Superannuation balances: what yours should be for your age

Rising living costs mean, whatever your age, you’ll now need extra money in your super if you want a comfortable retirement. Here’s what’s required.

Rising living costs and increased lifestyle expectations have lifted the superannuation balances that workers need today if they want to retire comfortably.

New figures from the Association of Superannuation Funds of Australia show people now need thousands more dollars in their super accounts if they want to achieve an annual income benchmark of $49,462 for a single person’s comfortable retirement.

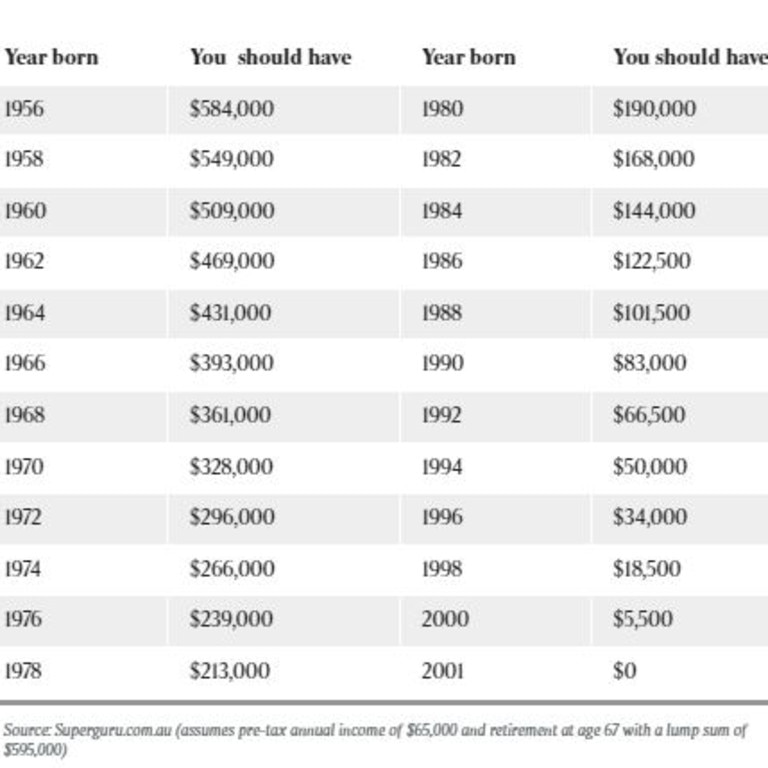

The ASFA Retirement Standard recently revised higher the lump sum needed to deliver that income, from $545,000 to $595,000 at age 67, and it has a flow-on effect across age groups.

Someone born in 1960 now needs $509,000 in super today, up from $449,000 before the revision, while a person born in 1970 needs $328,000 – up from $285,000, and people born in 1980 should have $190,000, compared with $164,000 previously. For couples combined, the figures are lower.

ASFA deputy CEO Glen McCrea said the adjustment of lump sums reflected higher living costs and low wages growth resulting in age pension payments not benefiting from wage-linked adjustments.

“ASFA typically revises the budgets every six to seven years to reflect changes in spending habits and more general movements in community living standards,” he said.

“The high rate of inflation in 2022 substantially raised the amount of spending required.

“While the rate of inflation may ease going forward, the costs of either a modest or comfortable retirement have been permanently ratcheted up by recent developments in living costs.” ASFA’s projections are based on an annual wage of $65,000.

A $595,000 lump sum at age 67 is well above Australians’ average super balances of $356,000 for men and $288,000 for women aged in their early 60s, and requires seniors use a mixture of their own money and the pension to fund their retirement.

Mr McCrea said retirement lifestyles varied greatly, and people could boost savings through extra contributions, build higher balances earlier in life to benefit from compounding interest, consider tax-deductible “carry-forward” contributions and use the ATO comparison website or ASFA’s Super Balance Detective Calculator to get a clearer picture.

Compulsory employer super payments rise to 11 per cent on July 1, and financial strategist Theo Marinis said most people could not simply rely on this to reach a comfortable retirement.

His mantra for building a bigger balance is to put extra cash into super “as soon as you can, as much as you can, for as long as you can”.

“Human nature is to think about shorter-term things, but even $20 a week is $1000 a year,” Mr Marinis said.

“Over 20 years you are putting away $20,000 plus what it grows to.”

People can make super saving automatic through salary sacrifice or other regular deposits.

“The older you are, the more you may have to salary sacrifice,” Mr Marinis said.

Working couples are better placed because of their dual super balances and the fact household expenses did not double when people lived together.

“Unfortunately, if you are single you have to work a little bit harder,” Mr Marinis said.

Originally published as Superannuation balances: what yours should be for your age