economic management, which had made room for cost of living relief and investments in the future.

“The forecasted surplus has come on top, not at the expense, of helping those doing it tough,” he said.

“The budget will ease cost of living pressures, not add to them, and incentivise investment in a Future Made in Australia.”

However by 2024-25 the budget bottom line will slip back into the red with weaker results than Treasury previously forecast in December.

The budget position, however, will be stronger in 2027-28 when compared to the December forecasts which showed the budget still remained in the red.

Over the next three financial years Treasury had expected combined deficits of about $73.3bn, but it is now expected this result will be worse than forecast.

Finance Minister Katy Gallagher said since coming into office Labor had found more than $77bn in savings and reprioritisations to help the budget bottom line.

“We understand there’s still pressures on the budget, including spending on the NDIS, aged care, hospitals, Medicare and debt interest,” she said.

“That’s why we’ve put a premium on responsible economic management that strikes the right balance between strengthening the budget and funding our priorities.”

Speaking to his Labor colleagues in Canberra on Monday Prime Minister Anthony Albanese said the budget would “make a difference” for all Australians.

“Our tax cuts for every Australian is a reminder that we want to represent … every single Australian,” he said.

Mr Albanese said the budget was also focused on growing the economy for the future.

“The decisions that we make in this decade will set Australia up for the decades ahead, and that is what a future made in Australia is about,” he said.

Despite the upgrades to the budget bottom line this budget, gross debt is still expected to head north of $1 trillion over the four year forward estimates period.

Ahead of the budget Opposition treasury spokesman Angus Taylor said the Coalition would propose to re-establish spending rules that would ensure government spending growth did not outpace economic growth at an unsustainable rate.

“If Australian households are struggling with their budgets, and showing restraint in their budgets, it’s time for the Australian government to show restraint,” he said.

More Coverage

Originally published as Treasurer Jim Chalmers will hand down a $9.3bn surplus amid concerns Labor’s budget fuels inflation